Key Findings

- Competition with China has become a key theme of American politics. One crucial aspect of that competition is aggregate economic growth.

- One policy lever that affects aggregate economic growth (among many) is the structure of the corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

system and its effects on investment and productivity. - Historically, broadly pro-investment tax policy has driven higher levels of investment and productivity growth. In contrast, narrow policy aimed at specific industries may benefit the recipients but often reallocates rather than stimulates investment.

- Currently, China provides more favorable tax treatment of investment broadly and layers on a much greater magnitude of subsidies than the United States, particularly with its super deduction for research and development (R&D).

- In the United States, full cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages.

for machinery and equipment investment is phasing out, a new tax penalty for R&D has taken effect, and the headline corporate rate when including the average of state and local rates already sits higher than China’s headline rate. - Restoring expensing for R&D, machinery, and equipment; extending better cost recovery to structures investment; and avoiding raising the corporate tax rate would create a stronger, pro-investment policy environment for the US economy. We estimate better cost recovery could boost US economic output by 1.7 percent and the size of the capital stock by 3.3 percent, at about half the budgetary cost of the InflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

Reduction Act’s green energy tax credits and the CHIPS and Science Act’s tax credits, grants, and spending authorizations. - Better tax policy would not serve as a cure-all for narrower security-related economic concerns with China but would support increased capacity to help meet such challenges.

Introduction

Global competition with the People’s Republic of China is one of, if not the, central overarching issue in United States politics today. It was a part of then-candidate Donald Trump’s 2016 presidential campaign, and (at least partly) drove his tariffTariffs are taxes imposed by one country on goods or services imported from another country. Tariffs are trade barriers that raise prices and reduce available quantities of goods and services for US businesses and consumers.

policy during his presidential term. The Biden administration’s signature post-pandemic policy achievements, the Inflation Reduction Act and the CHIPS and Science Act, feature competition with China as secondary and primary goals, respectively.

The competition with China is multidimensional, with geopolitical and military aspects taking center stage. Competition in specific industries has also been salient, particularly in the wake of supply chain disruptions during the COVID-19 pandemic. However, one dimension of US-China competition, perhaps upstream of all the others, is overall economic strength and size. Today, the United States remains the largest economy in the world (depending on how one adjusts for exchange rates and purchasing power parity). Over the past several decades, China has grown rapidly, surpassing Japan as the world’s second-largest economy in 2010 and shrinking the gap with the United States in the following decade. In recent years, China has seen its growth slow, but it remains the only country in the US’ tier in terms of aggregate output.

While economic size and strength are not the answer for all the other aspects of US-China competition, they certainly affect them. A larger economy means more potential to invest in the military and other security-related infrastructure and capacity, more leverage in international and foreign commercial markets, and more diplomatic heft.

Our paper is focused on merely one policy component of the overall economic race between the United States and China: tax policy design. Tax policy matters for the larger economy, and the larger economy matters for the United States on the global stage. As the debate over the expirations of the 2017 tax law looms, lawmakers should prioritize improvements to cost recovery of investment—namely, permanence for 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

, R&D expensing, and accelerated write-offs for structures investment. Tax policy improvements aimed at marginal investment would grow the US capital stock and strengthen our economy’s position around the world—particularly compared to that of our cross-Pacific rivals.

How Do the US and Chinese Economies Compare?

The US economy is larger than the Chinese economy, and Americans are richer than their Chinese counterparts. Together, the US and Chinese economies accounted for 43 percent of 2023 world GDP—26 percent and 17 percent, respectively. The two superpowers have blown past all other nations in the race for the world’s largest economy, with their two closest competitors, Germany and Japan, each accounting for only 4 percent of world GDP.[1] Depending on how one adjusts for price level differences between countries, China’s GDP can be measured as greater than that of the United States.[2]

When considering per capita income, the US remains well ahead of China. The US’s GDP is spread over a population of around 340 million, while China’s is spread over a population of 1.4 billion. Accordingly, US GDP per capita is more than six times China’s: roughly $81,700 to $12,600 as of 2023.[3]

Along with being wealthier, the American population is more productive. As of 2019, US workers produced $73.90 of output per hour worked, compared to $11.70 per hour worked for Chinese workers.[4] In manufacturing, too, US workers are more productive.[5] However, in overall manufacturing output, the story is different, which is perhaps unsurprising given the sheer size of the Chinese workforce. China surpassed the United States in manufacturing output in 2010 and has widened the gap since.[6]

When it comes to trade, the United States is the largest importer of goods in the world and the second largest exporter of goods, behind China. In 2023, the US exported $148 billion of goods to China (out of nearly $2.1 trillion in total goods exports) and imported $427 billion of goods from China (out of more than $3.1 trillion of imports).[7] Concerns about the resulting (and persistent) US trade deficit are often intertwined with concerns about manufacturing. But the trade deficit is driven by macroeconomic trends, including the role of the dollar as the world’s reserve currency, the federal government’s budget deficit, and capital inflows, not trade or manufacturing-related policy choices.[8] Further, the trade balance has no empirical relationship to either GDP growth or employment.[9]

Political debates about manufacturing often focus on manufacturing jobs. But such a focus is ill-considered. A decline in manufacturing employment is in line with broad global and historical trends in which workers shift from agriculture to manufacturing in earlier stages of development, then from manufacturing to services in later stages of development.[10]

The US has moved down this curve, with manufacturing employment falling as the US has become a more advanced economy. Even as China has increased support for certain manufacturing industries, its service sector has grown as a share of the Chinese economy in recent years, suggesting China is not immune to the phenomenon either.[11]

The main driver behind the phenomenon is increasing manufacturing productivity. As production processes advance, fewer workers are needed to produce the same quantity of goods, resulting in a negative relationship between productivity and manufacturing employment share. Accordingly, manufacturing output can continue to grow even as a smaller share of the workforce works in the sector.[12] Indeed, economist Kyle Handley goes as far as to conclude that it is “difficult to imagine any policy or technological changes, short of turning back the clock on U.S. manufacturing productivity (e.g. smashing all the machines), that can bend this curve in a way that reverses the long-run decline in the U.S. employment share of manufacturing.”[13]

In the past 15 years, however, manufacturing productivity growth in the United States has slowed, lagging overall productivity growth, particularly in the aftermath of the Great RecessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years.

.[14] When looking at production, the manufacturing sector actually outpaced growth in the overall economy from 2000 until 2007: in real terms, manufacturing value added cumulatively grew by 25.9 percent over that period compared to 18.9 percent in cumulative economic growth overall. Since 2007, though, manufacturing value added in the United States has only grown by 11 percent, while the overall economy has grown by 33.5 percent.[15]

Looking at labor productivity rather than production makes the same point more clearly. Through the 1990s and early 2000s, labor productivity growth in manufacturing was strong, even as employment (measured both in absolute terms and as a share of the total labor force) declined. However, in the past decade, employment has stabilized (and even grown in absolute terms), but productivity in the industry has been stagnant or even negative.

The most salient area of competition between the United States and China is in advanced industries, manufacturing and otherwise. The Made in China 2025 plan, released in 2015, outlines China’s ambitions to take leadership of top technology industries and move up the value chain, from being the world’s factory to being the world’s R&D lab, while also establishing independence from foreign suppliers.[16]

That vision has not been realized. The US performs more R&D than China does, and the US is more R&D-intensive: the US leads China in both R&D expenditure and R&D expenditure as a share of GDP. China has narrowed, but not closed, this gap in recent years. In 2021, 3.5 percent of US GDP went toward R&D, compared to 2.4 percent in China.[17]

While the US leads in overall R&D, China has found success in several innovation-based industries. The Informational Technology and Innovation Foundation (ITIF) has identified ten key technology industries, of which China is the leading producer in terms of total output in seven (computers and electronics, chemicals, machinery and equipment, motor vehicles, basic metals, fabricated metals, and electrical equipment) and the US is the leading producer in three (IT and information services, pharmaceuticals, and other transportation [primarily aerospace]).[18] However, a lead in output does not necessarily mean a lead in innovation.[19]

The US remains the world’s largest and most innovative economy, but that is not guaranteed to continue if the US does not continue to reinvest and grow. Sustained overall economic growth can also support the capacity necessary to meet other challenges the US faces in the global competition with China. Though tax policy is but one lever, it can be pulled rather easily to ensure the US tax system encourages—rather than actively discourages—productivity-enhancing investments and does not disadvantage US firms relative to their Chinese competitors.

How Do the US and Chinese Tax Systems Compare?

Tax policy has a strong effect on economic behavior, including incentives to work, save, and invest. Different tax policies have different effects on economic growth. According to a review from the Organisation for Economic Co-operation and Development (OECD), property taxes and consumption taxes are the least harmful taxes for economic growth, with individual income taxes being more harmful and corporate income taxes being the most harmful.[20]

The US and Chinese tax systems differ in several important ways, and they have some surprising parallels. The most important difference, at a high level (including national and subnational taxes), is that the US relies heavily on income taxes, while China relies heavily on consumption taxes.

