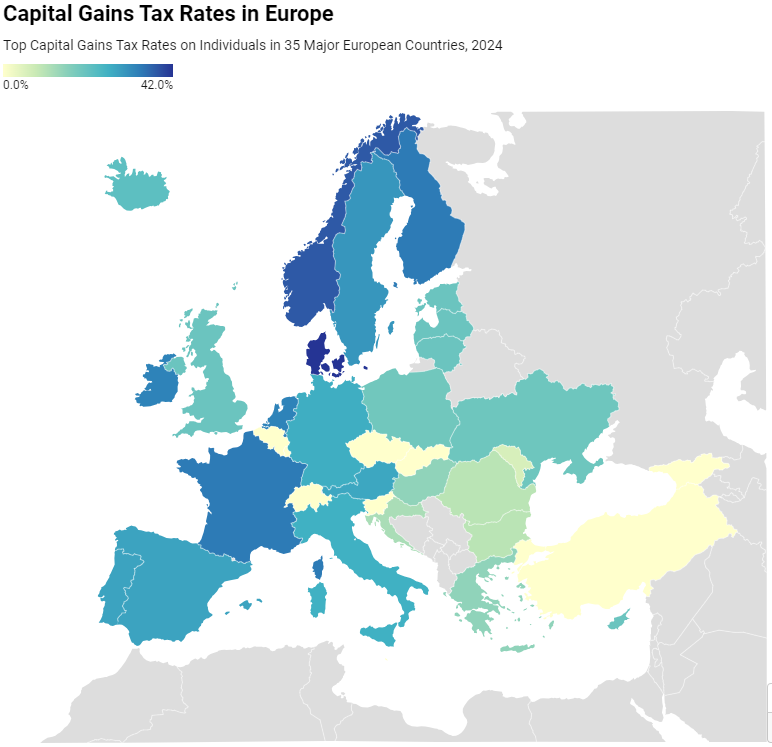

In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Today’s map focuses on how capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

rates differ across Europe.

When a person realizes a capital gain—that is, sells an asset for a profit—they face a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

on that gain. For example, if you buy a share for €100 and sell it for €120, you pay capital gains tax on your €20 gain.

These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. Higher taxes also cause investors to sell their assets less frequently, which leads to fewer taxes being assessed. This is known as the realization or lock-in effect.

The capital gains tax rates shown in the map are the top marginal capital gains tax rates levied on individuals, taking into account exemptions and surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services.

es. If the capital gains tax rate varies in a country by type of asset sold, the tax rate applying to the sale of listed shares after an extended period of time is used.

Explore our interactive map below to see how your country compares.

Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent. Norway levies the second-highest top capital gains tax at 37.8 percent. Finland and France follow at 34 percent each.

A number of European countries do not levy capital gains taxes on the sale of long-held shares. These include Belgium, the Czech Republic, Georgia, Luxembourg, Malta, Slovakia, Slovenia, Switzerland, and Turkey. Of the countries that do levy a capital gains tax, Moldova levies the lowest rate, at 6 percent, followed by Bulgaria and Romania, at 10 percent each.

On average, the European countries covered tax capital gains arising from the sale of listed shares at 17.9 percent. Across EU Member States, the average lies at 18.6 percent.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share

Previous Versions

-

Capital Gains Tax Rates in Europe, 2023

3 min read

-

Capital Gains Tax Rates in Europe, 2022

4 min read

-

Capital Gains Tax Rates in Europe, 2021

4 min read

-

Capital Gains Tax Rates in Europe, 2020

2 min read

-

Capital Gains Taxes in Europe, 2019

2 min read