The Internal Revenue Service (IRS) uses 1099 forms, also called information returns, to report various types of income. If you received a 1099-CAP form as a taxpayer this tax year, it might look particularly confusing, but don’t worry — we’re here to break it down for you. This article will give you all the details you need to navigate Form 1099-CAP and confidently file your taxes this season.

At a glance:

- Corporations send a 1099-CAP when they experience changes in structure, such as mergers or acquisitions.

- If you received any cash, stock, or property as a shareholder due to these changes, you might get Form 1099-CAP.

- Any gains from this situation must be reported on your tax return.

What is a 1099-CAP?

Corporations send out IRS Form 1099-CAP, Changes in Corporate Control and Capital Structure, to filers and the IRS when they experience significant structure changes. You will receive Form 1099-CAP if you own stock in a corporation that has undergone such changes, like a merger or acquisition, and you received cash, stock, or other property because of this change.

Essentially, the 1099-CAP form is your official notice that the corporation’s capital structure has shifted. As a shareholder, that might have implications for your investments, such as a gain or loss.

What counts as a substantial change in capital structure?

The IRS recognizes a change in capital structure when:

- The corporation provides $100 million or more in cash or other property to shareholders, and it merges, consolidates, or transfers all or substantially all its assets to another corporation.

- The corporation transfers all or part of its assets to another corporation in bankruptcy proceedings, including distributing its stock or securities.

- The corporation changes its identity, form, or place of organization, and the corporation or any of its shareholders must recognize gain under Internal Revenue Code 367(a) because of the transaction.

Exempt shareholders

The corporation does not have to send you Form 1099-CAP if you are an exempt shareholder. You are exempt if:

- You receive stock in an exchange that is not subject to gain recognition in section 367(a) and the regulations.

- Your amount of cash plus the fair market value (FMV) of any stock and other property does not exceed $1,000.

- You provide the corporation with a properly completed exemption certificate.

- You are a foreign individual with whom the corporation associated with a valid Form W-8BEN.

Additionally, the following entities are exempt from being required to file a Form 1099-CAP:

- Corporations (except S corporations)

- Tax-exempt organizations

- Individual retirement accounts (IRAs)

- The U.S. government or a state

- Foreign governments, international organizations, or a foreign central bank of issue

- Real estate investment trusts (REITs)

- Regulated investment companies (RICs)

- Securities or commodities dealers

- Entities registered under the Investment Company Act of 1940

- Common trust funds

- Financial institutions such as banks, credit unions, or similar

Example of Form 1099-CAP

Let’s look at a 1099-CAP example. Here’s what this tax form looks like:

On Form 1099-CAP, you’ll see the name and identifying information of the corporation making the report, including its taxpayer identification number (TIN). You’ll also see your information and TIN, which is often your Social Security number.

To the right, there are several boxes with key information:

- Box 1: Date of sale or exchange: The date the stock was exchanged for cash, stock, or other property.

- Box 2: Aggregate amount rec’d: The amount of cash and the fair market value of any stock (or other property) you received in exchange for the stock you held.

- Box 3: No. of shares exchanged: The total number of shares you owned that were exchanged.

- Box 4: Classes of stock exchanged: This tells you what kind of stock was exchanged. You might see “C” for common stock, “P” for preferred stock, or “O” for other.

Form 1099-CAP instructions

Here’s what you should do if you receive a 1099-CAP form:

- Review the form: Make sure all the information is correct. Double-check your share details and the FMV listed. If anything looks off, contact the issuer immediately.

- Determine your taxable income: Not every entry on Form 1099-CAP will lead to taxable income. It depends on how the corporate action affects your shares and if it leads to a gain or a loss.

- Report the information: If you had a gain, you’d use the amount in Box 2 of your 1099-CAP to fill out Form 8949, Sales and Other Dispositions of Capital Assets. TaxAct® software can help you figure out where to report 1099-CAP information if you e-file with us.

FAQs about Form 1099-CAP

Do I need to report the amount listed on my 1099-CAP?

If the corporate changes resulted in a gain, you must report it on your tax return and pay applicable income taxes. Losses should also be reported, as they can be used to offset other gains or income.

Where do I report 1099-CAP information on my taxes?

When you file with TaxAct, you’ll report any gains and losses with Form 1099-B, which will then automatically flow to Form 8949 or Schedule D, depending on your situation. We will go over this in more detail in the next section.

What if I didn’t receive a 1099-CAP, but I think I should have?