China relies heavily on consumption taxes, which account for 35.4 percent of its total tax revenue compared to 15.7 percent in the US and 31.6 percent on average in the OECD.[21] The US raises some consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or an income tax where all savings is tax-deductible.

revenue from state-level sales taxes and excise taxes on products like alcohol, gasoline, and cigarettes, but unlike China and virtually every other major country around the world, the US does not levy a value-added tax.[22]

The almost exact inverse is true of income tax usage. The US raises 45.3 percent of revenue from individual income taxes, well above the OECD average of 23.6 percent and dwarfing the Chinese total of just 6.1 percent of revenue. China leaning on consumption taxes for revenue while the US leans on income taxes is disadvantageous for the US.

While China’s larger share of corporate tax revenues seems to indicate higher corporate taxes than the US, that is not necessarily the case. The US’s relatively low share of corporate revenue is explained by its large noncorporate business sector—in fact, more than 50 percent of business net income in the US is reported on personal income tax returns.[23] Adjusting for the US’s comparatively small corporate sector, US corporate taxes are not notably small.[24]

One shared trait between the US tax system and the Chinese tax system is a relatively high level of fiscal federalism. Both delegate a large portion of their tax collections to local or provincial levels, and both have significant variation in policy by region. However, there is a key difference here too. In the United States, state-level policy variation is driven by state and local government decisions. States set their own tax policies with minimal influence from the federal government. Conversely, most official variation in provincial and local government tax policy in China is driven by national-level decisions, as the national government largely sets province-level tax parameters such as which taxes are allowed to be levied and at what rates.[25]

US vs. Chinese Corporate Tax Systems

As previously mentioned, corporate income taxes are considered the most economically harmful taxes per dollar raised, as they significantly distort capital investment.

The corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

affects investment incentives by raising the cost of capital, making it more costly for companies to invest in equipment, factories, and productive technologies. The tax burden on corporate investment consists of the statutory tax rate and structural elements of the corporate tax code such as deductions and credits.

Statutory Rates

In the United States, the statutory federal corporate income tax rate is 21 percent. Forty-four US states and the District of Columbia also levy their own corporate income tax, and factoring in the average rate across states, the combined US corporate tax rate reaches 25.6 percent.

Profits earned from highly immobile intangible assets to support exports face a lower tax rate (13.125 percent, scheduled to rise to 16.406 percent after 2025) due to the deduction for foreign-derived intangible income (FDII), discussed in more detail below. Under a federal corporate income tax rate of 28 percent, as proposed by Vice President Kamala Harris, the combined rate in the US would reach 32.2 percent—considerably higher than that of China and the OECD average excluding the US (23.6 percent).

The standard statutory corporate income tax rate in China is 25 percent at the central government level and there are no additional subcentral government levies, while countless specific regions and industries receive preferential rates or, in some cases, full tax exemptions.[26]

DepreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment.

for Capital Investment

Firms deduct capital investment cost by taking depreciation deductions over an asset’s lifespan, eventually adding up to the nominal investment cost. However, spreading deductions over time diminishes their real value due to inflation and opportunity cost, thereby increasing the cost of capital. This tax-driven increase in the cost of capital hampers investment across the economy.

The US tax code’s Modified Accelerated Cost Recovery System (MACRS) requires deductions to be delayed from 3 years up to 39 years depending on the asset. Machinery, equipment, and software have shorter, more accelerated schedules while structures follow much longer schedules. Residential structures must be depreciated over 27.5 years, while commercial structures must be depreciated over 39 years.[27]

Additionally, MACRS permits a special first-year deduction, known as bonus depreciation. The Tax Cuts and Jobs Act (TCJA) provided 100 percent bonus depreciation for short-lived assets (asset lives under 20 years), namely machinery and equipment, for five years from 2018 through 2022. Starting in 2023, it began phasing out by 20 percentage points each year and will fully phase out by 2027.[28] The US tax code also includes Section 179 expensing, which allows a full deduction for limited amounts of investment; for 2024, the maximum deduction is $1.22 million, with a dollar-for-dollar phaseout beginning at $3.05 million in investments. This comparatively small policy is targeted at small businesses.[29]

In China, companies similarly deduct their capital investment costs over time, with schedules ranging from 3 years up to 20 years, generally following the straight-line method, though accelerated depreciation is available for certain industries and investments like manufacturing and R&D.[30] Some investments qualify for full and immediate deductions if they meet certain cost (similar to the US Section 179 rules) or location requirements.

Research and Development Deductions and Credits

The United States treats research and development poorly compared to the rest of the world. Historically, the US allowed companies to fully deduct R&D costs, but since 2022, companies must deduct R&D expenses across 5 years or 15 years. In real terms, the delay means companies only deduct around 89 percent of R&D costs, creating a tax penalty. Belgium is the only other country with this approach.[31]

The US also offers the R&D tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly.

,[32] which is incremental and applies only to R&D expenses above a baseline. It uses two main calculations: the regular R&D credit of 20 percent and the alternative simplified credit of 14 percent. The incremental design of both calculations is intended to incentivize marginal R&D investment but comes with the trade-off of increased complexity.

Compared to other countries, the US does not provide significant tax support for R&D. On average, European countries provide a 15 percent subsidy for R&D investment, while the US offers just 3 percent.[33]

China, by contrast, heavily supports R&D through two key policies: the super deduction and the InnoCom system.

