Key Findings

- Growing levels of waste and pollution, paired with increasing burdens on taxpayers to address environmental problems, have spurned policymakers in the US and abroad to encourage producers to be responsible, either financially or operationally, for the end-life of their products.

- Extended producer responsibility is a policy approach that could shape incentives to encourage recycled materials and help shift waste management costs from taxpayers to the producers of waste.

- Low-rate taxes on unrecycled raw materials like virgin plastics, coupled with enabling innovation in recycling, would encourage a circular economy—a model of economic consumption and production that involves reusing and recycling materials for as long as possible to reduce waste.

- Policy options that include recycled-based manufacturing standards, non-neutral burdens on products and materials, and exclusive focus on one link in the circular economy chain are suboptimal policies that threaten to create counterproductive environmental outcomes.

- Conformity across states would minimize compliance costs and maximize environmental outcomes.

- Soundly designed policies could help enable a circular economy, achieve environmental goals, and bring economic growth from more efficient recycling and competitive waste disposal industries.

Introduction

Growing quantities of consumer waste and associated pollution have long raised environmental concerns. At the same time, taxpayer burdens of waste collection, disposal, and recycling have also continued to grow as more waste is generated. The result is a strong desire to reduce pollution and waste through public policies that improve recycling and align taxation with better outcomes.

There is no official government data on the current national recycling rate, but estimates indicate the rate is about 33 percent, well behind the Environmental Protection Agency’s (EPA) goal of achieving a 50 percent recycling rate by 2030.[1] Some types of renewable materials, especially some plastics, are not viably recyclable with existing technology and processes. Only 21 percent of recyclable materials are successfully collected, sorted, and recycled with existing infrastructure.[2]

Governments have sought policies that effectively reduce waste, promote the recycling and reuse of materials, and shift the cost of waste management back to the producers of the waste—all while avoiding undue burdens on already suffering economies.

Extended producer responsibility (EPR) encompasses a broad array of policies that seek to accomplish one or more of these goals by making producers responsible, in some way, for the management of their products at the end of their use cycle.[3]

The current trajectory of US and global environmental policy indicates a certain degree of inevitability for the implementation of EPR in some capacity. Individual states have already established their own unique EPR programs. This patchwork of disparate policy designs presents unique challenges and costs for businesses that operate in multiple states. Policy design and conformity between jurisdictions is an important consideration for state and federal policymakers.

Many policy designs and structures fall under the EPR umbrella. Some ideas have a strong chance of achieving their policy aims, while others risk significant unintended consequences and have counterproductive economic and environmental effects. EPR may not be the optimal vehicle to meet all environmental goals, enable recycling, and/or promote a circular economy, but it is highly likely to be a part of the policy toolkit, and there are certainly policy options under the EPR umbrella that are better than others.

A Blueprint for Sound Policy

An EPR policy that embodies the principles of simplicity, transparency, neutrality, and stability would have the greatest potential to reduce waste, promote recycling, distribute burdens equitably, and establish a lasting circular economy. Adhering to these principles also minimizes the economic costs associated with pursuing environmental goals and may even yield long-term economic gains resulting from less waste of resources. Despite the clear implication of added costs and complexity to production, industry leaders tend to support EPR programs and other environmental efforts that are structured well and implemented effectively.[4] Concerns tend to arise when policies conflict with each other, impose unnecessary compliance burdens, or are poorly calibrated to achieve their desired ends.

The foundational principles for best-practice EPR policy are:

- Place a low-rate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

as early in the production process as possible. - Use the revenues from the tax to support the weakest links in the circular economy process.

- Apply international border adjustments to imports from locations without EPR policies.

- Avoid overly restrictive mandates and regulations.

EPR programs would be most effective as low-rate specific taxes levied on unrecycled raw materials used in production. A tax on unrecycled raw materials would provide price incentives for market participants to use more recycled materials and fewer raw materials and for suppliers to provide more recycled materials for use.

By targeting raw materials, these taxes would be neutral to all production using the taxed product, regardless of the end use of products being made. Exempting or providing rebates for materials used in certain industries, in certain products, or for certain purposes violates this neutrality.

Non-neutral treatment of manufacturing or recycling processes also threatens to undermine environmental goals and distort markets, a common critique of certain narrowly targeted environmental excise taxes, such as plastic bags taxes.[5] Traditional mechanical recycling, advanced chemical recycling, and possibly new technologies or processes yet to be developed are likely to all be important for realizing environmental goals and establishing a sustainable circular economy. For recycling to truly conserve resources, rational prices and competition among disposal methods and material sources should direct allocations. Burdening or favoring a particular recycling process may ensure that resources are wasted instead of conserved.

Taxes should be proportional to the costs that materials or products impose on the waste management system, applied evenly across industries and end uses. Advanced EPR policies could involve eco-modulation of fees—variable rates based on the amount of environmental harm caused by a product or the relative ease with which a product can be recycled—but that introduces additional complexity.

A simple tax applied early in the production process will also have relatively few remitters, thus minimizing complexity and compliance costs. Extending taxes or EPR requirements to distributors, retailers, or consumers would significantly complicate tax administration and compliance as well as risk double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income.

of the same material, overly distorting markets.

A tax on raw aluminum would be more neutral and effective at incentivizing the use of recycled aluminum than would a tax exclusively on soda cans, for example. A tax on virgin plastic applied at the manufacturer level would carry far fewer compliance costs than a tax applied on wholesalers or retailers, who may be unaware of exactly the amount of plastic used in the production of the products they sell.