If you think you should have received Form 1099-CAP but didn’t, contact the corporation directly. Sometimes, forms get lost in the shuffle, so it’s always best to check.

How to File Form 1099-CAP with TaxAct

Ready to file your taxes? Here’s how to use Form 1099-CAP with TaxAct.

In TaxAct, capital gains and losses are entered on Form 1099-B, Proceeds From Broker and Barter Exchange Transactions, which details the securities you sold and your capital gains and losses. Depending on your tax situation, they then transfer automatically to Schedule D or Form 8949.

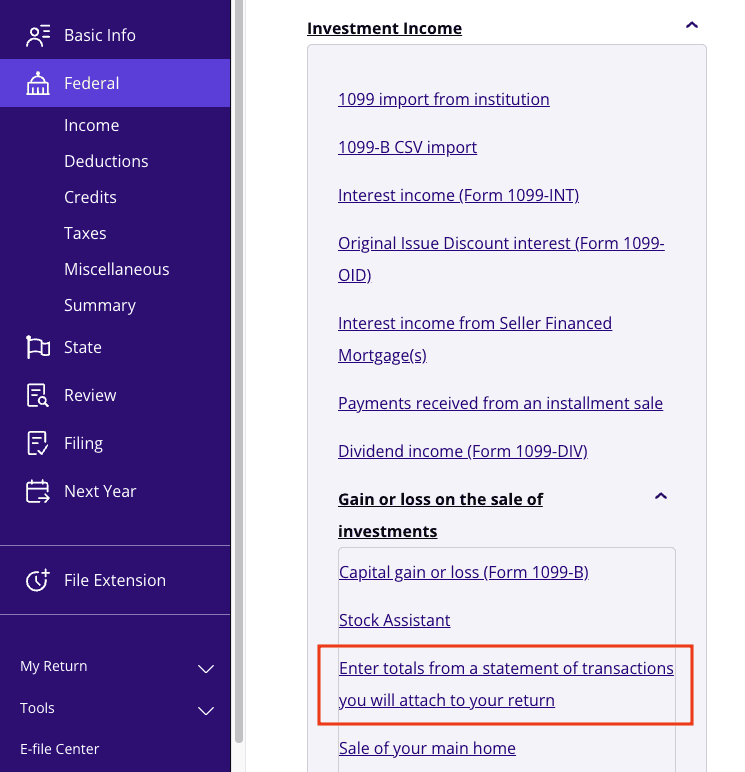

For further details on how to enter Form 1099-B in the TaxAct program, go to our Forms 8949 and 1099-B – Entering Stock Transactions in Program FAQ. You’ll have several options available:

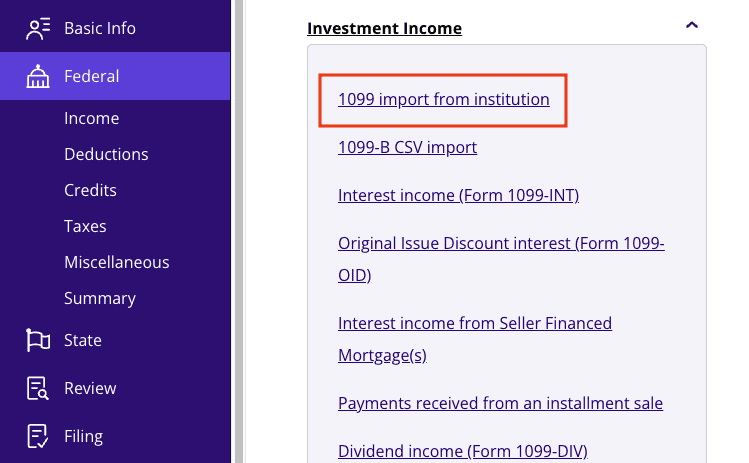

1. Electronically import from a TaxAct-supported brokerage:

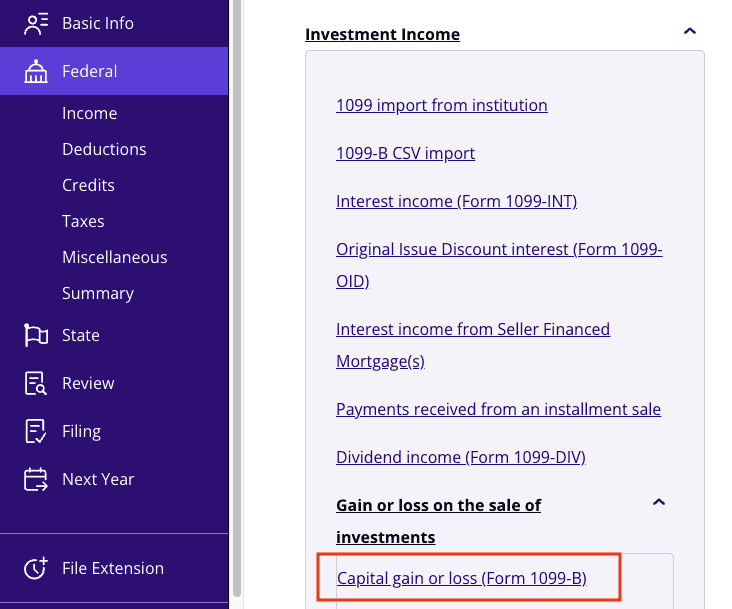

2. Enter each Form 1099-B manually in your income tax return:

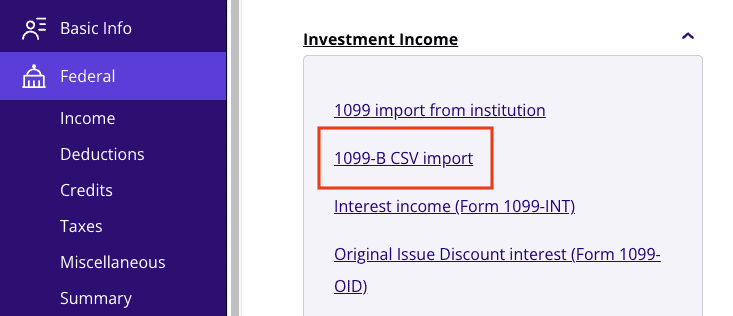

3. CSV import of transactions from your brokerage:

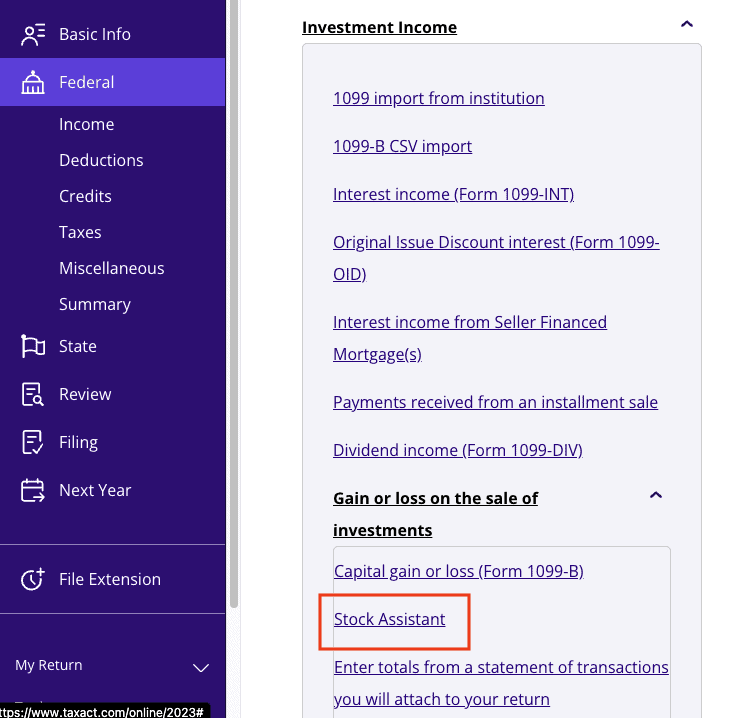

4. Using Stock Assistant for entering multiple transactions at once:

5. Entering information from Form 8949 if you received this tax statement:

You must enter the property description, date acquired, cost or other basis, date sold, sales proceeds, and any federal income tax withheld. The 1099-B form you received may or may not report the date acquired or the cost basis. If there are various purchase dates, go to our Capital Gains and Losses – Various Purchase Dates FAQ.

The bottom line

Tax filing might not be your idea of a good time, but with the right knowledge, it doesn’t have to be stressful. Understanding your Form 1099-CAP and what to do with it is a step in the right direction. And remember, TaxAct is always here to help you navigate filing your 1099 forms with confidence.

For more detailed information about Form 1099-CAP, head to the IRS website or TaxAct’s 1099-CAP support page.