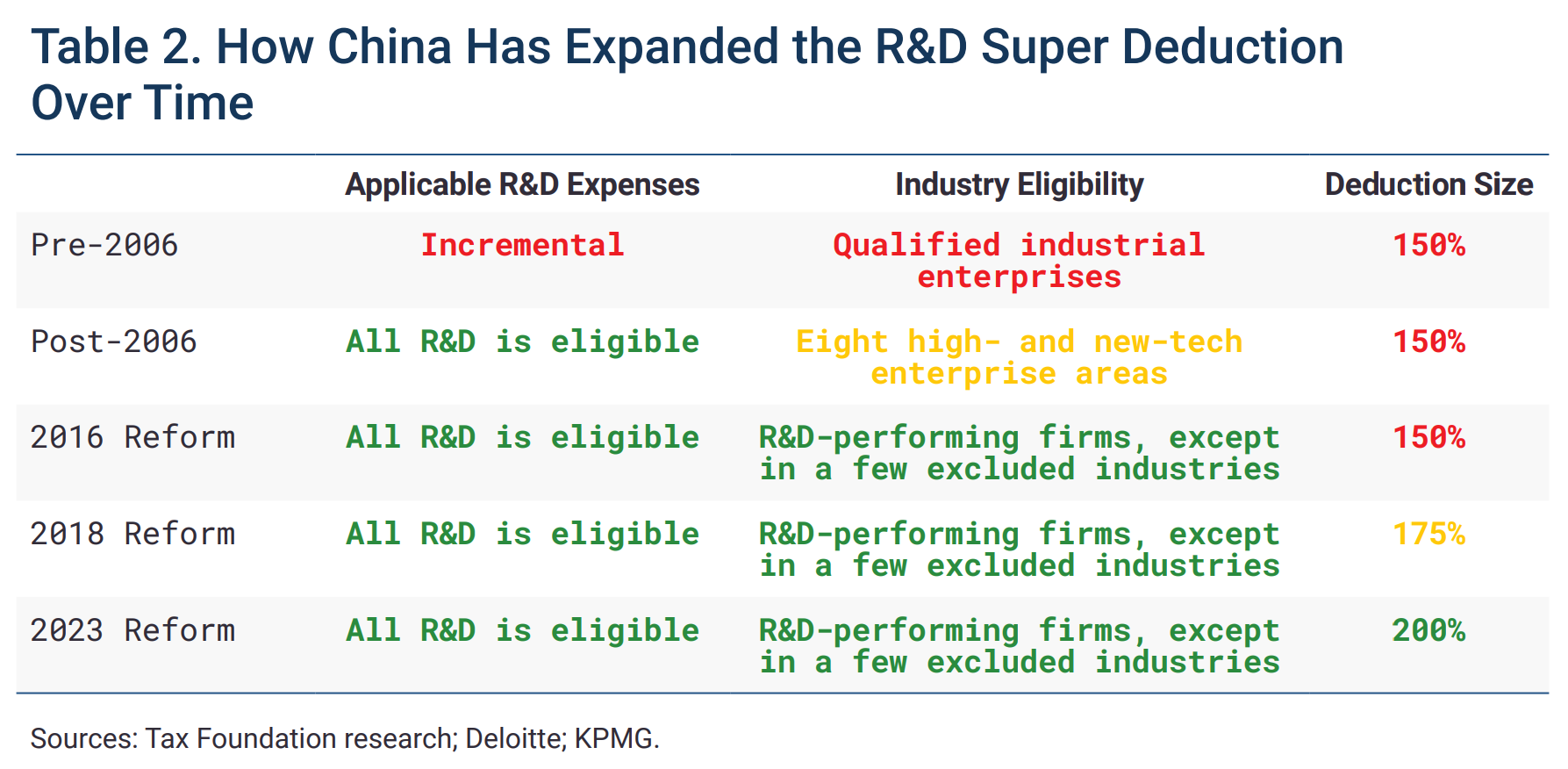

China has expanded its super deduction over time, allowing firms to deduct more than 100 percent of the cost of their R&D investments. Originally a 150 percent deduction for incremental R&D limited to certain sectors, it’s now permanently set at 200 percent and is widely available to firms with qualifying R&D activity, as illustrated in Table 2. In 2006, the super deduction (then 150 percent) moved from being an incremental incentive to a widely accessible one.[34] In 2016, China expanded R&D super deduction eligibility to all firms with qualifying R&D activities, except for a few still-excluded service industries.[35] In 2019, China increased the super deduction from 150 percent to 175 percent of R&D expenses and, in 2023, further raised the super deduction to 200 percent permanently after issuing temporary expansions for specific activities during the pandemic.[36]

The InnoCom program reduces the tax rate on high- and new-technology enterprises (HNTEs) to 15 percent. Unlike the R&D super deduction, which is now broadly available, the reduced tax rate on HNTEs is still only available by application. To qualify, firms must be in a designated HNTE industry and meet benchmark levels of R&D expenses and R&D employment, among other criteria.[37]

Deductions for Interest

Prior to reforms made in 2017, interest paid was generally deductible under the US tax system, while interest income was taxed at ordinary rates. The deductibility of interest led firms to prefer debt issuance over equity for financing, which increases leverage and macroeconomic risk, since creditors must be compensated, while firms have no similar obligation to shareholders. Interest deductibility can also enable profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens.

, where firms borrow in high-tax jurisdictions, and then receive interest income in low-tax jurisdictions, generating negative effective tax rates on some investments.[38]

The 2017 reforms in the TCJA limited interest deductibility, first to 30 percent of earnings before interest, taxes, depreciation, and amortization (EBITDA), and then to 30 percent of earnings before interest and taxes (EBIT) beginning in 2022. Disallowed interest expense can be carried forward indefinitely.

While the limitation is intended, at least in part, to reduce the tax code’s bias in favor of debt-financed investment, the recent switch from EBITDA to EBIT can disadvantage companies undertaking domestic investment.[39] An EBIT-based limitation may be especially disadvantageous with interest rates much higher than when the limitation was enacted, and it diverges from international norms. Most OECD countries limit their interest based on EBITDA, not EBIT.[40]

In China, interest on loans is generally deductible across businesses. The exceptions are narrowly focused rules designed to prevent earnings stripping, which limit interest deductibility for payments to related parties for companies with debt levels far exceeding equity levels.[41] In particular, financial firms with debt-to-equity ratios exceeding 5 to 1 are subject to the limitations, while the ratio must not exceed 2 to 1 for all other industries.[42] Outside of rules for related-party payments, interest deductions are not limited.

Other Tax Incentives

The main structural components of the US and Chinese tax systems are a helpful starting point to evaluate the tax treatment of businesses generally. However, both systems provide deviations for specific categories of investment.

A landmark study from the Center for Strategic and International Studies (CSIS) estimated China’s total industrial policy spending, along with the industrial policy spending of seven other major economies (Brazil, France, Germany, Japan, South Korea, Taiwan, and the United States). The study broke spending out among six categories of industrial policy, two of which were tax-related: R&D tax incentives and other (non-R&D) tax incentives.[43]

According to CSIS, China spent roughly $16.5 billion on R&D tax incentives in 2019, along with $89.8 billion in non-R&D tax incentives in purchasing power parity-adjusted terms. Meanwhile, the United States spent $24.7 billion in R&D tax incentives and $24.2 billion in non-R&D tax incentives in 2019. For context, the report estimates total (tax and non-tax) Chinese industrial policy at $406 billion in purchasing power parity terms, compared to around $84 billion in the United States.

The estimates face two main challenges. The first is determining what ought to qualify as industrial policy. Industrial policy is often defined as government support for a specific industry to generate greater economic growth or otherwise better commercial outcomes. Industrial policy is often contrasted with horizontal, economy-wide policies to stimulate growth across the board.[44] Nonetheless, some policies blur that line: for instance, a subsidy for R&D expenses is a horizontal policy, but some industries are naturally more R&D-intensive than others, resulting in disproportionate support. When estimating the size of “industrial policy” initiatives, one must make many value judgments for what qualifies.

Perhaps the more significant challenge is the dramatic changes in industrial policy activity since 2019 on both sides of the Pacific (and beyond). In the United States, the CHIPS Act and the Inflation Reduction Act both included large tax credits targeted at specific industries.[45] China has also ramped up its support for specific industries, with the super deduction rising from 175 percent to 200 percent and expansions for non-R&D incentives, such as a 10-year tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax.

for semiconductor firms introduced in 2020.[46]

Similarly, both countries have tax policies for investment in specific regions, although the scale of the policies is much larger in China. Many of the Inflation Reduction Act tax credits include location-specific incentives focused on either low-income areas or areas with historically high employment in fossil fuel industries.[47] The Opportunity Zone program implemented under the 2017 tax reform provides a capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

break for investment in designated census tracts, while the new markets tax credit also provides relief for investment in specific areas.[48]

China, meanwhile, makes heavy use of location-based policymaking, including but by no means limited to location-based tax policy. One of the earliest economic reforms of post-Mao China was the introduction of Special Economic Zones (SEZs): cities or regions allowed to experiment with more market-driven economic policymaking and foreign investment. As China began to open to market reforms more broadly, though, the country continued to enact place-based policies, with specific regions levying substantially lower corporate tax rates (among other policy differences).[49]

At the national level, China’s InnoCom system provides a 15 percent corporate tax rate to qualified firms in eight categories of HNTE. China also provides initial tax holidays, followed by several years of reduced tax rates, for several types of semiconductor firms and other computer electronics manufacturing and services, as well as for a few other types of businesses.[50] The Appendix features a table of major national-level incentives, but in addition to these national-level incentives for specific industries, different subnational jurisdictions can have both general corporate tax rate reductions and specific industry rate reductions of their own.[51]

The Track Record of Broad Tax Policy in the US and China

Recent changes to US tax policy design are instructive for lawmakers to consider before moving forward. The 2017 TCJA permanently reduced the corporate income tax rate from 35 percent to 21 percent and temporarily introduced 100 percent expensing for machinery and equipment investment, among many other changes to business, individual, and estate taxes.

The Congressional Budget Office in 2018 projected that the TCJA’s effects would “include higher levels of investment, employment, and gross domestic product” and estimated that business fixed investment would be higher across the entire projection period due to the changes in incentives.[52] Likewise, several other groups—from private sector estimators to government agencies to think tanks—estimated the reforms would have a positive impact on growth and investment.[53]

A growing body of evidence shows the TCJA’s approach to reduce the cost of capital across all sectors has boosted US investment.

Economists Gabriel Chodorow-Reich, Matthew Smith, Owen M. Zidar, and Eric Zwick used tax data to estimate that the TCJA’s corporate tax reforms, primarily the lower rate and accelerated depreciation, “stimulated domestic investment substantially.” According to their research, the investment increases will result in a 7 percent increase in the capital stock and a 0.9 percent increase in real wages, largely occurring within the first 10 years of the reforms.[54]

Another recent paper by economists Steven Crawford and Garen Markarian uses a different approach, comparing US businesses to Canadian businesses, to provide evidence that “the TCJA appears to have increased investment particularly for capital intensive firms.”[55]

New studies on the effects of the TCJA are consistent with the existing literature on the effects of previous rounds of accelerated depreciation in the US.