Revenues from the taxes should be solely dedicated to establishing and fortifying the other links in the circular economy chain: reforming waste management systems, supporting curb-side municipal recycling efforts, and improving recycling infrastructure. EPR revenues should not be used for general spending or unrelated programs.

Transparency in EPR taxes is also important. Explaining to constituencies and taxpayers the net long-term effects of raw materials taxes, and why they may or may not be desirable, is a necessary step in ensuring their success. Acknowledging the inherent trade-offs and economic impacts when considering the viability of the overall policy efforts is crucial to fostering genuine public support and understanding.

EPR taxes are, in effect, a proxy user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided. A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them.

for the waste management system, including the up-front costs for building out recycling infrastructure. User fees are a way to generate funds for a particular government-provided product or service from the actual consumers and users, instead of general taxpayers. User fees attempt to approximate market prices for government services, which enables more efficient provision and ensures the burden of associated costs falls on the users of the services in proportion to the costs they impose.

Costs and prices are and should be dynamic as conditions and preferences change. Instead, stability in a user fee tax structure would entail keeping the relative treatment of materials and processes neutral and stable while allowing for prices to reflect market preferences and incorporate industry changes.

EPR policies that mandate recycled content use or require changes to existing production processes should be avoided. These would amount to indirect production caps (manufacturing is limited by the amount of recycled material available), undermine competition, and introduce semantical issues that threaten needed innovations. Similarly, product bans, such as those on single-use plastic products like straws or utensils, are also counterproductive for the environment and the economy. These are not merely theoretical dangers; some states have already fallen into foreseeable pitfalls with EPR policy. It is far better to tax materials once—when they are new, and not when they are recycled—which creates an incentive for reuse without resorting to counterproductive mandates.

EPR policy should also be cohesive across state jurisdictions. Multistate businesses should not be forced to adapt to disparate programs in different states that impose vastly different requirements, costs, and rates. It may, then, be appropriate for a federal policy to ensure conformity across state lines and to preempt state policy to preclude harmful and counterproductive effects inflicted by piecemeal or unprincipled state policy.

Ideally, the introduction of new taxes on raw materials would be coupled with reforms elsewhere in the circular economy chain—reforms not appropriate to be made via tax policy. To enable production with more raw materials as EPR taxes would incentivize, it would be necessary to enable innovation and competition within the recycling industry, between recycling and other waste disposal services, and elsewhere in the collection, sortation, and waste management process.

Domestic US policy alone would obviously not have much impact on foreign countries, which remain the largest sources of global waste and pollution.[6] EPR cannot be a tax solely on domestic manufacturers. Domestic producers would be competitively disadvantaged by foreign producers that do not incorporate the environmental impact of their products into their prices due to government mismanagement of waste, improper enforcement of property rights, or another special privilege.

Levying taxes on importers to equalize the treatment of domestic and foreign production and prevent punishing or protecting domestic industry is not a new idea. The European Council approved the world’s first Carbon Border Adjustment Mechanism (CBAM) in 2023.[7] A plastic border adjustment can follow the same model, for example, by applying a tariffTariffs are taxes imposed by one country on goods or services imported from another country. Tariffs are trade barriers that raise prices and reduce available quantities of goods and services for US businesses and consumers.

on imported plastic products from countries where plastic products are not already taxed. Similar discussions have been held regarding special tax treatment on imported Chinese vapor products that haven’t been authorized for sale in the US and, when seized, must be treated as hazardous waste.[8]

Extended producer responsibility policy does not need to impose significant burdens on production processes, consumer prices, or the environment. The best EPR policy is one with a low rate levied on unrecycled materials; revenues from the EPR taxes can then be explicitly directed to sound reforms enabling and fortifying the other links in the circular economy chain. A federal policy that creates uniformity across state jurisdictions, and that also preempts state programs’ capacity to be counterproductive by precluding the many EPR pitfalls, could help achieve both environmental and economic goals.

