U.S. states fund most of their road and infrastructure budgets with revenues from gasoline taxes. The historical rationale behind this is intuitive. The more people use public roads, the more gasoline they consume, making the gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline.

a well-designed user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided.

A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them.

.

The gas taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

is often levied as a specific tax per gallon. While the commodity price of oil can fluctuate dramatically, the volume basis for the tax and citizens’ general dependence on gas for transportation have made the gas tax a stable source for funding roads. Gas taxes also serve as a disincentive to drive, decreasing both traffic congestion and pollution on the margin.

As the market share of electric vehicles (EVs) on the road grows, however, the gas tax’s ability to fund road projects and decrease traffic congestion erodes. Both federal and state real tax revenue per vehicle mile traveled has been on a steady decline for decades, creating a fiscal gap for road expenditures even as the demand for road infrastructure improvements has grown.

EVs produce lower emissions than traditional combustible-engine vehicles. Combining the fiscal gap with a desire to incentivize lower-emission vehicles, states have responded with a variety of tax policies.

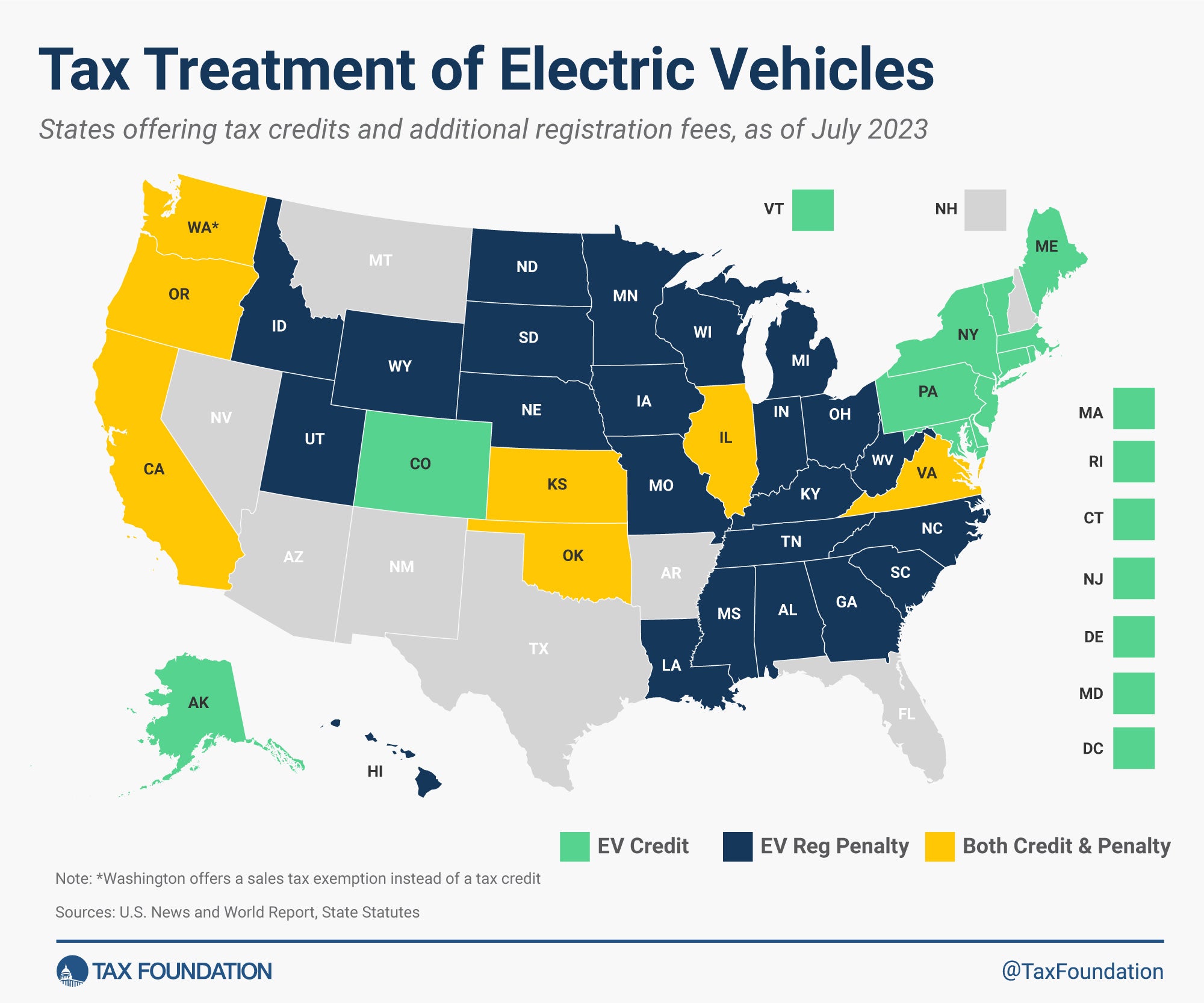

The following map depicts states’ different approaches to incentivizing EV adoption and the imposition of higher registration fees for EV ownership.

Residents of all states are eligible to receive a federal tax credit of $7,500 for qualified EV purchases. Nineteen states offer an additional incentive beyond the federal credit ranging from a $1,000 incentive in Alaska and Delaware to a $7,500 credit in California, Connecticut, and Maine.

Contrary to a tax incentive, 24 states impose a higher annual vehicle registration fee for EVs and some hybrid vehicles to help offset forgone gas tax revenue. These fees range from $50 in Hawaii and South Dakota to $200 in Ohio, West Virginia, and Wyoming.

Five states offer both an incentive for the purchase of an EV and impose a higher registration fee for EVs than for combustible-engine vehicles. The table below summarizes details about these policies.

Another response by states to backfill reductions in gas tax collections has been to implement a tax on EV charging stations. Six recent state laws targeting EV charging stations include the following:

- Georgia will require stations to track kilowatt-hour usage and collect a tax for every 11 kilowatt-hours (effective January 2025).

- Iowa imposes a $0.026 per kilowatt-hour tax on public EV charging stations (effective July 2023).

- Kentucky will impose a tax of $0.03 per kilowatt hour on electric vehicle power distributed by an electric power dealer (effective January 2024).

- Montana imposes a tax of $0.03 per kilowatt hour or its equivalent on electric current from public electric vehicle charging stations (effective July 2023). Public charging stations already in operation have until July 2025 to install meters to collect the tax. To relieve the tax burden on in-state electric vehicle owners, B. 55 reduces electric vehicle registration fees by 30 percent starting in 2028.

- Oklahoma will implement an electric vehicle charging tax (effective November 1, 2023).

- Utah imposes a tax on retail sales of electric current from electric vehicle charging stations (enacted March 2023).

Higher registration fees and EV charging station taxes are an attempt to better connect vehicle miles traveled (VMT) to transportation and road funding, yet in some instances, they are implemented in conflict with policies aimed at increasing EV adoption. A simpler transportation policy solution would be a VMT tax.

A VMT tax is levied on the number of miles traveled by an individual vehicle. While there are privacy concerns with the administration of the tax, it could directly link the miles traveled to public road and infrastructure spending.

Two pieces of federal legislation—the Surface Transportation System Funding Alternatives Program (2015) and the Infrastructure Investment and Jobs Act (2021)—provided funding for states to run VMT pilot programs. Utah already has, and Hawaii will enact (effective July 2025), an annual per-mile road usage charge for EVs in lieu of the EV registration fee.

The state EV taxation landscape reflects the evolving transportation sector and the pressing need to address both fiscal gaps in road funding and environmental concerns. As the EV market continues to evolve and technology advances, it’s likely that these tax policies will also adapt.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share