Economists Christopher House and Matthew D. Shapiro found sharp differences in investment for assets that qualified for the 2002 and 2003 rounds of temporary bonus depreciation: capital that benefited substantially from the policy saw sharp increases in investment, which they estimate may have increased output by roughly 0.1 percent to 0.2 percent and employment by roughly 100,000 to 200,000 jobs.[56]

Economists Eric Zwick and James Mahon analyzed data from more than 120,000 firms across bonus depreciation episodes between 2001 to 2004 and 2008 to 2010. They found bonus depreciation raised investment in eligible capital relative to ineligible capital by 10.4 percent in the first episode and by 16.9 percent in the second episode, with small firms responding more than large firms.[57]

Economists Daniel G. Garrett, Eric Ohrn, and Juan Carlos Suárez Serrato found from 2002 through 2012, places with larger decreases in investment costs experienced relative increases in employment. The increases tapered when bonus depreciation expired, and then stabilized after implemented again. The effects on earnings were mixed, with initial earnings gains dissipating (which the authors noted could reflect the policy’s temporary nature).[58]

Research by Curtis, Garrett, Ohrn, Roberts, and Suárez Serrato covering the years 1997 to 2011 shows that firms benefiting most from bonus depreciation increased their capital stock and employment, with capital rising by 7.8 percent and employment by 9.5 percent (and even greater among production workers).[59] The authors did not find an increase in the average level of earnings, largely because the expansion in employment opportunities was concentrated at the lower end of the earnings spectrum, and they noted their results mean capital and production workers are complementary inputs in modern manufacturing.

China’s economy liberalized rapidly in the 1980s, improving property rights and implementing financial reforms that channeled credit to its growing private sector.[60] The main contribution to this growth was the productivity of the township and village enterprises (TVEs) in China’s rural areas, most of which were fully private. From 1985 to 1996, the total number of TVEs nearly doubled from 12 million to 23.4 million.[61] Tariffs were also liberalized significantly over the period, even before China eventually entered the World Trade Organization (WTO) in 2001, falling from an average tariff rate of 56 percent in 1982 to 23 percent in 1996.[62]

But beyond reforms of state-owned enterprises and general economic opening, in more recent years, China has made incremental reforms to its tax code to further incentivize investment.

The most notable is the nation’s reforms to its value-added tax, or VAT. In the mid-2000s, the Chinese VAT was levied on a production base: it did not allow companies to deduct fixed asset investments when calculating their VAT liability. This created an additional tax wedgeA tax wedge is the difference between total labor costs to the employer and the corresponding net take-home pay of the employee. It is also an economic term that refers to the economic inefficiency resulting from taxes.

on capital investment—in practice, similar to the wedge created by requiring capital investment costs to be depreciated over several years when calculating corporate income tax liability.

The Chinese government initially made incremental reforms, allowing specific industries and/or specific regions to deduct the cost of fixed investment from their VAT liability. In response to the 2008 global financial crisis, China accelerated the reform process and allowed all firms subject to the VAT to deduct the cost of fixed investment. This reform drew a substantial investment response. Firms subject to the reform increased investment by 38.4 percent and saw productivity growth of 8.9 percent relative to firms not subject to the reform.[63] Some version of this finding has been replicated elsewhere.[64]

The track record of Chinese R&D tax policy is more mixed. R&D subsidies have some strong theoretical justifications based on findings that the social returns to R&D tend to be greater than the private returns.[65] However, one concern with R&D subsidies is that instead of generating additional productive R&D investment, they will instead drive reclassification of regular operating or general and administrative expenses.[66]

In the context of China’s comparatively broad subsidies for R&D, the answer to whether the additional spending reflects real additional R&D activity or reclassified normal expenses appears to be “both.” A study of China’s InnoCom system suggests almost a quarter of the additional R&D investment generated by the policy reflects relabeling.[67] Analysis of firm responses to expanded eligibility for the super deduction policy in 2006 showed less evidence of relabeling.[68] Another concern with the very strong tax incentives for R&D spending is that they encourage less productive R&D investment; plenty of evidence indicates lower patent quality arising from the tax subsidies.[69] Conversely, some research suggests the tax-based R&D subsidies have performed better than more top-down direct support for R&D.[70]

The Track Record of Narrowly Targeted Tax Policy in the US and China

Tax cuts for investment broadly can drive new investment across the board. Conversely, tax cuts aimed at narrow subcategories mostly shift investment to that sector, instead of driving aggregate investment growth.

So far, we can see this pattern play out in response to the CHIPS and Science Act and the Inflation Reduction Act.[71]

Most of the CHIPS and Science Act is not tax policy, but it includes $24 billion in semiconductor manufacturing investment tax credits, $39 billion in funding for the CHIPS for America Fund, and $200 billion in authorizations for a series of scientific initiatives across several federal agencies (requiring appropriations in subsequent legislation).[72] A large share of the IRA is devoted to tax policy. The law introduced new credits for green energy and expanded existing ones, among several other unrelated policy changes. The estimated fiscal costs of the tax credits continue to climb, with the most recent numbers pointing to a range exceeding $1 trillion over 10 years.[73]

Since the enactment of both laws, investment in manufacturing structures, specifically in computer and electronics manufacturing, has expanded dramatically. Some of that industry-specific investment boom was in progress before the enactment of the new subsidies, but the boom has continued. Aggregate investment, though, has roughly matched projections made before the laws were introduced.[74]

It appears that the laws may have stimulated new investment in the intended sub-industries, but that is not the end goal; productivity is. It is difficult to tell whether shifting investment to the subsidized industry will drive faster overall productivity growth, but usually one can at least see if the industry itself has become more productive. In the case of CHIPS and the IRA, it is too soon to say, but some possible indicators suggest the ongoing reallocation could prove to be a misallocation. Construction delays and regulatory compliance challenges suggest the high expenditures on new projects may not proportionately translate into productivity gains.[75]

China, too, has seen mixed evidence of the economic effects of targeted tax policy: there has been new investment, but it is likely misallocated as well. Some of the earliest SEZs, like Shenzhen, have grown into global metropolises.[76] However, as of late, many targeted, place-based policies are aimed at poorer regions to redistribute economic activity, and evidence so far is less favorable to these policies.[77]

In recent years, China has been starting to shift its export strategy. In 2015, President Xi Jinping announced China’s “Made in 2025” policy initiative that would shift its economy away from manufacturing cheap goods to producing high-tech products and services over a 10-year period, while also prioritizing non-growth goals such as increased autonomy and self-sufficiency.[78] A new paper looked at the impacts of this initiative on Chinese firms using their financial reports, where they are required to disclose the value of the subsidies they’ve received. The paper did not find evidence that subsidized firms increased their total factor productivity, nor did it find any statistically significant effects on R&D expenditures, patenting, and profitability.[79] The Information Technology and Innovation Foundation’s Hamilton Index, which measures global value-added output in high-tech industries, has also found that China’s targeted sectors actually grew 30 percent slower between 2015 and 2020 than in the five years prior, before “Made in 2025“ was announced.[80]

One comprehensive review of China’s industrial policies shows that while they may have generated some returns in China’s “catch-up” growth phase, in the long run, they are generating diminishing returns.[81] One paper that looked at the effects of China’s “Five-Year Plans” for 419 manufacturing industries from 1999 and 2010 found that the policies only had temporary effects on industrial output that didn’t persist past the Five-Year Plans. Other papers from this same review looked at China’s shipbuilding and automotive industries, finding evidence of large distortions and resource misallocations. Another paper found that China’s industrial policies led to “minimal gains in long-term profits, innovation, or favorable spillover effects to other Chinese industries.”[82]

Recapping all of China’s efforts to build up different industries and their performance is much too broad a task, but the track record is undeniably mixed. China has built impressive shipbuilding capacity, as it now dominates the production of large oceangoing ships.[83] However, a review of the economic literature surrounding the Chinese shipbuilding industry found the push to build capacity in the industry has not translated into spillovers for the greater Chinese economy.[84] Chinese firms have pushed the cutting edge in electric vehicles and solar panels, while investments in the semiconductor industry have yielded significant capacity, albeit at a high cost.[85] Their investments in developing commercial aircraft, meanwhile, have not borne substantial fruit yet.[86]

A Note on Protectionism

The Trump administration pursued an additional strategy to support manufacturing investment and jobs: higher tariffs. Tariffs provide benefits to protected industries by allowing them to charge higher prices, which shields them from lower-priced foreign competition and boosts their financial performance. However, those benefits represent a transfer from other sectors of the domestic economy, including downstream manufacturers stuck with higher input costs and other consumers stuck with higher prices.