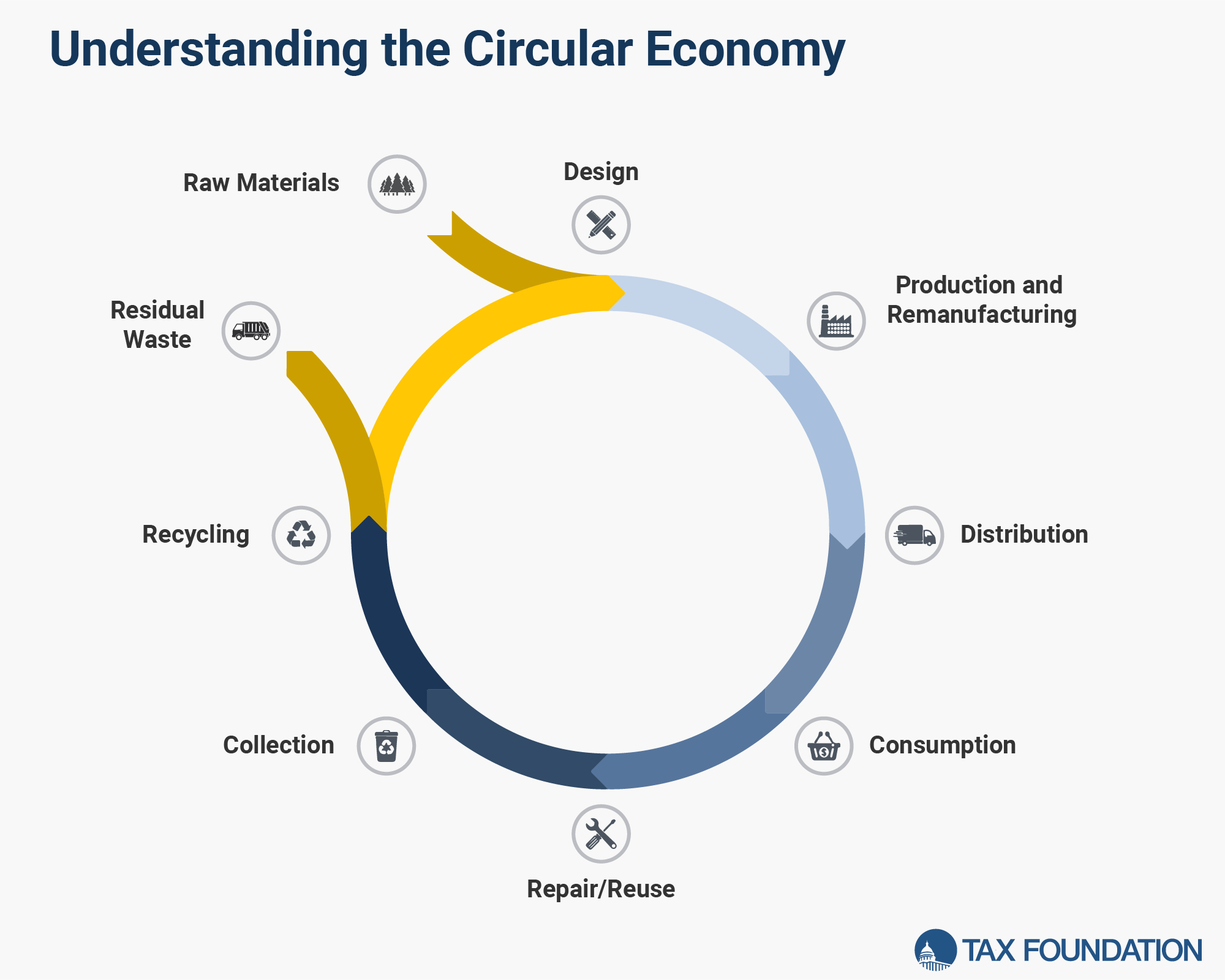

A Circular Economy

A circular economy minimizes waste by keeping materials and resources circulating from production to recycling back into production as much as possible.[9] The process attempts to maximize the utility of each finite resource available by recovering utility from used products.

Product design that incorporates end-of-life collection, sorting, and recycling helps lower the end cost of recycled materials, which thereby lowers the input costs of using recycled materials for producers.

Producers incentivized to consider the cost of waste management for their products make different decisions regarding the materials used, their physical characteristics, and their prices that better facilitate their collection, sorting, and recycling. Distributors may need to adjust their activities if changes to the physical characteristics of products are significant, but it seems more likely that existing distribution infrastructure and processes would be adequate to handle more recyclable products.

Consumers educated on how to recycle, and incentivized to do so, participate by engaging with haulers to put the used products back into the circular economy to be reused. Haulers collect the used products and distribute them to be sorted and transported to recycling or other waste disposal facilities.

Recycling facilities, waste-to-energy facilities, and other waste disposal providers then process the waste and optimize the recycling of materials that are then made available for producers to reuse. With adequate competition in the waste management industry and rational prices communicating market preferences, net resources can be maximized and environmental harm minimized.

The current state of waste collection, sorting, and recycling infrastructure is not sufficient to sustain a circular economy.[10] Many types of materials are not able to be reprocessed into materials suitable for production with existing technology and processes, including several types of plastic. Even if recycling innovations enabled more recycling, the collection infrastructure does not exist to supply recycling facilities with adequate feedstock of used materials to recycle.

Costs of waste collection, sorting, and recycling have historically been too high to warrant reusing resources instead of using cheaper new raw materials. If the resources needed to recycle are greater than the resources needed to extract new materials, recycling would be a net economic loss. Producers will simply use cheaper new materials instead of more expensive recycled ones. Without innovation and competition to increase efficiency and lower costs, there could be little hope of achieving recycling goals or sustaining a circular economy.

EPR policy that mandates the use of current inefficient technologies, processes, and infrastructure would be counterproductive, both for environmental goals and economic growth. Good policy in this area would not only incentivize production with recycled materials but also facilitate innovation in waste management and recycling and allow price mechanisms to optimize the proportions of waste disposal options.

An Unbroken Chain

For materials to successfully navigate through a circular economy, each step in the process must be properly enabled by the previous one. Each phase in the circular economy must be facilitated via appropriate infrastructure and incentivized with policy. If any link in the chain breaks, the entire system fails.

EPR policy failures may yield significantly harmful consequences, both to the economy and to the environment. Overly burdening production risks large increases in consumer prices and reduced economic outputs. Failing to improve waste management and recycling risks wasting resources via inefficient processes instead of conserving them via reuse and recovery. Policymakers must avoid the tendency to overlook secondary consequences and take care to account for the foreseeable downstream effects of policy interventions.

Important EPR Design Considerations

A well-designed EPR policy can promote a more circular economy with relatively small costs to society, while poorly designed EPR programs would do considerable harm. The stakes are high and policy design details matter.

