Check out the companies making headlines after hours.

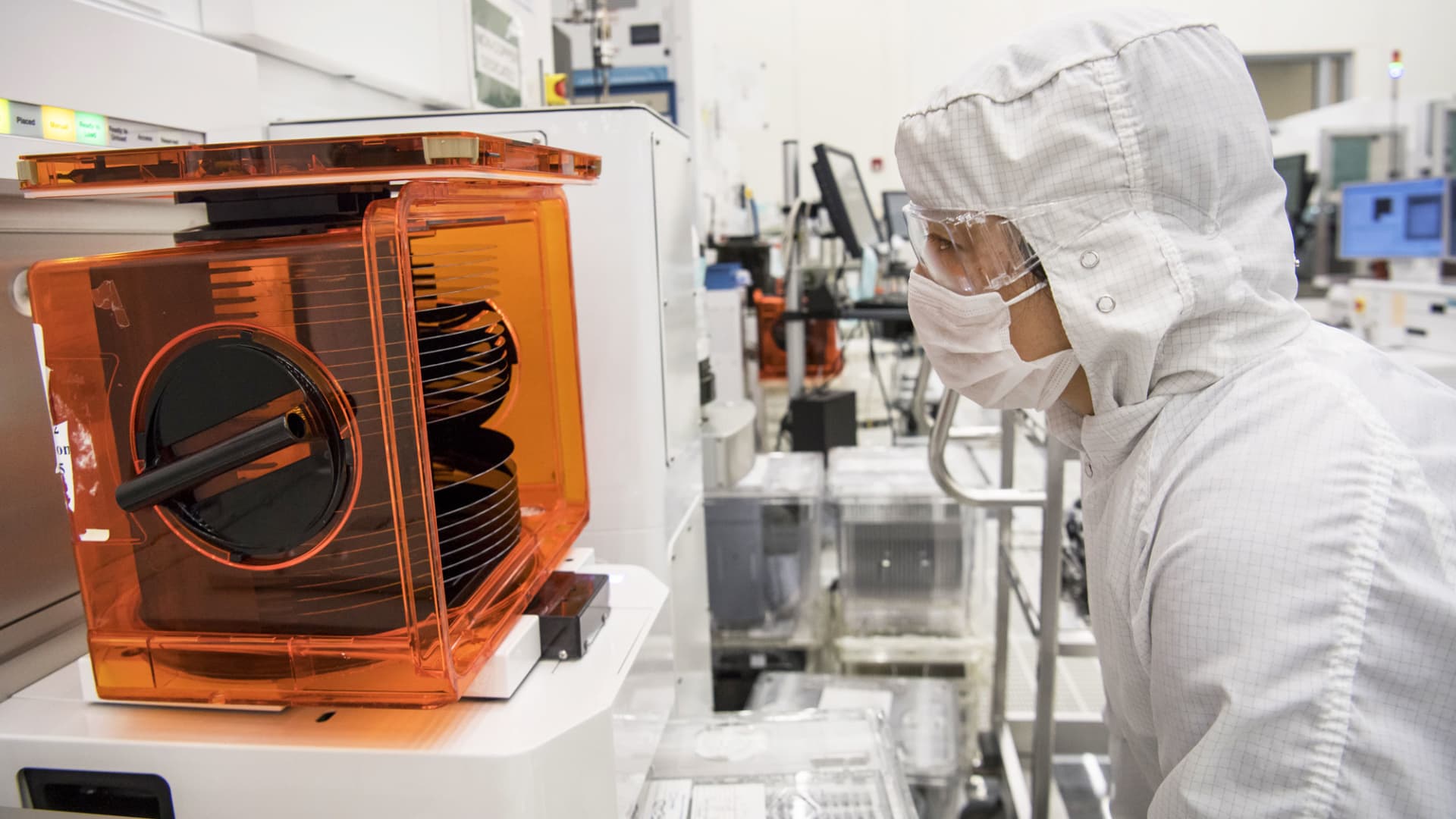

Applied Materials — Applied Materials rose nearly 2% in extended trading after beating analysts’ expectations on the top and bottom lines in its fiscal third-quarter results. The semiconductor equipment maker posted adjusted earnings of $1.90 per share, greater than the $1.74 per share expected by analysts polled by Refinitiv. Revenue came in at $6.43 billion, more than the anticipated $6.16 billion.

Ross Stores — The retail stock popped 5.7% in extended trading after Ross Stores topped forecasts for its second quarter. The discount store company reported earnings of $1.32 per share, better than the $1.16 consensus estimate, per Refinitiv. It posted revenue of $4.93 billion, above the expected $4.75 billion.

Bill Holdings — Bill Holdings’ shares slid 5.4% after the online payments company reported fiscal fourth-quarter results. Bill beat analysts’ expectations on the top and bottom lines, reporting fourth-quarter adjusted earnings of 59 cents per share on revenue of $296 million. Analysts polled by Refinitiv had expected 41 cents in earnings per share on revenue of $282 million. However, Bill issued a weak first-quarter and full-year revenue outlook.

Keysight Technologies — Shares of the electronic design company dropped 7% after Keysight provided a bleak outlook for its fiscal fourth quarter. Keysight anticipates adjusted earnings of $1.83 to $1.89 per share on revenue of $1.29 billion to $1.31 billion. Analysts polled by FactSet called for earnings of $2 per share and revenue of $1.39 billion.

Farfetch — Shares plunged 33% after Farfetch posted second-quarter revenue that missed estimates. The online luxury retailer posted revenue of $572 million, lower than the consensus estimate of $649 million from Refinitiv.