Under the Trump administration, the United States imposed tariffs on roughly $380 billion worth of imports across steel, aluminum, and a wide range of Chinese products based on initial import values subject to the initial tariffs. Accordingly, the average tariff rate roughly doubled from 1.4 percent in 2017 (before the trade war) to 3.0 percent in 2021.[87] The trade war led to billions in added tax costs for Americans, raising tax collections from tariffs by more than $233 billion from the start of the trade war through March 2024.[88]

Nearly all US trading partners responded to US tariffs with retaliatory tariffs on US exports, including Canada, Mexico, China, Japan, the UK, the EU, India, and Russia, affecting nearly $100 billion of US exports.[89]

Several empirical estimates have shown that nearly the full burden of the US-imposed tariffs passed through to the US economy through higher import prices.[90] US consumers, whether business consumers or retail consumers, have paid nearly all of the tariffs. Additionally, numerous empirical estimates have shown how the tariffs have led to net reductions in production and employment, as the harms from higher costs for tariffed goods, combined with retaliation from other countries, outweighed the benefits afforded by import protection.[91]

The Biden administration retained most of the Trump tariffs and has recently proposed increases on certain categories of goods from China. In a 2024 review of the tariffs on China, the United States Trade Representative’s office summarized the effects of the 2018-2019 tariffs as follows:[92]

- Depressed short-term investment growth

- No increase in overall manufacturing employment or wages in the short term

- Adverse impact on overall employment due to retaliation

- Complete pass-through of duties to US importers

- Small negative effect on US aggregate economic welfare and real incomes in the short term

Neither did the 2018-2019 tariffs fundamentally alter the US trade balance. Rather, as anticipated, higher tariffs resulted in “no discernable impact on the relative size of the trade deficit.”[93] Trade diversion is one reason for that, as tariffs on China resulted in importers switching to purchase from other foreign suppliers, leading to higher bilateral deficits elsewhere.[94]

The World Trade Organization estimates that across their top five export partners in 2021, exports from China faced an average tariff of 2.1 percent, and exports from the US faced an average tariff of 2.8 percent.[95] According to the World Bank, as of 2021, China imposed a weighted-average tariff of 2.3 percent on its imports.[96] Indeed, across the 1980s and 1990s, as developing economies like China opened to world trade, they lowered their trade barriers significantly.[97]

Overall, the differentials between tariffs levied by the United States and by other governments around the world are relatively small, and in some cases, the US levies higher tariffs on “sensitive” imports than foreign governments levy on those same exports.[98]

In contrast to the empirical support behind the strategy of improving the tax treatment of investment to boost economic growth, the strategy of using tariffs to improve economic growth has no empirical support. Indeed, an empirical review by David Furceri and others of 151 countries from 1963 through 2014 found that tariff increases lead to economically and statistically significant declines in domestic output and productivity, as well as increases in unemployment and inequality.[99]

How to Improve Tax Competitiveness

The basic model of long-term economic growth involves increased capital investment and technological progress.[100] Tax policy is relevant for both: the deductibility of capital investment affects the incentives for firms to invest in new capital to make workers more productive, and varied tax treatment of R&D costs can affect R&D investment behavior and thus long-term technological change.[101]

Another way to think about investment’s importance for more general industrial strength is capacity. Capacity has become something of a buzzword in recent years, from conversations about state capacity in response to the COVID-19 pandemic, to shifts in demand leading to supply chain challenges, to the sudden surge in orders for weapons systems in response to the full-scale Russian invasion of Ukraine in 2022.

The key to increased capacity is increased investment. If the tax code penalizes investment on the margin (by, for instance, not allowing companies to fully deduct their costs), companies will forgo marginal investments. In some cases, that might mean whole projects cease to become viable—a new factory, distribution center, power plant, or office park not worth the return on investment. In other cases, there might be slight enhancements to production: investing in a few additional trucks or machines to handle an increase in demand might be viable if the costs are fully deductible, but not if only 80 percent of the costs are.

We estimate that providing full cost recovery to R&D, machinery, and equipment investment through full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

and to structures investment through neutral cost recovery would reduce federal tax revenues by about $623 billion over 10 years—about half the fiscal cost of the subsidies included in the CHIPS Act ($280 billion across the tax credits, grants, and spending authorizations) and IRA ($921 billion according to our estimated 10-year fiscal costs for the green energy tax credits).[102]

Over the long run, allowing full cost recovery would boost economic output by 1.7 percent, the capital stock by 3.3 percent, wages by 1.5 percent, and employment by 381,000 full-time equivalent jobs, according to the Tax Foundation General Equilibrium Model. In contrast, while the IRA and CHIPS Act alter short-term investment incentives with debatable impacts, over the long run, the subsidies are scheduled to phase out and with them any impact on long-term investment. The White House argues there are other societal and worldwide benefits from the IRA, including a reduction in carbon emissions over the next two or three decades.[103]

We should separate policies targeted at idiosyncratic national security concerns from policies targeted at encouraging broader economic strength. Some argue that for security reasons, the US needs to invest in excess capacity in areas related to defense. Full expensing or neutral cost recovery will not achieve excess capacity. These policies are not subsidies. But the absence of full expensing or a similar tax treatment means we have suffered from undercapacity across the economy, in strategic and non-strategic areas alike, and expensing would give us more capacity than we would otherwise have.

Additionally, full expensing is a positive-sum policy, focused on strengthening the American economy rather than weakening the Chinese one or reallocating existing resources across the American economy. More narrow national security-specific concerns may require other policy levers. The report from the Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party considers several policies to this effect.[104]

Conclusion

Beyond the recent forays into industrial policy, the US has a long history of industrial policy done both through the tax code and outside of it, with analysts concluding, “The track record of such efforts has achieved mixed success at best. While import protection of aging industries seldom pays off, R&D subsidies have sometimes achieved their goals. But jobs created or saved by industrial policy often entail high costs, while targeting a single firm to carry the mission seldom succeeds.”[105]

Rather than competing with China on the shifting sands of industrial policy, it is better to establish broad-based rules and incentives that lead to higher levels of investment, innovation, productivity, and economic growth over the long run. Tax law is only one policy area, but it is an important one, with strong evidence pointing to the effectiveness of better deductibility of capital costs in driving investment and productivity.

China currently provides more favorable tax treatment for investment broadly, including better cost recovery for capital investment as well as many special tax breaks layered on top of that system aimed at specific industries. As Congress and the next president consider upcoming tax expirations from the 2017 tax law, they ought to prioritize reforming the tax code to make the United States more, not less, friendly to investment, which would be best accomplished through permanent, full cost recovery for all capital expenditures.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

[1] World Bank, “GDP Ranking,” last updated Jun. 30, 2024, https://datacatalog.worldbank.org/search/dataset/0038130.

[2] Purchasing power parity is a measure of the relative value of currencies based on differing price levels among countries for a given basket of goods. In the case of US-China, the average American resident may have six times the purchasing power of the average Chinese resident when it comes to international markets, but this extreme gap may not accurately reflect the difference in living standards between the two nations. In this case, purchasing power parity adjusts for the relatively lower cost of living in China compared to the US. See ChinaPower, “Unpacking China’s GDP,” Jun. 5, 2024, https://chinapower.csis.org/tracker/china-gdp/#easy-footnote-bottom-1-8685.

[3] World Bank, “GDP per Capita (current US$),” accessed October 2024, https://data.worldbank.org/indicator/NY.GDP.PCAP.CD?locations=US-CN.

[4] Our World in Data, “Productivity: output per hour worked, 2019,” https://ourworldindata.org/grapher/labor-productivity-per-hour-pennworldtable.

[5] See, for instance, World Bank Group, “Industry (Including Construction), Value Added Per Worker,” accessed August 2024, https://data.worldbank.org/indicator/NV.IND.EMPL.KD?locations=US-CN.

[6] Richard Baldwin, “China is the World’s Sole Manufacturing Superpower: A Line Sketch of the Rise,” VoxEU, Jan. 17, 2024, https://cepr.org/voxeu/columns/china-worlds-sole-manufacturing-superpower-line-sketch-rise.

[7] Bureau of Economic Analysis, “U.S. International Trade in Goods and Services, December and Annual 2023,” Feb. 7, 2024, https://www.bea.gov/sites/default/files/2024-02/trad1223.pdf.

[8] See discussion in Daniel Griswold and Andreas Freytag, “Balance of Trade, Balance of Power,” Cato Institute, Apr. 25, 2023, https://www.cato.org/policy-analysis/balance-trade-balance-power; Colin Grabow, “Concerns over U Manufacturing and the Trade Deficit Are Misplaced,” Cato Institute, Jan. 29, 2024, https://www.cato.org/blog/concerns-over-us-manufacturing-trade-deficit-are-misplaced.

[9] Benn Steil and Benjamin Della Rocca, “Tariffs and the Trade Balance: How Trump Validated His Critics,” Council on Foreign Relations, Apr. 21, 2021, https://www.cfr.org/blog/tariffs-and-trade-balance-how-trump-validated-his-critics.

[10] Kyle Handley, “What happened to U.S. manufacturing?,” Economic Innovation Group, July 2024, https://eig.org/wp-content/uploads/2024/07/TAWP-Handley.pdf; see also Scott Lincicome, “Manufactured Crisis: ‘Deindustrialization,’ Free Markets, and National Security,” Cato Institute, Jan. 27, 2021, https://www.cato.org/publications/policy-analysis/manufactured-crisis-deindustrialization-free-markets-national-security.