Policies to Avoid

Some policy options that have been proposed or considered have potentially quite harmful, but also very foreseeable, unintended consequences that threaten to render the entire system a failure. Among these policy pitfalls is a recycled content mandate, a top-down requirement that manufacturers use a specific arbitrary percentage of recycled materials in their production processes. Current waste collection, sortation, and recycling infrastructure does not have the capacity to provide enough recycled materials to support even the 30 percent goal suggested by America’s Plastic Makers, nor does current infrastructure seem efficient enough yet to make that level of recycling environmentally worthwhile.[11]

A recycled material production mandate could result in an artificial barrier to entry for producers, arbitrarily raising input costs and undermining competition. Undercutting competition and market entry in packaging production would worsen the economic impact of EPR policy and undermine environmental goals as well. Without accompanying changes to the waste management system, a recycled content mandate would likely amount to an indirect production cap given the limited supply of recycled materials.

Direct production caps designed to restrict plastic use and production have also been considered. There are several foreseeable problems with such a mandate, both for the economy and the environment. Plastic is not, itself, environmentally harmful. In fact, because it requires so few resources to create and has near-universal applications, plastic tends to have a net positive effect on the environment compared to the use of alternative materials.[12] Plastic waste and its improper disposal present an environmental problem, not plastic use. EPR policies that mandate reductions to plastic production or use may merely incentivize producers to switch to alternative materials. Plastic alternatives tend to create worse environmental outcomes, in addition to hindering economic capacity and growth.

Bans on plastic bags, for instance, have been consistently found to undermine recycling and necessitate switching to more resource-intensive alternatives like paper or cotton bags—which are often worse on net for the environment and can drastically increase foodborne illnesses.[13]

Another type of mandate that has been discussed is a requirement that manufactured products or packaging be readily recyclable. This still introduces the natural hindrance that a top-down mandate would have on efficiency and the ability of competition and prices to optimize production and recycling processes.

A recyclable content mandate also introduces a new problem: how exactly “recyclable” is to be defined. The statutory and regulatory semantics of EPR policy are delicate considerations. Structuring definitions too broadly would render the policy impotent, but defining terms too narrowly would preclude any innovation or advancements in the recycling process or industry—innovations that would be crucial to enabling a sustainable circular economy.

The policy most doomed to fail would be a government takeover of the recycling and waste management industries. Rational prices are necessary to even determine if resources are being wasted or conserved, so further removing recycling and waste management from market preferences via nationalization would only undermine the efficiency of processes that are already struggling—and would all but guarantee that environmental and economic goals could not be achieved.

Extended producer responsibility does not need to invite unintended consequences. Policy that considers the long-term, or even medium-term, effects on the economy and the environment to avoid obvious pitfalls could work toward environmental goals without inflicting too much damage on the economy. Policy that enables competition, innovation, and rational prices in the waste management industry can yield environmental gains that may even be coupled with economic growth.

Covered Products

A foundational aspect of EPR programs is an enumeration of which materials and/or products are to be covered. Some programs limit coverage to only beverage containers or plastic packaging, others extend to all packaging or plastic products, and still others extend to all packaging, plastic, and paper products.

The obvious danger of too strictly narrowing the list of covered products is introducing non-neutrality into the system. Targeting only beverage containers, for instance, bestows an undue advantage on producers of other containers, and targeting only one material, like plastic, forces one industry to bear burdens created by others, and both may even yield unintended consequences to the environment, the economy, and food safety as producers try to get around the tax—as seen with plastic bag taxes and bans.

Some materials also have special considerations and requirements for their management. Paint, for instance, has special legislation governing its management in 10 states and the District of Columbia. Other chemicals and “toxic” substances that create profound environmental harms often must be addressed separately or differently according to their specific characteristics.

Batteries and electronics are also unique in their waste management. Because they are often filled with hazardous metals not suitable for some landfills, eight states and the District of Columbia have established an EPR program for at least some batteries. Electronics often contain valuable and recoverable metals, making landfilling e-waste particularly wasteful. Half of states and the District of Columbia have established some form of EPR or product stewardship program specifically governing the recycling of electronics.[14] More states may seek to address electronic waste as the rise in illicit disposable electronic cigarettes and vapes illegally imported from China create substantial amounts of e-waste and burdens to the waste management system.[15]

The key consideration for determining and enumerating covered products for an EPR program is ensuring neutrality between materials, product end uses, and industries. Punishing one disfavored material, product, or industry, or exempting favorites, has serious risks of inadvertently undercutting environmental goals by incentivizing switching to less environmentally sound alternatives, undermining competition, and distorting market signals that better allocate scarce resources.

Semantics

Particularities of language, phraseology, semantics, and even punctuation are of critical concern for all statutory, regulatory, legislative, or otherwise governmental endeavors. EPR policy would not be different in this regard. The way in which relevant terms are defined could have an outsized impact on the expected success of the program—both environmentally and economically.

One longstanding roadblock to effective recycling in the US has been existing regulatory language and definitions. Foundational legislation for waste disposal and recycling largely comes from the 1976 Resource Conservation and Recovery Act.[16] Technologies, processes, and innovations developed since then are often not adequately addressed or considered by underlying regulatory frameworks.

This is not a novel phenomenon—legislation and regulation often lag market innovations, usually to economic detriment. For instance, longstanding categorical definitions of alcohol types present challenges to innovative products in the industry.[17] Enumerating statutory and regulatory definitions in such a way as to allow, enable, and even encourage innovation would be necessary to both succeed now and avoid more problems in the future.

The current suppression of innovation via semantics in the recycling industry can be seen most clearly in the treatment of advanced or chemical recycling of plastics. Advanced recycling refers to several processes and technologies that return used plastic into basic molecular components which can then be reused in production.[18] There are several advantages to advanced recycling, and established environmental goals would likely need advanced recycling to supplement traditional mechanical recycling. This is because advanced recycling can handle types of plastic otherwise not recyclable and can create “virgin-quality” raw materials necessary for high-grade plastics used for food or medicine.

