Changes from Last Year

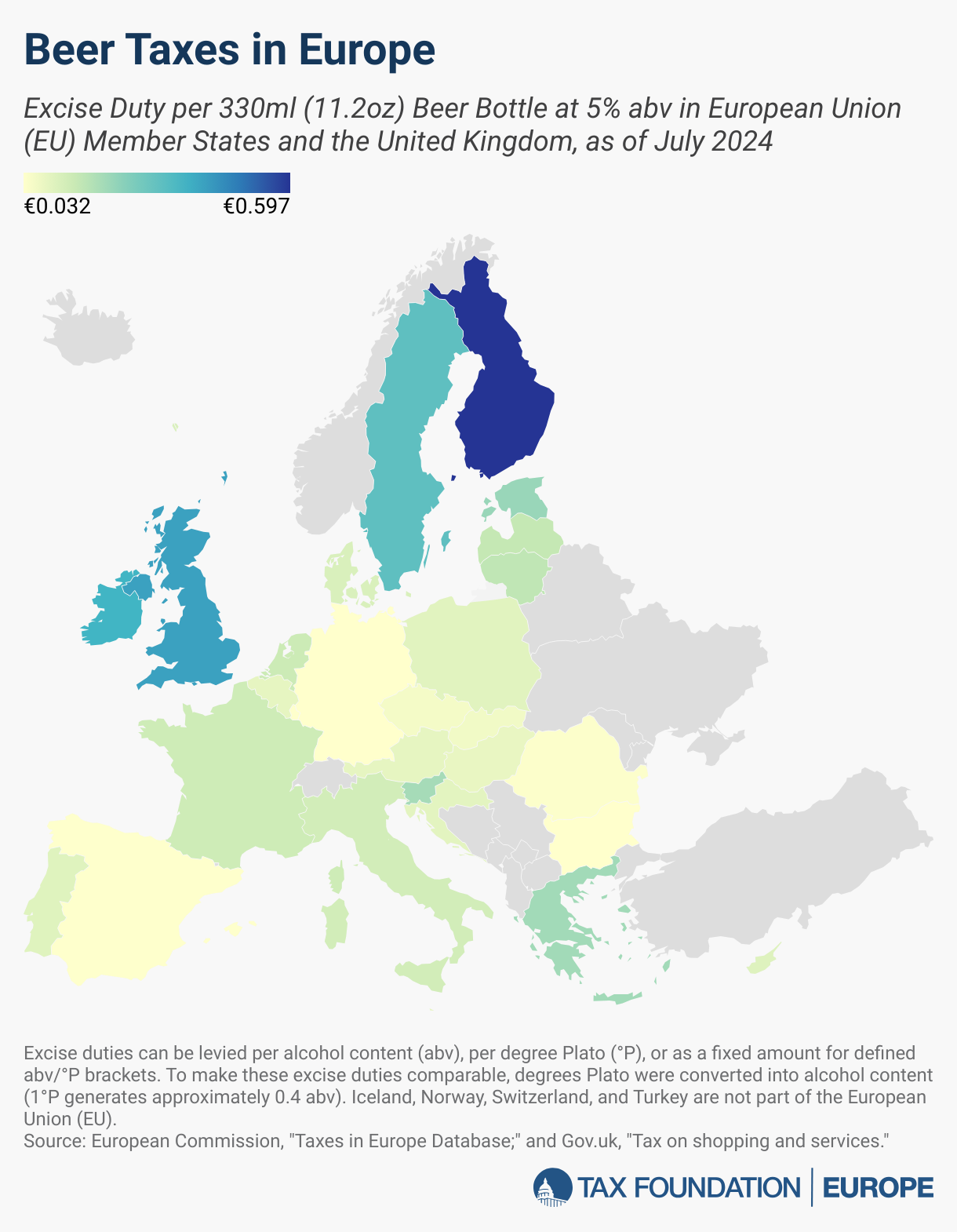

- Estonia increased its excise duty on beer from €12.70 to €13.34 per hectoliter per alcohol content in January 2024, amounting to €0.01 more per drink.

- Finland decreased its excise duty on beer from €38.05 to €36.20 per hectoliter in January 2024, amounting to €0.03 less per drink.

- France increased its excise duty on beer from €7.82 to €7.96 per hectoliter per alcohol content in January 2024, amounting to €0.04 more per drink.

- Lithuania increased its excise duty on beer from €8.60 to €9.46 per hectoliter per alcohol content in January 2024, amounting to €0.014 more per drink.

- Latvia increased its excise duty on beer from €8.20 to €9.00 per hectoliter per alcohol content in March 2024, amounting to €0.013 more per drink.

- Several other EU countries experienced changes to their beer excise rate, either through legislated rate changes or changes in their currency exchange rate to euros, that changed the levied tax per drink by less than €0.01.

The motivations for excise taxes on beer are straightforward. Governments tax beer and other alcohol both to discourage people from consuming alcohol and to generate revenues from a broadly, but socially disdained, product. Beer taxes remain a blunt tool for reducing harm, however.

European tax treatment of alcohol varies even more widely than just the treatment of beer. Generally speaking, beer is taxed heavier than wine, with several countries placing no excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

on wine whatsoever. Beer is taxed lighter than spirits, however.

Innovation in the alcohol industry has blurred existing categorical lines. Craft brewing, with a diverse flavor profile and wider range of alcohol content, revolutionized the beer industry, exponentially increasing the number of beers available to global consumers. Malt liquor, a higher-alcohol-content beer brewed with extra malt, by its own name is such a clear category stratifier. Many ready-to-drink cocktails are distilled spirits drinks, but after combining the spirit with a mixer, the final product available to purchase has an alcohol content closer to a beer than a bottle of liquor.

The alcohol product landscape has changed. As such, we should be on the lookout for changes in tax policy.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.