[11] World Bank Group, “Services, value added (% of GDP – China),” accessed Sep. 14, 2024, https://data.worldbank.org/indicator/NV.SRV.TOTL.ZS?locations=CN; Xilu Chen, Guangyu Pei, Zheng Song, and Fabrizio Zilibotti, “Tertiarization Like China,” National Bureau of Economic Research Working Paper 30272, April 2023, https://www.nber.org/system/files/working_papers/w30272/w30272.pdf.

[12] See, for instance, Jon Emont, “How Singapore Got its Manufacturing Mojo Back,” The Wall Street Journal, Jun. 22, 2022, https://www.wsj.com/articles/singapore-manufacturing-factory-automation-11655488002.

[13] Handley, “What happened to U.S. manufacturing?”

[14] Joseph Politano, “America’s Manufacturing Productivity Problem,” Apricitas Economics, May 14, 2024, https://substack.com/@josephpolitano/p-143698099.

[15] Bureau of Economic Analysis, “Real Value Added by Industry,” last revised May 23, 2024, https://apps.bea.gov/iTable/?reqid=150&step=2&isuri=1&categories=gdpxind.

[16] See PRC State Council, “Made in China 2025,” May 8, 2015, https://cset.georgetown.edu/wp-content/uploads/t0432_made_in_china_2025_EN.pdf; Bonnie Glaser, “Made in China 2025 and the Future of American Industry,” Testimony Before the Senate Small Business and Entrepreneurship Committee, Feb. 27, 2019, https://csis-website-prod.s3.amazonaws.com/s3fs-public/congressional_testimony/190226_Glaser_Testimony.pdf.

[17] World Bank Group, “Research and development expenditure (% of GDP) – United States, China,” https://data.worldbank.org/indicator/GB.XPD.RSDV.GD.ZS?locations=US-CN.

[18] Robert Atkinson and Ian Tufts, “The Hamilton Index, 2023: China Is Running Away With Strategic Industries,” Information Technology & Innovation Foundation, December 2023, https://www2.itif.org/2023-hamilton-index.pdf.

[19] See, for instance, Stephen Ezell, “How Innovative is China in Semiconductors,” Information Technology & Innovation Foundation, Aug. 19, 2024, https://itif.org/publications/2024/08/19/how-innovative-is-china-in-semiconductors/.

[20] See, for instance, Jens Arnold, “Do Tax Structures Affect Aggregate Economic Growth? Empirical Evidence from a Panel of OECD Countries,” OECD Economics Department Working Papers No. 643, October 2008, https://www.oecd-ilibrary.org/docserver/236001777843.pdf?expires=1724179165&id=id&accname=guest&checksum=6E36777C8F3502106B20C1C181EF3790.

[21] OECD, “Revenue Statistics in Asia and the Pacific 2024,” Jun. 25, 2024, https://www.oecd.org/en/publications/revenue-statistics-in-asia-and-the-pacific-2024_e4681bfa-en.html; see also Cecilia Perez Weigel and Daniel Bunn, “Sources of Government Revenue in the OECD, 2024 Update,” Tax Foundation, Mar. 18, 2024, https://taxfoundation.org/data/all/global/oecd-tax-revenue-by-country-2024/.

[22] Ibid. China once also levied a gross receipts taxA gross receipts tax, also known as a turnover tax, is applied to a company’s gross sales, without deductions for a firm’s business expenses, like costs of goods sold and compensation. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding.

on certain businesses in place of a VAT, but the VAT base has expanded and replaced the gross receipts tax; see OECD, “Revenue Statistics in Asia and the Pacific 2024”; Zhao Chen, Yuxuan He, Zhikuo Liu, Juan Carlos Suárez Serrato, and Daniel Yi Xu, “The Structure of Business Taxation in China” Tax Policy and the Economy 35:1 (2021), https://www.journals.uchicago.edu/doi/epdf/10.1086/713495.

[23] Huaqun Li, “How the TCJA Affected Legal Business Forms,” Tax Foundation, Jun. 19, 2024, https://taxfoundation.org/blog/tcja-pass-through-business-tax-reform/.

[24] Kyle Pomerleau and Donald Schneider, “The Biden Administration’s Corporate Tax Statistic Is Misleading,” Bloomberg Tax, Apr. 16, 2021, https://www.aei.org/op-eds/the-biden-administrations-corporate-tax-statistic-is-misleading/.

[25] Arthur Kroeber, China’s Economy: What Everyone Needs to Know, Second Edition (Oxford University Press: New York, 2020); see also Ehtisham Ahmad, “Taxation Reforms and the Sequencing of Intergovernmental Reforms in China: Preconditions for a Xiaokang Society” in Public Finance in China: Reform and Growth for a Harmonious Society ed. Jiwei Lou and Shuilin Wang (The World Bank: 2008), https://openknowledge.worldbank.org/server/api/core/bitstreams/21dbb6b0-5572-5f97-af7d-877cf10ceef9/content.

[26] Hannah Feng, “Corporate Income Tax (CIT) Incentives,” China Briefing, accessed Sep. 16, 2024, https://www.china-briefing.com/doing-business-guide/china/taxation-and-accounting/tax-incentives-in-china.

[27] See Internal Revenue Service, “How to Depreciate Property,” IRS Publication 946, https://www.irs.gov/pub/irs-pdf/p946.pdf.

[28] Ibid.

[29] Alex Muresianu, “Section 179 Expensing: Good First Step?,” Tax Foundation, Aug. 23, 2023, https://taxfoundation.org/blog/section-179-expensing/.

[30] PwC, “China, People’s Republic of: Corporate –Deductions,” https://taxsummaries.pwc.com/peoples-republic-of-china/corporate/deductions.

[31] PwC, “Belgium: Corporate – Deductions,” https://taxsummaries.pwc.com/belgium/corporate/deductions.

[32] Alex Muresianu and Garrett Watson, “Reviewing the Tax Treatment of Research and Development Expenses,” Tax Foundation, Apr. 13, 2021, https://taxfoundation.org/research/all/federal/research-and-development-tax/.

[33] Alex Mengden, “Tax Subsidies for R&D Expenditures in Europe, 2024,” Tax Foundation, Jul. 2, 2024, https://taxfoundation.org/data/all/eu/rd-tax-incentives-europe-2024/.

[34] Xuedong Ding, Jun Li, and Jia Wang, “In Pursuit of Technological Innovation: China’s Science and Technology Policies and Financial and Fiscal Incentives,” Journal of Small Business and Economic Development 15:4 (2008), https://www.researchgate.net/profile/Jun-Li-64/publication/235306226_In_pursuit_of_technological_innovation_China%27s_science_and_technology_policies_and_financial_and_fiscal_incentives/links/551413220cf2eda0df303f43/In-pursuit-of-technological-innovation-Chinas-science-and-technology-policies-and-financial-and-fiscal-incentives.pdf.

[35] Alan Garcia, Yang Bin, Dylan Jeng, and State Shi, “Moving Up the Value Chain – Greater Access to R&D Incentives” in China Looking Ahead, 5th Edition, International Tax Review (December 2015), https://assets.kpmg.com/content/dam/kpmg/pdf/2015/12/China-Looking-Ahead-ITR-201512.pdf.

[36] Bin Yang and Nicole Cao, “R&D Tax Incentives: Continuous Encouragement and Enhanced Supervision” in China Looking Ahead, 9th Edition, International Tax Review (December 2019), https://assets.kpmg.com/content/dam/kpmg/cn/pdf/en/2019/12/china-looking-ahead-edition-9.pdf; see also Jeff Zuming Xu, Xiaoyao Zhu, Aaron Zihong Meng, Jesse Jin Zhang, and Lluvia Xiao Chen, “R&D Super Deduction Rate Increased to 100% For All Sectors,” Deloitte, Apr. 12, 2023, https://www.taxathand.com/article/29775/China/2023/R-D-super-deduction-rate-increased-to-100-for-all-eligible-sectors.

[37] Qian Zhou, “What Are the Tax Incentives in China to Encourage Technology Innovation,” China Briefing, Mar. 29, 2023, https://www.china-briefing.com/news/tax-incentives-china-to-encourage-technology-innovation-updated/.

[38] Alan Cole, “Interest Deductibility: Issues and Reforms,” Tax Foundation, May 4, 2017, https://taxfoundation.org/research/all/federal/interest-deductibility/.

[39] Garrett Watson, “Tighter Limits on US Interest Deductibility Make US an Outlier and Increase Pain of Rising Interest Rates,” Tax Foundation, Dec. 5, 2022, https://taxfoundation.org/blog/business-interest-deduction-limitation/.

[40] Kyle Pomerleau, Daniel Bunn, and Thomas Locher, “Anti-Base Erosion Provisions and Territorial Tax Systems in OECD Countries,” Tax Foundation, Jul. 7, 2021, https://taxfoundation.org/research/all/federal/anti-base-erosion-territorial-tax-systems/.

