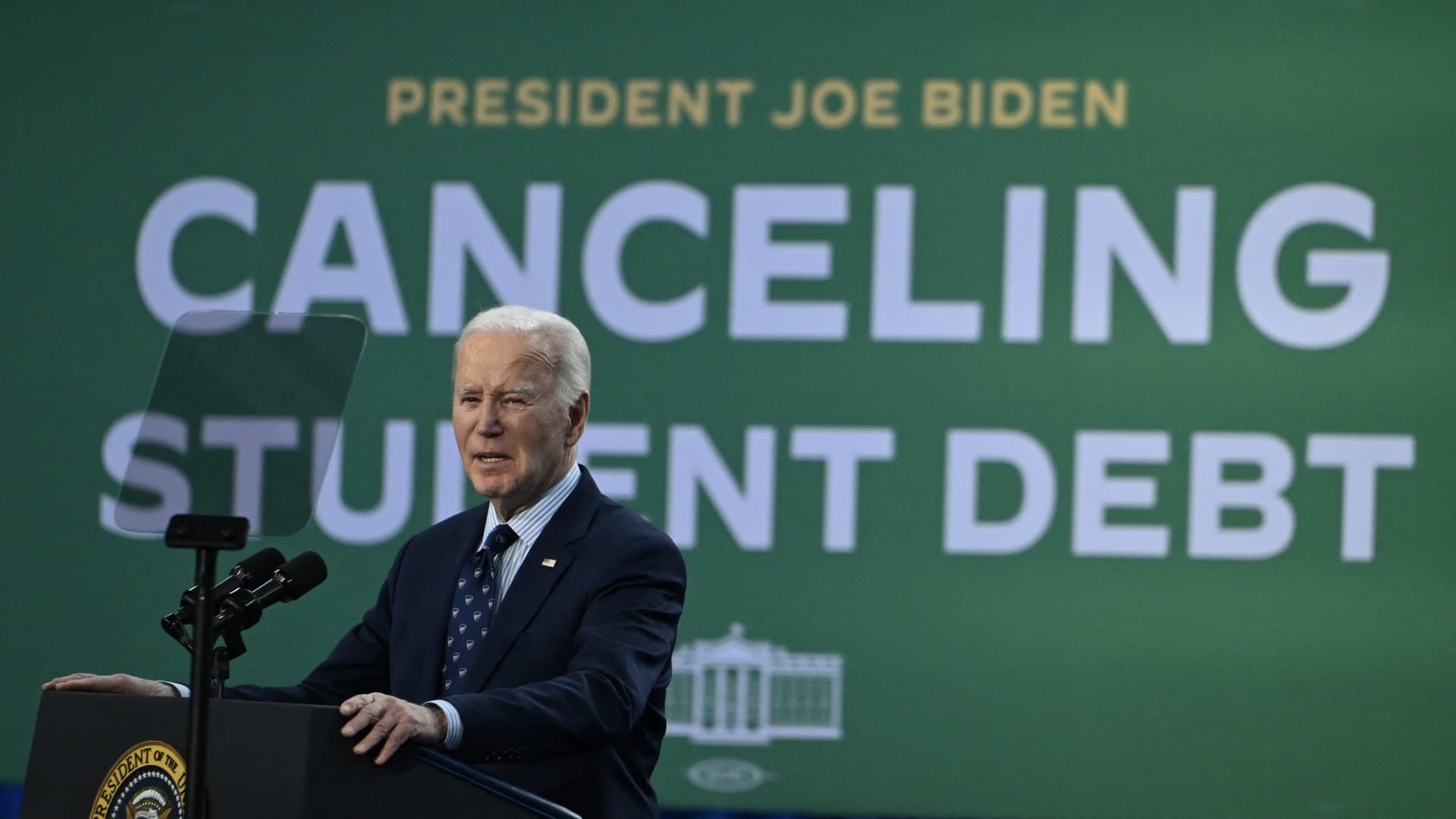

President Joe Biden on Monday unveiled a new student loan forgiveness plan — and any of that relief dispensed in 2024 wouldn’t trigger a federal tax bill.

But borrowers could still owe federal taxes on future forgiveness, experts say. Some states may also tax debt forgiveness received this year or in future years.

If enacted as proposed, Biden’s plan would cancel up to $20,000 in unpaid interest for millions with student loans. The plan could also cancel debt for certain groups of borrowers.

More from Personal Finance:

Biden’s student loan forgiveness plan could erase up to $20,000 in interest

Here’s how to make key college decisions amid FAFSA delays

‘Proceed with caution’ before tapping AI chatbots to file your tax return

Tax treatment of student loan forgiveness

Student loan forgiveness is federally tax-free through 2025 — thanks to a provision from the American Rescue Plan Act of 2021. Biden wants to make that policy permanent, according to his 2025 fiscal year budget. But the future taxability of student loan forgiveness is unclear.

If Biden’s new plan is finalized as proposed and borrowers receive cancellation before 2026, the forgiven balance won’t incur federal taxes.

However, some borrowers could still see a state tax bill, according to Tommy Lucas, a certified financial planner and enrolled agent at Moisand Fitzgerald Tamayo in Orlando, Florida.

Many states have conformed to federal rules on the taxability of student loan forgiveness. But borrowers shouldn’t assume there won’t be state liability, he said.

“You need to take that into account and understand what your state is going to do,” Lucas added.

Borrowers could owe taxes after 2025

If you’re slated to receive student loan forgiveness under an income-driven repayment plan after 2025, that’s not automatically tax-free, explained CFP Ethan Miller, founder of Planning for Progress in the Washington, D.C., area.

Biden’s proposal to cancel student loan interest could reduce balances. But if tax-free forgiveness isn’t extended, “some borrowers are potentially facing a pretty large tax bill down the line,” said Miller, who specializes in student loans.

For example, if you received $50,000 in forgiveness after 2025, and you’re in the 22% tax bracket, your federal tax liability could be $11,000.

Plus, federal income tax brackets are scheduled to rise after 2025 due to an expiring provision from the Tax Cuts and Jobs Act of 2017.

After 2025, the individual tax brackets will revert to 10%, 15%, 25%, 28%, 33%, 35% and 39.6%, which “could be a double whammy for some people,” Miller said.

Depending on your situation, higher income from taxable student loan forgiveness could cause “a chain of [tax] consequences,” such as phaseouts for other tax breaks, Lucas said.