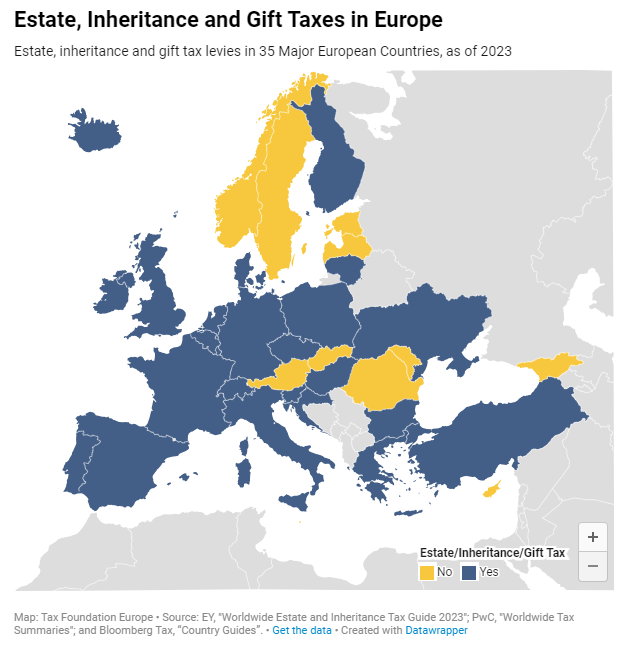

Inheritance taxes date back to the Roman Empire, which collected 5 percent of all inherited property to pay its soldiers’ pensions. Today, the practice is widespread. Twenty-four out of the 35 European countries covered in this map currently levy estate, inheritance, or gift taxes.

Estate taxes are levied on the property of the deceased and paid by the estate itself. In contrast, inheritance taxes are only levied on the value of assets transferred and are paid by the heirs. Gift taxes are levied when property is transferred by a living individual.

Countries typically charge either an estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs.

or an inheritance taxAn inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs. Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate.

. However, estates can be double taxed if they fall under two jurisdictions that apply different taxes. For this reason, European Union Member States have installed mechanisms intended to prevent or relieve double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income.

if such a situation occurs.

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

The taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

rates applied to estates, inheritances, and gifts often depend on the level of familial closeness to the inheritor as well as the amount to be inherited. For example, in France, different rates are applied to transfers to ascendants and descendants, transfers between siblings, blood relatives up to the fourth degree, and everyone else. For transfers to ascendants and descendants as well as between siblings, higher rates are applied to larger sums of money.

In some countries—such as Belgium, Spain, or Switzerland—estate, gift, and inheritance tax rates also vary by region. Most European countries do not tax transfers below a certain amount.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share