In the spring of 2021, Marjorie Bloom waited for a phone call that would never come.

Over the course of the previous month, the retiree had wired hundreds of thousands of dollars into cryptocurrency per the suggestion of someone she believed to be a trusted confidant. The man claimed to be a “fraud investigator” at PNC Bank, where she’d been a longtime customer.

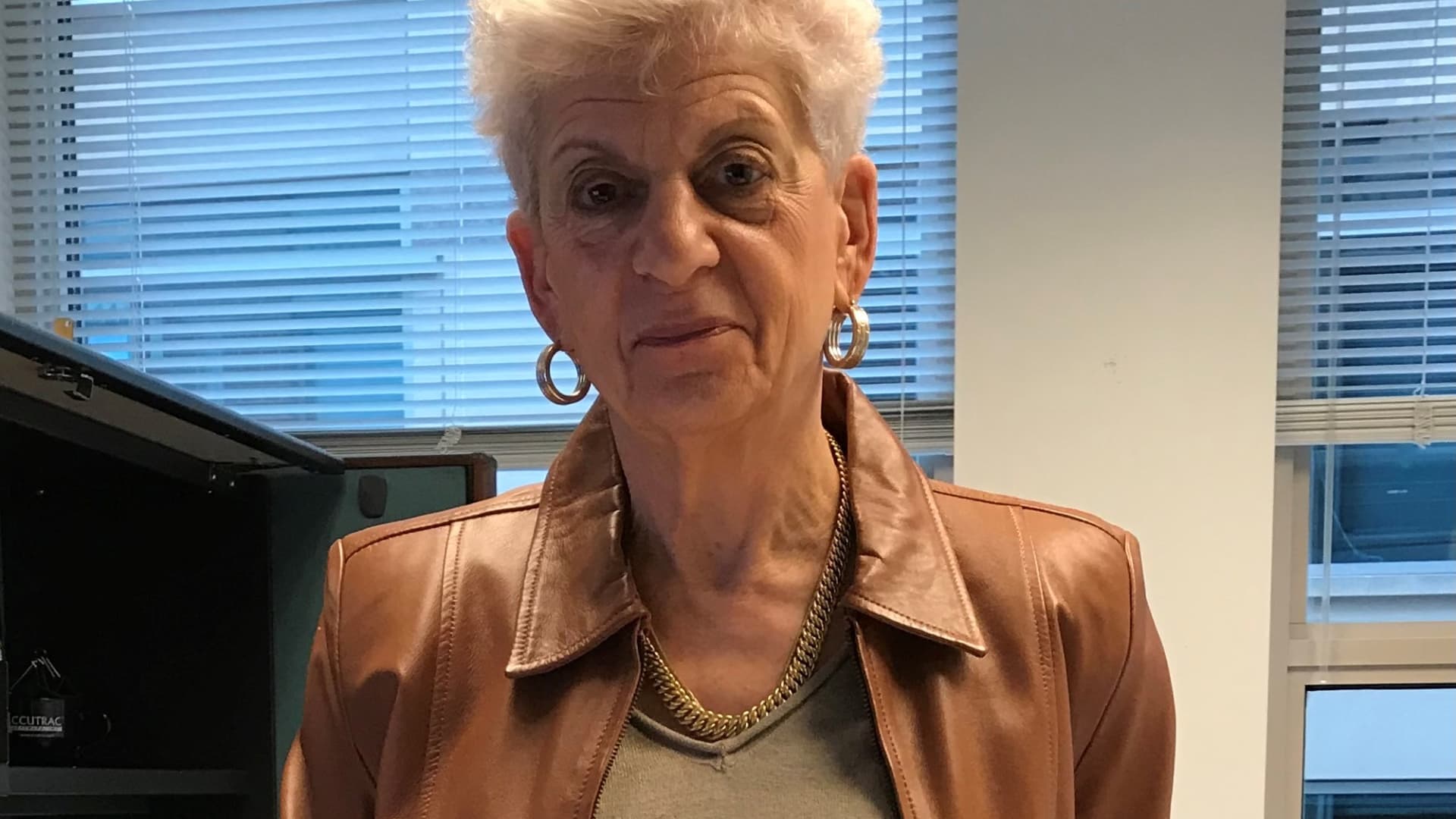

At his behest, Bloom, a widow who is now 77, liquidated her nest egg — savings, stocks, an annuity — for a total of $661,000.