[41] PwC, “China, People’s Republic of: Corporate –Deductions.”

[42] PwC, “China, People’s Republic of: Corporate – Group Taxation,” https://taxsummaries.pwc.com/peoples-republic-of-china/corporate/group-taxation.

[43] Gerard DiPippo, Ilaria Mazzocco, Scott Kennedy, and Matthew Goodman, “Red Ink: Estimating Industrial Policy Spending in Comparative Perspective,” Center for Strategic and International Studies, May 23, 2022, https://www.csis.org/analysis/red-ink-estimating-chinese-industrial-policy-spending-comparative-perspective.

[44] Scott Lincicome, “Questioning Industrial Policy: Why Government Manufacturing Plans are Ineffective and Unnecessary,” Cato Institute, Sep. 28, 2021, https://www.cato.org/white-paper/questioning-industrial-policy.

[45] See, for instance, Emily Blevins, Alice Grossman, and Karen Sutter, “Frequently Asked Questions: CHIPS Act of 2022 Provisions and Implementation,” Congressional Research Service, Apr. 25, 2023, https://crsreports.congress.gov/product/pdf/R/R47523; White House, “Inflation Reduction Act Guidebook,” January 2023, https://www.whitehouse.gov/wp-content/uploads/2022/12/Inflation-Reduction-Act-Guidebook.pdf.

[46] Jeff Zuming Xu, Xiaoyao Zhu, Aaron Zihong Meng, Jesse Jin Zhang, and Lluvia Xiao Chen, “R&D Super Deduction Rate Increased to 100% For All Sectors”; see also Zoey Zhang, “China’s Incentives for Integrated Circuit, Software Firms,” China Briefing, Aug. 6, 2020, https://www.china-briefing.com/news/china-integrated-circuit-software-enterprises-tax-incentives/.

[47] See, for instance, Internal Revenue Service, “IRS Issues Guidance for Energy Communities and the Credit Program Under the Inflation Reduction Act,” Notice 2024-30, Mar. 22, 2024, https://www.irs.gov/newsroom/irs-issues-guidance-for-energy-communities-and-the-bonus-credit-program-under-the-inflation-reduction-act; Theodore Lee and Anisha Steephen, “Analysis of the First Year of the Low-Income Communities Bonus Credit Program,” US Department of the Treasury, Sep. 4, 2024, https://home.treasury.gov/news/featured-stories/analysis-of-the-first-year-of-the-low-income-communities-bonus-credit-program-building-an-inclusive-and-affordable-clean-energy-economy.

[48] Joint Committee on Taxation, “Tax Incentives for Economic Development and Financing,” Jul. 26, 2024, https://www.jct.gov/publications/2024/jcx-36-24/; see also Scott Hodge, “Opportunity Zones ‘Make a Good Return Greater,’ but Not for Poor Residents,” Tax Foundation, Aug. 25, 2023, https://taxfoundation.org/blog/opportunity-zones-tax-incentives/.

[49] Arthur Kroeber, “China’s Economy: What Everyone Needs to Know.”

[50] PwC, “People’s Republic of China: Corporate – Taxes on Corporate Income,” updated Jun. 28, 2024, https://taxsummaries.pwc.com/peoples-republic-of-china/corporate/taxes-on-corporate-income; PwC, “People’s Republic of China: Corporate – Tax Credits and Incentives,” Jun. 28, 2024, https://taxsummaries.pwc.com/peoples-republic-of-china/corporate/tax-credits-and-incentives; Hannah Feng, “Corporate Income Tax (CIT) Incentives,” China Briefing, https://www.china-briefing.com/doing-business-guide/china/taxation-and-accounting/tax-incentives-in-china.

[51] Ibid., see also Appendix.

[52] Congressional Budget Office, “The Budget and Economic Outlook: 2018 to 2028,” April 2018, https://www.cbo.gov/publication/53651.

[53] See summary of 2017 and 2018 projections in “The Budget and Economic Outlook: 2018 to 2028.”

[54] Gabriel Chodorow-Reich, Matthew Smith, Owen M. Zidar, and Eric Zwick, “Tax Policy and Investment in a Global Economy,” March 2024, NBER, https://www.nber.org/papers/w32180.

[55] Steven Crawford and Garen Markarian, “The effect of the Tax Cuts and Jobs Act of 2017 on corporate investment,” Journal of Corporate Finance, August 2024, https://www.sciencedirect.com/science/article/abs/pii/S0929119924000816.

[56] Christopher House and Matthew D. Shapiro, “Temporary Investment Tax Incentives: Theory with Evidence from Bonus Depreciation,” NBER Working Paper No. 12514, September 2006, https://www.nber.org/system/files/working_papers/w12514/w12514.pdf.

[57] Eric Zwick and James Mahon, “Tax Policy and Heterogenous Investment Behavior,” American Economic Review 107:1 (January 2017), https://www.aeaweb.org/articles?id=10.1257/aer.20140855.

[58] Dan G. Garrett, Eric Ohrn, and Juan Carlos Suárez Serrato, “Tax Policy and Local Labor Market Behavior,” American Economic Review: Insights 2:1 (March 2020), https://pubs.aeaweb.org/doi/pdfplus/10.1257/aeri.20190041.

[59] E. Mark Curtis, Daniel G. Garrett, Eric C. Ohrn, Kevin A. Roberts, and Juan Carlos Suárez Serrato, “Capital Investment and Labor Demand,” NBER Working Paper No. 29485, November 2021, https://www.nber.org/papers/w29485.

[60] Yasheng Huang, Capitalism with Chinese Characteristics (Cambridge University Press, 2008).

[61] Ibid., 78-79.

[62] Arvind Panagariya, Free Trade & Prosperity (New York, NY: Oxford University Press, 2019), 291.

[63] Yongzheng Liu and Jie Mao, “How Do Tax Incentives Affect Investment and Productivity? Firm-Level Evidence from China,” American Economic Journal: Economic Policy 11:3 (August 2019), https://www.jstor.org/stable/10.2307/26754073.

[64] Zhao Chen, Xian Jiang, Zhikuo Liu, Juan Carlos Suárez Serrato, and Daniel Yi Xu, “Tax Policy and Lumpy Investment Behavior: Evidence from China’s VAT Reform,” The Review of Economic Studies 90:2 (March 2023), https://academic.oup.com/restud/advance-article-abstract/doi/10.1093/restud/rdac027/6586315?redirectedFrom=fulltext&login=false.

[65] See, for instance, Nicholas Bloom, Mark Schankerman, and John Van Reenen, “Identifying Technology Spillovers and Product Market Rivalry,” Econometrica 81:4 (July 2013), https://onlinelibrary.wiley.com/doi/abs/10.3982/ECTA9466; William D. Nordhaus, “Schumpeterian Profits in the American Economy: Theory and Measurement,” NBER Working Paper No. 10433, April 2004, https://www.nber.org/papers/w10433.pdf.

[66] Philipp Boeing and Bettina Peters, “Misappropriation of R&D Subsidies: Estimating Treatment Effects with One-Sided Noncompliance,” IZA Discussion Paper No. 14852, November 2021, https://docs.iza.org/dp14852.pdf.

[67] Zhao Chen, Zhikuo Liu, Juan Carlos Suárez Serrato, and Daniel Yi Xu, “Notching R&D Investment with Corporate Income Tax Cuts in China,” American Economic Review 111:7 (2021), https://dukespace.lib.duke.edu/server/api/core/bitstreams/3ad5edb0-bcd7-40e9-b51a-57fe733ef50c/content.

[68] Binbin Tian, Baixue Yu, Shi Chen, and Jingjing Ye, “Tax Incentive, R&D Investment, and Firm Innovation: Evidence from China,” Journal of Asian Economics 71 (December 2020), https://www.sciencedirect.com/science/article/abs/pii/S1049007820301251.

[69] Shang-Jin Wei, Jianhuan Xu, Ge Yin, and Xiaobo Zhang, “Bureaucratic Bean Counting and Patent Subsidies: A Welfare Analysis of China’s Pro-Innovation Program,” Asian Bureau of Finance and Economic Research, May 2021, https://abfer.org/media/abfer-events-2021/annual-conference/papers-tgd/AC21P4019_Bureaucratic-Bean-Counting-and-Patent-Subsidies-A-Welfare-Evaluation-of-China-Pro-innovation-Program.pdf.

[70] Hong Cheng, Takeo Hoshi, Hanbing Fan, and Dezhuang Hu, “Do Innovation Subsidies Make Chinese Firms More Innovative? Evidence from the China Employer Employee Survey,” NBER Working Paper No. 25432, February 2019, https://www.nber.org/system/files/working_papers/w25432/w25432.pdf.