There is some debate among environmental interests on whether advanced recycling should truly count as recycling, especially for plastic “recovery” and conversion into fuel.[19] Conversion of used plastic into fuel to be consumed, while reducing plastic waste, does not seem to reintroduce those materials into a production process to be recycled again in a circular economy, even if it does confer benefits by reducing plastic waste. However, advanced recycling of plastics back into new plastics is undeniably recycling that furthers the circular economy, and will likely be necessary to meet environmental goals, provide enough recycled materials to enable production in a circular economy, and ensure that recycling is truly conserving resources instead of wasting them.

As of March 2024, only half of US states have updated their regulations to recognize advanced recycling as a manufacturing process instead of as solid waste facilities (the same as incineration and landfills).[20] States that fail to keep up with market innovations may see less recycling in their jurisdictions and worse environmental outcomes for their communities.

What counts as “recycling” is not the only semantical question. Regulations that mandate recyclable content, or eco-modulation of fees lowering the levy for more recyclable materials, must also define what exactly “recyclable” means. Here, too, definitions must be broad enough to enable innovations, new technology and processes, and other changes to the recycling industry and market. Excluding advanced recycling, limiting recycling to existing or traditional processes, or otherwise precluding innovation or market fluctuations would similarly undermine the ability of EPR policies to be effective.

Development of innovative technologies and processes that make more materials recyclable, make recycling more environmentally efficient, and make recycling more economically viable would be crucial to establishing a lasting circular economy and ensuring that recycling yields real resource gains. Policymakers should take care to craft regulatory definitions in such a way as to enable those innovations.

Eco-Modulation of Fees

There is also much discussion regarding whether and to what degree the taxes and fees imposed on producers should be “eco-modulated” to further encourage participation in the circular economy. Eco-modulation of fees refers to structuring fees according to products’ environmental impact. Greater fees are assigned to products that are more harmful or less recyclable, while smaller fees are assigned to products that are more recyclable and/or use more recycled materials. This often includes rewarding packaging or products with less weight and volume, or which otherwise feature more recyclable product designs.[21]

Basic economic reasoning would support fees that vary according to harm generated or the burden placed on waste management systems for disposal and/or recycling. However, there are several risks associated with eco-modulation.

There are firstly the questions of semantics that would need to be addressed, but additional concerns involve unintended consequences of certain fee structures, difficulties determining and quantifying overall environmental impacts, and the neutrality or non-neutrality of the tax policy.

The biggest concern is that imposing non-neutral fees for different materials would incentivize producers to switch materials to a less environmentally friendly and economically efficient option. Overly burdening plastic relative to paper, glass, or metal, for instance, may induce producers to use more resource-intensive materials in their products and inadvertently yield worse environmental outcomes.

Structuring the tax to incentivize arbitrary changes to the weight, volume, shape, or other characteristics of packaging or products also risks other unintended consequences. Changed packaging or products may be less able to protect from contamination, more cumbersome to distribute, more difficult to recycle, or less efficient to produce. This threatens to create obstacles to a viable circular economy.

It may be more reasonable to modulate fees based on the difficulty and costs associated with collecting, sorting, recycling, and disposing of the waste from different materials. This would amount to a closer, more neutral, proxy for a user fee of the waste management system charged to producers of waste. Eco-modulation of fees, then, may entail charging producers different rates for the use of different raw materials, proportionate to the costs of managing the waste of those materials.

This may have the best chance of shifting the burden of waste management away from the general taxpayer and onto the real users of the collection, recycling, and disposal systems. However, there are obvious challenges with accurately determining, quantifying, and calculating the total costs associated with the collection, sortation, recycling, and disposal of a specific material. Exacerbating this natural difficulty is that much of the collection, sortation, recycling, and disposal infrastructure and operations are government-funded and/or managed. Some municipalities create economic and environmental inefficiencies by granting a single organization a monopoly and/or a monopsony over waste collection and recycling services.[22]

The reforms necessary to collection, sortation, recycling, and disposal infrastructure, processes, and industries would have large up-front costs. However, once infrastructure is built out, competition is introduced, and innovation is encouraged, the costs of waste management will likely decrease. Eventually, after the changes are made, collection, sortation, recycling, and disposal services should be profitable—otherwise, they would be wasting resources instead of conserving them. There are several options to address these market fluctuations that could be incorporated into fee modulation.

A producer responsibility organization (discussed below), the National Academy of Sciences, the Environmental Protection Agency, or some other appropriate institution could conduct periodic reviews of the costs of waste management and adjust rates accordingly. After up-front funds are furnished, operating costs of competing collection, sortation, recycling, and disposal services could be collected in many ways, as determined by economic and environmental efficiency. Whether consumers contract with haulers individually, communities contract with haulers collectively, or haulers contract with producers directly, the burdens of waste management would be more effectively disbursed to the creators of waste and the users of waste management services.

Eco-modulation of fees in EPR may be an appropriate measure to incorporate differences in environmental and waste management burdens associated with different materials and products. As with other aspects of EPR policy, care should be taken to avoid foreseeable counterproductive effects, structure definitions to enable innovation, and create a neutral burden that does not distort competitive market forces or rational prices.