More from Personal Finance:

Student loan borrowers at risk of scams as payments restart

Social Security’s trust funds are running dry: 4 things to know

This account is like an ‘extra strength’ Roth IRA

The action was supposedly preventative: The “investigator” persuaded Bloom that criminals, using stolen personal data, were in the process of pilfering her life savings. To protect her money, he said, she had to move it quickly — and covertly. Divulging the problem to anyone, even her three children, could compromise their efforts, he said.

Had she alerted her children, she might have avoided the scam: Bloom’s daughter, Ester, is the deputy managing editor for CNBC Make It. (Ester Bloom put CNBC in touch with her mother but was not involved in the reporting or editing of this story.)

The “investigator,” though very convincing, turned out to be a wolf in sheep’s clothing. Bloom, a retired civil servant, was ensnared in a “tech support” scam.

This type of fraud is increasingly common and largely targets older adults, who lost $588 million to tech support scams in 2022, according to the Federal Bureau of Investigation. Criminals persuade victims they have a serious computer issue such as a virus, then masquerade as computer technicians from well-known companies as a cover for theft. Often, they persuade victims to wire funds to fraudulent accounts.

So on that Friday morning in May 2021, Bloom eagerly awaited a call with instructions on how to access the life savings she had diligently taken steps to secure.

The hours ticked by. Growing nervous, she eventually called the “investigator.” His number had been disconnected. She called PNC, but the bank didn’t have a record of the employee.

“All of a sudden, this grayness lifted,” said Bloom, who lives in Chevy Chase, Maryland. “I realized I had been defrauded of everything.”

‘The money is there. The scammers know that’

Bloom’s experience reveals an unsettling reality at a time when technological advancement, little-understood investment options and a patchwork of protections in the U.S. financial system expose more older Americans to financial fraud.

Americans 60 and older lost $3.1 billion to cyber fraud in 2022, an 84% increase from 2021, according to the FBI. Losses have jumped ninefold in just five years, from $342 million in 2017, FBI data shows. Because fraud statistics are based only on reported incidents, its true scope may be far greater.

Older adults, many of whom have saved their entire careers for retirement, can have the most to lose. In addition to retirement savings, they might have other pots of income and wealth: home equity, Social Security payments, pension checks and, if widowed, maybe a life insurance payout.

“The money is there,” said Rebecca Keithley, a supervisory special agent in the FBI’s Economic Crimes unit and the bureau’s national program coordinator of the Department of Justice’s Elder Justice Initiative. “The scammers know that.”

Keithley — also the FBI’s national program coordinator for frauds and swindles — is not involved in the investigation of Bloom’s case.

Meanwhile, the U.S. is undergoing a massive demographic shift as an average of 10,000 baby boomers hit retirement age every day. This generation has shouldered more responsibility for their retirement preparations as employers began shifting away from pensions to 401(k)-type retirement plans decades ago.

Consumers ages 65 and older had an average of $232,710 in 401(k) plan savings in 2022, according to Vanguard Group, one of the nation’s largest retirement-plan administrators. Further, 65- to 74-year-olds had a net worth of more than $1.2 million, on average, in 2019, according to the Federal Reserve’s most recent Survey of Consumer Finances.

Fraud may deprive victims of funds for basic living expenses such as food and shelter, or for the travel and leisure they’d worked so hard to attain in their post-work life.

Beyond the immediate financial hit, fraud has several knock-on effects: Victims who raid their tax-preferred retirement funds may owe the IRS a hefty bill. Taking out a second mortgage or maxing out credit cards carry regular debt payments.