[71] Alex Muresianu, “Tax Cuts and Jobs Act, Inflation Reduction Act, CHIPS Act: Comparing and Contrasting the New Industrial Policy,” Tax Foundation, Mar. 8, 2024, https://taxfoundation.org/research/all/federal/supply-side-economics-industrial-policy/.

[72] Justin Badlam, Stephen Clark, Suhrid Gajendragadkar, Adi Kumar, Sara O’Rourke, and Dale Swartz, “The CHIPS and Science Act: Here’s What’s In It,” McKinsey and Company, Oct. 4, 2022, https://www.mckinsey.com/industries/public-sector/our-insights/the-chips-and-science-act-heres-whats-in-it.

[73] US Treasury Department, “The Inflation Reduction Act’s Benefits and Costs,” Mar. 1, 2024, https://home.treasury.gov/news/featured-stories/the-inflation-reduction-acts-benefits-and-costs.

[74] Alex Muresianu, “Tax Cuts and Jobs Act, Inflation Reduction Act, CHIPS Act: Comparing and Contrasting the New Industrial Policy”; see also Congressional Budget Office, “Data Supplements: The Budget and Economic Outlook: 2022 to 2032,” May 2022; Bureau of Economic Analysis, “Gross Domestic Product, Fourth Quarter and Year 2023.”

[75] See, for instance, Amanda Chu, Alexandra White, and Rhea Basarkar, “Delays Hit 40% of Biden’s Major IRA Manufacturing Projects,” Financial Times, Aug. 12, 2024, https://www.ft.com/content/afb729b9-9641-42b2-97ca-93974c461c4c.

[76] Simon Alder, Lin Shao, and Fabrizio Zilibotti, “Economic Reforms and Industrial Policy in a Panel of Chinese Cities,” Journal of Economic Growth 21 (May 2016), https://www.ubscenter.uzh.ch/static/5d70e4c513d0457a7420246a66c2663b/WP5_Economic_Reforms_and_Industrial_Policy_in_a_Panel_of_Chinese_Cities.pdf.

[77] See, for instance, Binkai Chen, Ming Lu, Christopher Timmins, and Kuanhu Xiang, “Spatial Misallocation: Evaluating Place-Based Policies Using a Natural Experiment in China,” NBER Working Paper No. 26148 (August 2019), https://www.nber.org/system/files/working_papers/w26148/w26148.pdf.

[78] PRC State Council, “Made in China 2025.”

[79] Lee Branstetter and Guangwei Li, “Does ‘Made in China 2025’ Work for China? Evidence from Chinese Listed Firms,” NBER Working Paper No. 30676. https://www.nber.org/papers/w30676.

[80] Robert Atkinson and Ian Tufts, “The Hamilton Index, 2023: China Is Running Away With Strategic Industries.”

[81] Lee Branstetter and Guangwei Li, “The Challenges of Chinese Industrial Policy.”

[82] Ibid.

[83] Brian Potter, “Why Can’t the U.S. Build Ships?,” Construction Physics, Sep. 5, 2024, https://substack.com/@brianpotter/p-148503520.

[84] Lee Branstetter and Guangwei Li, “The Challenges of Chinese Industrial Policy,” Enterprise and Innovation Policy and the Economy 3 (2024), https://www.journals.uchicago.edu/doi/abs/10.1086/727768?journalCode=eipe.

[85] PRC State Council, “Made in China 2025”; see also Center for Strategic and International Studies, “China’s Uneven High-Tech Drive,” ed. Scott Kennedy, February 2020, https://csis-website-prod.s3.amazonaws.com/s3fs-public/publication/200302_Kennedy_ChinaUnevenDrive_v3.pdf.

[86] Scott Kennedy, “China’s COMAC: An Aerospace Minor Leaguer,” Center for Strategic and International Studies, Dec. 7, 2020, https://www.csis.org/blogs/trustee-china-hand/chinas-comac-aerospace-minor-leaguer.

[87] US International Trade Commission, “Table 1 US Imports for Consumption, Duties Collected, and Ratio of Duties Collected to Value, 1891–2021 (Thousand $),” https://www.usitc.gov/documents/dataweb/ave_table_1891_2021.pdf.

[88] Tax Foundation calculations based on US Customs and Border Protection, “Trade Statistics,” https://www.cbp.gov/newsroom/stats/trade.

[89] See Congressional Research Service, “Escalating U.S. Tariffs: Affected Trade,” Jan. 29, 2020, https://sgp.fas.org/crs/row/IN10971.pdf.

[90] See review of empirical estimates and the USITC’s own confirming estimates in United States International Trade Commission, “Economic Impact of Section 232 and 301 Tariffs on U.S. Industries,” May 2023, https://www.usitc.gov/publications/332/pub5405.pdf?source=govdelivery&utm_medium=email&utm_source=govdelivery.

[91] See summary of academic literature in Erica York, “Tariff Tracker: Tracking the Economic Impact of the Trump-Biden Tariffs,” Tax Foundation, Jun. 26, 2024.

[92] Office of the United States Trade Representative Executive Office of the President, “Four-year Review of Actions Taken in the Section 301 Investigation: China’s Acts, Policies, And Practices Related to Technology Transfer, Intellectual Property, And Innovation,” May 14, 2024, https://ustr.gov/sites/default/files/05.14.2024%20Four%20Year%20Review%20of%20China%20Tech%20Transfer%20Section%20301%20(Final).pdf.

[93] Griswold and Freytag, “Balance of Trade, Balance of Power.”

[94] Erica York, “Separating Tariff Facts from Tariff Fictions,” Cato Institute, Apr. 16, 2024, https://www.cato.org/publications/separating-tariff-facts-tariff-fictions.

[95] World Trade Organization, ”World Tariff Profiles 2023,” https://www.wto.org/english/res_e/publications_e/world_tariff_profiles23_e.htm.

[96] World Bank, “World Integrated Trade Solution: Trade Summaries,” https://wits.worldbank.org/countrysnapshot/en/.

[97][97] Douglas A. Irwin, “Most developing economies reduced tariffs voluntarily, not because of trade agreements,” Peterson Institute for International Economics, Dec. 2, 2022, https://www.piie.com/research/piie-charts/most-developing-economies-reduced-tariffs-voluntarily-not-because-trade.

[98] Scott Lincicome, “Tariff Myths Debunked,” The Dispatch, Sep. 11, 2024, https://www.cato.org/commentary/tariff-myths-debunked.

[99] Davide Furceri, Swarnali A. Hannan, Jonathan David Ostry, and Andrew K. Rose, “Macroeconomic Consequences of Tariffs,” International Monetary Fund, Jan. 15, 2019, https://www.imf.org/en/Publications/WP/Issues/2019/01/15/Macroeconomic-Consequences-of-Tariffs-46469.

[100] See, for instance, Robert Solow, “A Contribution to the Theory of Economic Growth,” The Quarterly Journal of Economics 70:1 (February 1956), https://www.jstor.org/stable/1884513; N. Gregory Mankiw, David Romer, and David Weil, “A Contribution to the Empirics of Economic Growth,” The Quarterly Journal of Economics 107 (May 1992), https://eml.berkeley.edu/~dromer/papers/MRW_QJE1992.pdf.

[101] Robert Hall and Dale Jorgenson, “Tax Policy and Investment Behavior,” The American Economic Review 57:3 (June 1967), https://www.jstor.org/stable/1812110; see also Ufuk Akcigit, John Grigsby, Tom Nicholas, and Stefanie Stancheva, “Taxation and Innovation in the 20th Century,” Quarterly Journal of Economics 137:1 (2022), https://scholar.harvard.edu/files/stantcheva/files/taxation_20th_century.pdf.

[102] A policy of neutral cost recovery would retain the current depreciation schedules for commercial and residential structures investment but augment the write-offs with adjustments to reflect inflation and the time value of money. In present value terms, the adjustments result in the same treatment as full expensing.

[103] US Treasury Department, “The Inflation Reduction Act’s Benefits and Costs,” Mar. 1, 2024, https://home.treasury.gov/news/featured-stories/the-inflation-reduction-acts-benefits-and-costs.

[104] Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party, “Reset, Prevent, Build: A Strategy to Win America’s Economic Competition with the Chinese Communist Party,” Dec. 12, 2023, https://selectcommitteeontheccp.house.gov/sites/evo-subsites/selectcommitteeontheccp.house.gov/files/evo-media-document/reset-prevent-build-scc-report.pdf.

[105] Gary Clyde Hufbauer and Euijin Jung, “Scoring 50 Years of US Industrial Policy,” Peterson Institute for International Economics, November 2021, https://www.piie.com/sites/default/files/documents/piieb21-5.pdf and “Lessons learned from half a century of US industrial policy,” Nov. 29, 2021, https://www.piie.com/blogs/realtime-economics/2021/lessons-learned-half-century-us-industrial-policy.

Share