Recent innovations in alcohol production have created a boon for alcoholic beverage consumers. However, taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

policy has lagged behind the rapidly changing product environment. We have previously detailed how newer products like hard seltzers and ready-to-drink cocktails (RTDs) straddle the historical product categorical lines used to delineate tax policy, resulting in non-neutral and often counterintuitive tax policy. Our suggestions were to either eliminate the tax categories and tax all alcoholic products based on their alcohol content or to create new tax categories that better fit the current product landscape. A new Maryland bill shows that neutrality can be improved by reducing taxes on some products.

Maryland House Bill 0663 would establish a new tax category for RTDs. House Bill 663 defines an RTD as a beverage containing a distilled spirit, mixed with a nonalcoholic beverage and possibly containing wine, containing 12 percent or less alcohol by volume, and which is contained in original packaging consisting of a metallic container or can that is not more than 12 ounces.

Maryland HB 663 would reduce the rate applied on RTDs to $0.40 per gallon, which is equal to the rate applied to wine.

Currently, Maryland applies a tax rate for distilled spirits of $1.50 per gallon, plus an additional $0.015 per gallon for each 1 proof over 100 proof. For comparison, the excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

rate for wine is $0.40 per gallon and the excise tax rate for beer and mead is $0.09 per gallon. Maryland also charges a 9 percent sales and use tax to alcoholic beverage sales and additional taxes can be added based on place of production, size of container, or place purchased.

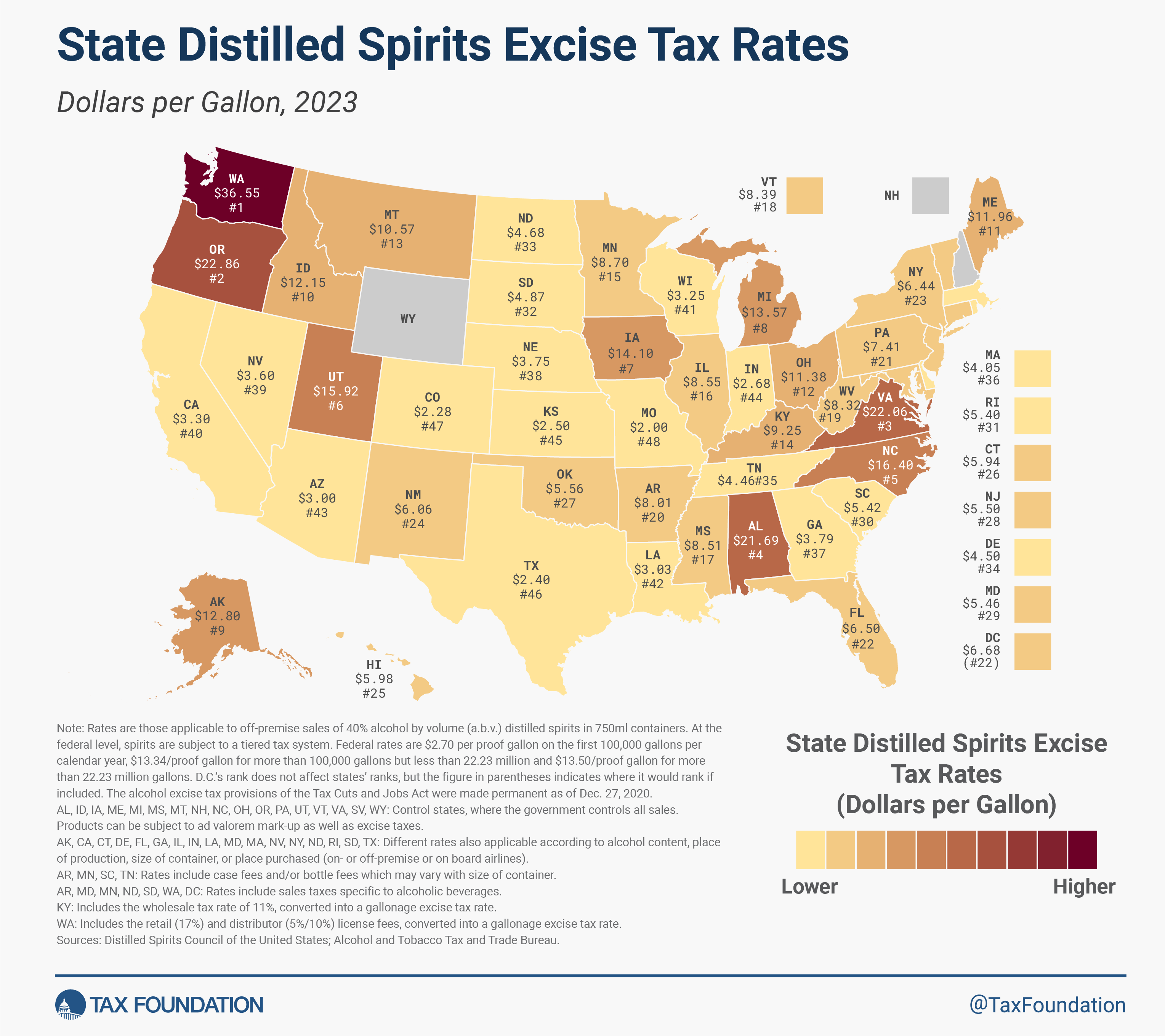

We estimate the combined tax on the sale of distilled spirits is $5.46 per gallon—the 29th-highest rate in the country.

Spirits have historically been taxed more heavily than beer or wine. When categorical taxes were initially implemented, the categories were clearly delineated. Beer, wine, and spirits were very different products, each having a significantly different alcohol content. Even today, wines have 10-16 percent alcohol content, most beers have an alcohol content of around 5 percent, and spirits tend to have around 40 percent alcohol by volume. With differing alcohol contents and corresponding risks for alcohol abuse and external harms, higher tax rates on clearly delineated categories of products would be a practical approach.

A categorical system does not work as well in a rapidly changing product environment, however. By including the mixer (e.g. the Coca-Cola in a Jack and Coke) in the prepackaged drink product, the alcohol content in an RTD is often much closer to that of beer or wine than a bottle of liquor. Despite the reduced alcohol content, many RTDs and other products are still taxed at the higher spirits tax rate.

At the federal level, for example, spirits are taxed more heavily even across products containing the same alcohol content. Consider three “standard drinks,” each containing 0.6 ounces of alcohol: a 12-ounce beer containing 5 percent alcohol, a cocktail made with 1.5 ounces of 40-proof spirits, and a 5-ounce glass of wine with 12 percent alcohol content. Even though the alcohol content of each beverage is the same, the federal taxes applied to the cocktail are more than three times the rate applied to wine and more than double the rate applied to beer.

A tax based on alcohol content would be the most neutral, straightforward means of raising revenue from alcohol. But since such a tax would constitute a redesign of the entire alcohol tax system at both the state and federal levels, the next best approach is to create more categories for new products.

Maryland’s HB 663 starts the process of creating new categories for new products by giving RTDs their own tax rate identical to the rate the state charges wine. The state may need more categories in the future, or to overhaul the entire system based on alcohol content, but HB 663 would make alcohol taxes in Maryland more neutral than they currently are.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share