Producer Responsibility Organizations

A producer responsibility organization (PRO) is one way to administer producer-oriented EPR policy. PROs are entities tasked with designing, managing, implementing, and/or enforcing the tax and fee collection, production requirements, and end-of-life product stewardship of covered products. There are many ways that a PRO could be structured, designed, and financed.[23]

PROs are often required to be nonprofit organizations and are sometimes granted a regional or national monopoly over one or more covered products. Producers could be given the option of complying individually, encouraged to join a collective PRO, or may even be mandated to join one.[24]

A PRO is not strictly necessary to successfully implement a sound EPR policy, especially with producers around the world already designing products with circular intentions.[25] A poorly structured PRO may introduce complexity and administrative costs that undermine an EPR program’s viability, but a properly designed PRO could be an effective tool to organize producers, collect associated taxes, and direct the funds toward the weakest links in the circular economy chain.

The complexity of a PRO is driven primarily by the number and type of entities that are encouraged or required to join and participate in its bureaucratic functions. For instance, the 2021 Break Free from Plastic Pollution Act required that all manufacturers, distributors, and retailers of beverage containers, with few exceptions, participate in the funding and implementation of the product stewardship plans.[26]

Creating one or several bureaucracies for each covered product, which may cover one region or span the whole nation, tasked with trying to monitor and coordinate between hundreds of thousands of businesses is an unworkable solution.[27] Saddling every industry with ever more bureaucratic red tape and complicating the system’s implementation is poor policy and would undermine both economic and environmental goals.

Monopolized PROs run the same risk of undermining innovation in recycling and waste management. Inefficient and unchecked PRO policies would not only burden waste management and recycling services, but costs of such inefficiencies could also be shifted to taxpayers who would be worse off than before any EPR policies were implemented.

Part of the impetus for EPR policy is an effort to shift the burden of waste away from the taxpayer and back onto the producers of that waste. Centralizing control over the waste management system hinders competition and innovation, undermines efficiency and resource conservation capacity, and may also ensure that the burdens remain borne primarily by the average consumer.

If a PRO is deemed worthwhile, it should be limited to actual producers and importers, without distributors or retailers, to minimize the number of responsible parties—thereby minimizing the bureaucratic complexity and administrative costs. The taxes and fees charged to producers should be directed solely to the establishment and fortification of the other links in the circular economy chain, particularly building out waste collection, sortation, and recycling infrastructure and enabling competition and innovation in those industries.

The costs of a PRO also scale with the scope and complexity of the underlying EPR program, so it would also be important to maintain simplicity elsewhere in policy design as well.

Trade-Offs and Drawbacks of EPR Programs

EPR, even soundly designed, will involve trade-offs and significant economic impacts. Imposing a tax on raw materials will raise input costs for everything that gets produced using that product. As this cost increase works through the production chain, it both reduces the quantity of raw materials being produced and increases prices for end products.

The decrease in the materials available for production could eventually be offset by an increase in the supply of recycled materials, but this would take some time even after bolstering recycling capacity. If EPR policy properly addresses every link in the circular economy chain, it is possible that the efficiency gains from waste management competition and innovation yield a net increase in the materials available for use in production, but this is sure to take some time and depends on the efficacy of the other aspects of EPR policy.

Until recycled materials can offset the loss to raw materials, prices for most finished products will increase. Price increases, particularly for manufactured goods, tend to have a particularly regressive effect, disproportionately burdening those with lower incomes. While the tax is not levied on consumers directly, it would undeniably have a noticeable effect on lower-income households.

EPR policy will undoubtedly create new compliance and administrative costs. These costs can be minimized by keeping the tax structure reasonably simple, but will nonetheless add to the governmental burden experienced by producers.

One of the most significant challenges that sound EPR policy faces is accurately estimating the overall impact of specific materials, packaging, or products on the environment or even just waste management systems. Given the impossibility of comparison between interpersonal utilities, the obvious challenges quantifying environmental impact, and the general lack of rational prices in waste management services, these estimations are quite difficult.

EPR in the US will also likely have difficulty addressing or influencing the largest global sources of consumer waste, plastic waste, and ocean pollution: foreign countries. Applying a border adjustment to equalize the treatment of domestic production and imports may have some influence over foreign production and waste, but only insofar as that foreign production is exported to the US. Production in other countries that is consumed within those countries or exported to countries without EPR or similar programs seems likely to remain unaffected by US EPR and would continue to generate waste and pollute the environment. Additionally, since EPR will increase the cost of US production, other countries may actually increase their consumption of non-US-produced goods, which can have adverse environmental outcomes if that foreign production is more ecologically insensitive than US production even prior to the implementation of an EPR regime.

EPR border adjustment also accentuates the issue of determining and quantifying nominal and relative impacts. Doing so becomes more complicated when analysis is needed for many countries, and some countries may not have data or infrastructure available to make those determinations. Inaccurate estimations of the appropriate border adjustment threaten to either result in protectionism for domestic production or undue punishment for domestic production, making consumers and the environment even worse off in both cases.

Another significant challenge to EPR programs being effective, and a sustainable circular economy being established, is the present inefficiencies in recycling programs. For most materials, the energy and resources necessary to recover used materials for reuse are currently greater than the energy and resources needed to produce new raw materials. This means that increased use of these inefficient recycling processes would waste more resources than are conserved via recycling.

Revenues from EPR taxes and fees could and should be directed toward improving the collection, sortation, and recycling infrastructure and processes, but more revenue does not guarantee efficiency improvements. Additional revenue could mean enabling innovation, increasing competition, and allowing market forces and prices to create true resource conservation. However, it could also mean a further entrenchment of existing inefficient systems, and the industry could experience increased monopolization, centralization, or cartelization, and more disconnect from rational prices—all of which ensure that a circular economy is impossible, resources are wasted, and both the environment and the economy suffer.

Despite the many drawbacks and trade-offs necessary, EPR policies will be coming to more US jurisdictions. A few states have already begun to implement them, more are expected to do so in the future, and a federal policy may also be established.