Older adults don’t have the same ability as younger victims to earn in the workforce, and it’s often challenging to recoup money from criminals or financial institutions.

“Most victims will say, ‘I’m devastated financially, I’m ruined,'” said Kathy Stokes, director of fraud prevention programs at AARP, an advocacy group for older adults. “But emotionally it’s as bad, if not worse.”

How criminals ‘hijack’ the aging brain

Tech support scams like the one Bloom suffered are an acute threat for older adults.

They are a type of “call center” fraud, which “overwhelmingly target” older adults, the FBI said. About half of people victimized by illegal call centers are 60 or older, and they experience 69% of the total financial losses relative to other age groups.

Nearly 18,000 Americans ages 60 and over reported being a victim of tech support scams in 2022, the FBI said. That’s more than any other type of elder fraud and almost doubled from 2020.

Victims 60 and older lost more to these scams than all other age groups combined, the FBI reported. The average person lost $33,000, though losses extended to over $1 million in some cases, the FBI said.

In Bloom’s case, her computer froze suddenly on April 22, 2021. A popup window alerted her to call a customer support phone number listed on the screen, supposedly for Microsoft.

Bloom then made a key mistake: She called the number, an action that real tech companies won’t ever ask of customers in a security pop-up warning.

During the call, a “Microsoft engineer” told her that foreign hackers had hijacked her computer and stolen sensitive personal data. Her financial accounts, he suggested, were also likely under threat.

When Bloom told him she banked with PNC, the engineer — who was really a con artist — transferred her to an accomplice posing as a PNC fraud investigator. The man convinced Bloom that there were pending transactions worth $29,000 tied to her bank account. Her money had to be moved without delay to a new account, the scammer urged.

None of it was true.

“I fell for it,” said Bloom, who retired in December 2017 after serving 42 years as a federal attorney, including stints at the Department of Energy and, most recently, the Pension Benefit Guaranty Corporation.

“I didn’t tell anybody,” Bloom added.

The appearance of an immediate threat is an “age-old psychological technique” common in frauds that tends to be “more successful with the aging brain,” said Keithley of the FBI.

In this technique, known as an “amygdala hijack” in reference to the brain’s fear and threat response center, criminals trigger strong emotional reactions that overwhelm the rational part of our brains. We act rather than think, a classic fight-or-flight response — in this case induced by nefarious social engineers, often part of sophisticated organized crime networks.

Older adults tend to be home more often, use landline phones and be generally unsophisticated about technology and safe online behavior — all of which make them vulnerable and therefore frequent targets, Keithley said.

The Covid pandemic was a disproportionate threat to older adults, keeping Americans indoors and quickly pushing them online. The health emergency “ushered in a new wave of exploitative practices targeted at older Americans,” U.S. Attorney General Merrick Garland said in a 2022 report to Congress.

‘Somebody should have asked’

Bloom, an avid traveler, is undeniably tough. In 2013, at 67 years old, she trekked to the base camp of Mount Everest, the world’s tallest mountain; the base camp alone sits at an altitude of about 18,000 feet.

But the scam tested her resolve.

A year after the fraud, Bloom set out on a road trip to North Dakota. Five days in, she had a panic attack that seized the right side of her body in pain. She canceled everything and went home.

“In retrospect, I think the entire ordeal was a fearful reaction to spending money,” Bloom said.

Before she realized she’d been scammed, Bloom had made five wire transfers within 28 days, amounting to $661,000, according to receipts of the transactions, which were reviewed by CNBC.

Much of those funds came from liquidating a stock portfolio — an inheritance from her parents — worth more than $400,000. She also liquidated the bulk of an annuity worth more than $200,000; if she’d kept it intact, it would have begun paying her a guaranteed income stream of about $2,700 a month for the next three decades, starting in 2023.

“This was my life savings,” Bloom said. “It’s what I was going to live on as a retiree.”

When she discovered the loss, Bloom’s immediate thought was of her three kids: a “profound disappointment” at squandering the reserves she’d intended to bequeath them. Bloom had wanted to offer the same financial assistance to her children as her parents had provided for her. Now, much of that money is gone, she said.

Her second concern was for her own financial security. Bloom still receives regular checks from a federal pension and Social Security, now her main sources of retirement income. It’s enough to cover her mortgage, condo fee, car payment and other necessities — but the financial loss exposes Bloom to sacrifices nonetheless.

For one, she laments an inability to travel as frequently as she’d hoped in retirement. She is a member of the North Bethesda Camera Club and uses trips as an outlet for photography, a hobby that developed during her Everest expedition.

“I’m not starving,” Bloom said. “But I could do a lot more [if I hadn’t lost money].”

“I’ve lost a significant amount that I’ve worked for,” she said.

All of a sudden, this grayness lifted. I realized I had been defrauded of everything.Marjorie BloomMaryland resident

Bloom sued PNC Bank — where she’d been a customer for over a decade — in May 2022 for full financial restitution and other damages, such as interest and attorney’s fees.

In her lawsuit, Bloom argued that the fraud was ultimately successful because PNC ignored “obvious red flags” and “textbook evidence” of financial exploitation raised by her wire transfer requests, which were inconsistent with her typical pattern of banking.

According to the lawsuit, the bank didn’t take steps to investigate or determine whether her money was at risk. The lawsuit claimed the bank acted negligently and breached its contractual duty of care.

“I’m retired … [and] I look my age,” Bloom said. “There’s just no doubt about it.”

“Somebody should have asked,” she added.

In February, a federal judge in the District of Columbia dismissed the negligence claim but allowed the claim for breach of contract to move forward in court.

Bloom and the bank settled the lawsuit in September. Bloom declined to disclose terms of the agreement to CNBC. (Bloom’s comments to CNBC for this story occurred in the spring, before the parties entered into settlement negotiations.)

A spokesperson for PNC Bank declined comment on the settlement.

Asked about the lawsuit in the spring, the bank said it acted within the scope of its legal duty.

“PNC maintains a comprehensive set of security controls to help protect our customers from increasingly sophisticated fraud threats and, when possible, we do our best to recover funds on behalf of impacted customers,” a spokesperson told CNBC, when asked about Bloom’s case and statements about the bank.

“While PNC regrets any losses incurred by a customer, we disagree with the allegations in this case and believe we acted appropriately with respect to these transactions,” the spokesperson added.

‘You’re basically at the mercy of your bank’

Lawsuits such as Bloom’s are rarely successful, legal experts said. Outcomes hinge on a complex web of federal and state rules that govern banking and elder financial fraud.

For instance, there’s a distinction between “unauthorized” and “authorized” banking transactions.

Unauthorized transactions occur when criminals get hold of a customer’s personal information — a debit card number, let’s say — and buy something without approval. Customers are often reimbursed in such instances.

However, in Bloom’s case, she made the wire transfers. Transactions initiated by a customer — even a victim duped by scammers — are generally considered “authorized,” said Carla Sanchez-Adams, senior attorney at the National Consumer Law Center. And such transactions carry weak customer protections, she said.

“You’re basically at the mercy of your bank,” Sanchez-Adams said.

Wire transfers also have weaker protections than other types of electronic fund transfers — such as debit card, ATM or peer-to-peer transactions, for example — because they’re exempt from the Electronic Fund Transfer Act, a federal consumer protection law passed in 1978, she said.

I’m retired … [and] I look my age. There’s just no doubt about it. Somebody should have asked.Marjorie Bloomfraud victim

Another federal law — the Bank Secrecy Act — sets standards for banks to ensure they have controls to prevent and detect crime such as money laundering and terrorist financing. While the law requires banks to file reports to regulators in certain cases to flag suspicious activity, it doesn’t give individual consumers a legal remedy to recoup money lost due to criminal enterprise, Sanchez-Adams said.