Current State Programs

Many states have considered implementing EPR policies, and several of them have successfully passed legislation to do so. Most of the existing programs succumb to at least one of the several pitfalls lurking in EPR proposals, but some of them have sound aspects that other states and federal policymakers could emulate.

Washington’s prohibition on certain plastic products, regulation of some single-use plastics, and recycled content mandates for certain products began in July 2021.[28]

Maine created the first EPR policy with a stewardship program in July 2021. This program relies heavily on eco-modulation of fees and does little to address the current inadequate municipality-operated waste management systems.[29]

Oregon began its EPR program in January 2022. The state relies heavily on eco-modulation of fees, imposes additional convenience standards that increase the costs of waste management, and heavily limits the definition of “recycling” in Oregon.[30]

Colorado established an EPR program in May 2022 to be in full effect by July 2025. The Colorado program excludes certain product end uses and imposes harmful requirements similar to other states, but it does empower private recycling providers.[31] Colorado Governor Jared Polis recently vetoed a bill that would have prohibited the state from offering incentives to advanced recycling operations.[32]

California implemented an extensive EPR program in June 2022 that contains overly broad definitions of producers and product bans.[33] This was separate from California’s 2014 plastic bag ban, which is set to be expanded by a new law.[34] New mandates, bans, and regulations are introduced seemingly every legislative session to address the poorly performing existing programs, but California has yet to embrace more efficient recycling processes.[35]

Minnesota enacted an EPR program in May 2024, including many product end-use exemptions and a heavy reliance on fee eco-modulation, with the statute drawn too narrowly to accommodate recycling innovation.[36] Many more states are considering EPR programs of their own, with a variety of structures, designs, and foreseeable unintended consequences.[37]

Maryland and Illinois ordered recycling needs assessments in 2023 for policymakers to review before setting statewide EPR policy.[38]

The disparities between state programs and jurisdictions create additional challenges for states that implement EPR policies. Since some production occurs out of state for products sold, and waste is generated in state, definitions of producers must be altered to include distributors or retailers as they are the earliest entities to be involved within the state and thus subject to the state tax. Conformity across states would enable only actual producers and importers to be responsible for paying the tax and administering any PROs.

Conclusion

Growing levels of waste and pollution, paired with increasing burdens on taxpayers to address these and other environmental problems, have spurned policymakers in the US and abroad to encourage producers to be responsible, either financially or operationally, for the end-life of their products. EPR encompasses a broad array of different policy tools, structures, and ideas—some of which may help address ongoing environmental concerns and properly attribute waste management burdens to those producing the waste, and some of which may exacerbate poor economic conditions and have counterproductive effects on environmental outcomes.

Low-rate, neutrally levied taxes on raw unrecycled materials imported or used in production seem to be the least distortionary mechanism to encourage the use of more recycled materials in production. The revenues from these taxes can and should be directed toward forging and fortifying the other links in the circular economy chain, primarily building out collection and recycling infrastructure, enabling innovation and competition among waste management services, and reintroducing rational prices into the processes and industries.

Successful implementation of a program like this—adhering to fundamental principles of simplicity, neutrality, transparency, and stability—has the best chance of reducing wasted resources, maximizing resource utility, and achieving environmental goals, all while promoting much-needed economic growth.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

[1] Arlene Karidis, “Recycling Outlook 2023: Improving Plastic Recycling Rates,” Waste360, Jan. 18, 2023, https://www.waste360.com/waste-recycling/recycling-outlook-2023-improving-plastic-recycling-rates; Environmental Protection Agency, “U.S. National Recycling Goal,” Feb. 22, 2024, https://www.epa.gov/circulareconomy/us-national-recycling-goal.

[2] The Recycling Partnership, State of Recycling: The Present and Future of Residential Recycling in the U.S., The Recycling Partnership, Jan. 31, 2024, https://www.recyclingpartnership.org/wp-content/uploads/2024/01/SORR-ByTheNumbers-1.31.24.pdf.

[3] National Conference of State Legislatures, “Extended Producer Responsibility,” Oct. 24, 2023, https://www.ncsl.org/environment-and-natural-resources/extended-producer-responsibility.

[4] America’s Plastic Makers, “Extended Producer Responsibility,” American Chemistry Council, April 2024, https://www.plasticmakers.org/extended-producer-responsibility/; American Chemistry Council, “Plastic Makers Support Fair, Feasible Policy Approaches to Improve Packaging Recycling,” Feb. 3, 2021, https://www.americanchemistry.com/chemistry-in-america/news-trends/press-release/2021/plastic-makers-support-fair-feasible-policy-approaches-to-improve-packaging-recycling; Global Partners for Plastics Circularity, “Global Agreement,” https://www.plasticscircularity.org/global-agreement/.

[5] Institute for Energy Research, “California Is Throwing Away More Plastic After It Banned Plastic Bags,” Mar. 1, 2024, https://www.instituteforenergyresearch.org/climate-change/california-is-throwing-away-more-plastic-after-it-banned-plastic-bags/; Rachel Meidl, “Smart Policy and Innovative Technologies, Like Advanced Recycling, Will Deliver on Climate and Sustainability Goals,” Baker Institute, Apr. 19, 2021, https://www.bakerinstitute.org/research/smart-policy-and-innovative-technologies-advanced-recycling-will-deliver-climate-and-sustainability.