“Banks should have some skin in the game,” Sanchez-Adams said. “If you don’t make them hurt, they won’t change their practices.”

Some states have elder-protection laws that establish separate duties to protect older adults from financial fraud, but they vary broadly in scope, she said.

For example, under Maryland law, banks are required to report suspected elder fraud to local law enforcement and other parties. As Bloom argued in her lawsuit, that means employees have likely received training to identify such activity. Such “heightened procedures” to protect older adults are part of the bank’s duty of care relative to older customers, the lawsuit said.

To sidestep internal protocols — which most banks have established, according to industry data — scammers will often coach victims on what to say to bank tellers or other representatives, experts said. Perhaps the money is for a loan, or for a home-improvement project, for example. Bloom didn’t require coaching, she said; according to her lawsuit, PNC bank employees didn’t perform more than a “perfunctory inquiry” necessary to complete the transfers.

And there’s an additional tension: Banks and other financial institutions have to weigh issues such as consumer privacy when choosing to intervene, said Marve Ann Alaimo, a partner and elder law expert at Porter Wright Morris & Arthur.

If the bank reasonably does its best to protect a client and there’s still financial damage, it isn’t necessarily the bank’s fault, she said.

“We live in a free-market economy. And when you own something, you have the ultimate right to dispose of it as you wish,” Alaimo said, referring to money held in a financial account.

“There’s only so much protection a third party can provide for you,” she added. They “aren’t the ultimate arbiter of free will.”

Cryptocurrency gives thieves ‘new advantages’

Meanwhile, Bloom’s money apparently went on a global tour.

Scammers had her wire funds from her PNC bank account to an account at the now-defunct Signature Bank in New York. According to the lawsuit, from there, her money was transferred to an account on the cryptocurrency trading platform Coinbase, which scammers created using Bloom’s picture and personal data. The assets were then converted into cryptocurrency — a type of virtual asset — and, an investigation later showed, moved to offshore accounts on the Binance crypto trading platform in the Cayman Islands.

Thieves have successfully used crypto to steal increasing amounts of money across all types of internet scams, according to the FBI.

In this context, cryptocurrency — examples of which include bitcoin and ethereum — is like cash; it’s just another way to move money from Point A to Point B. But crypto “offers up new advantages” for thieves who transfer and launder illicit proceeds, said Patrick Wyman, chief of the FBI’s Virtual Asset Unit. Wyman is not involved in the investigation of Bloom’s case.

For one, using crypto is an easy way to move large sums of money across borders very quickly without having to engage with the financial system, Wyman said.

Another benefit for scammers: Crypto offers them a level of anonymity. Criminals use the digital assets to obfuscate their real identity — which, by the nature of crypto transactions, is difficult if not impossible to ascertain.

However, unlike with traditional financial transactions, which are private, all crypto transactions are recorded on a public ledger, or blockchain. So, while law enforcement officials may not be able to learn the identity of a perpetrator, they can generally trace the flow of money, Wyman said.

And that offers a silver lining for victims: “In some cases, we absolutely are able to recover those funds,” Wyman said.

In April, the U.S. Department of Justice seized more than $112 million worth of virtual currency linked to crypto investment scams. The assets were seized from six accounts, one of which held $66.4 million, likely tied to wire fraud schemes, the DOJ said.

Wyman encourages victims to report fraud to the FBI’s Internet Crime Complaint Center as soon as possible. It generally gets harder to recoup money the longer victims wait, he said.

Bloom reported the theft to the FBI; her case remains open. She’s not optimistic about her chances of recovering money via law enforcement efforts. Even if the authorities are successful, she expects it will take years.

“I oscillate,” she said of her reflections on the theft.

“I go from being thoroughly upset and [asking] ‘What in the world was I thinking?’ to saying ‘You just have to move forward. What’s done is done.'”