[6] Hannah Ritchie, “Where does the plastic in our oceans come from?,” Our World in Data, May 1, 2024, https://www.ourworldindata.org/ocean-plastics; Louis Lugas Wicaksono, “Which Countries Pollute the Most Ocean Plastic Waste?,” Visual Capitalist, Feb. 17, 2023, https://www.visualcapitalist.com/cp/visualized-ocean-plastic-waste-pollution-by-country/; Hannah Ritchie, Veronika Samborska, and Max Roser, “Plastic Pollution,” Our World in Data, 2023, https://www.ourworldindata.org/plastic-pollution; Jenna Jambeck et al., “Plastic waste inputs from land into the ocean,” Science 347:6223 (February 2015): 768-771, https://www.science.org/doi/10.1126/science.1260352.

[7] Sean Bray, “What the EU’s Carbon Border Adjustment Mechanism Means for Europe and the United States,” Tax Foundation, Apr. 26, 2023, https://www.taxfoundation.org/blog/cbam-eu-carbon-border-tax/.

[8] Adam Hoffer, “Taxes and Illicit Trade,” Tax Foundation, Aug. 10, 2023, https://taxfoundation.org/blog/illicit-trade-taxes-counterfeit-cigarettes/.

[9] Environmental Protection Agency, “What is a Circular Economy?,” EPA, Aug. 26, 2024, https://www.epa.gov/circulareconomy/what-circular-economy.

[10] Prashanth Sabbineni, “INSIGHT: How the US can achieve high plastic recycling rates,” Independent Commodity Intelligence Services, Jul., 6, 2021, https://www.icis.com/explore/resources/news/2021/07/06/10660235/insight-how-the-us-can-achieve-high-plastic-recycling-rates/; Craig Cookson, “30 by ’30?,” American Chemistry Council, Aug. 22, 2021, https://www.americanchemistry.com/chemistry-in-america/news-trends/blog-post/2021/30-by-30.

[11] America’s Plastic Makers, 5 Actions For Sustainable Change, American Chemistry Council, July 2022, https://www.plasticmakers.org/wp-content/uploads/2022/07/5-Actions-for-Sustainable-Change.pdf.

[12] Henry Worthington and Alice Gambarin, “Mapping the Plastics Value Chain: A framework to understand the socio-economic impacts of a production cap on virgin plastics,” Oxford Economics, Apr. 18, 2024, https://www.oxfordeconomics.com/resource/mapping-the-plastics-value-chain/; International Council of Chemical Associations, “New Economic Study Reveals Major Contributions of Plastic Industry to Global Economy,” Apr. 18, 2024, https://www.icca-chem.org/news/new-economic-study-reveals-major-contributions-of-plastic-industry-to-global-economy/; America’s Plastic Makers, “Plastic: Essential to a Resilient American Infrastructure,” American Chemistry Council, May 3, 2021, https://plasticmakers.org/wp-content/uploads/2022/06/Plastic-Essential-to-a-Resilient-American-Infrastructure_-FINAL.pdf.

[13] E Frank Stephenson, “Persecuting Plastic Bags,” from Adam Hoffer & Todd Nesbit, For Your Own Good (Arlington, VA: Mercatus Center, 2018); Greg Rosalsky, “Are Plastic Bag Bans Garbage?,” NPR, Apr. 9, 2019, https://www.npr.org/sections/money/2019/04/09/711181385/are-plastic-bag-bans-garbage; Rebecca L.C. Taylor, “Bag leakage: The effect of disposable carryout bag regulations on unregulated bags,” Journal of Environmental Economics and Management 93 (January 2019): 254-271, https://doi.org/10.1016/j.jeem.2019.01.001; Renée Cho, “Plastic, Paper or Cotton: Which Shopping Bag is Best?,” State of the Planet, Apr. 30, 2020, https://news.climate.columbia.edu/2020/04/30/plastic-paper-cotton-bags/.

[14] National Conference of State Legislatures, “Extended Producer Responsibility.”

[15] Adam Hoffer and Jacob Macumber-Rosin, “Current Challenges in Vaping Markets,” Tax Foundation, Jul. 26, 2024, https://www.taxfoundation.org/blog/vaping-market-challenges/; Matthew Perrone, “Communities can’t recycle or trash disposable e-cigarettes. So what happens to them?,” AP News, Oct. 19, 2023, https://www.apnews.com/article/vaping-ecigarettes-waste-environment-disposable-pollution-3d19dce9693ce78dd244729f524df02a; Lucas Gutterman, “Vape Waste: The environmental harms of disposable vapes,” Public Interest Research Group, Jul. 11, 2023, https://www.pirg.org/edfund/resources/vape-waste-the-environmental-harms-of-disposable-vapes/; Justine Calma, “Vapes, chargers, and other ‘invisible’ e-waste are a 9-million-ton problem,” The Verge, Oct. 11, 2023, https://www.theverge.com/2023/10/11/23912751/vapes-chargers-invisible-ewaste-recycling.

[16] Environmental Protection Agency, “EPA History: Resource Conservation and Recovery Act,” EPA, May 31, 2024, https://www.epa.gov/history/epa-history-resource-conservation-and-recovery-act.

[17] Adam Hoffer, “Modernization of the Alcohol Tax,” Tax Foundation, Dec. 19, 2023, https://www.taxfoundation.org/research/all/federal/alcohol-tax-modernization-abv-tax/.

[18] America’s Plastic Makers, “Advanced Recycling for Plastic: Helping Meet Recycling Goals,” American Chemistry Council, https://www.plasticmakers.org/advanced-recycling-technologies/.

[19] Cheryl Hogue, “Chemical recycling of plastic gets a boost in 18 US states—but environmentalists question whether it really is recycling,” Chemical & Engineering News, May 15, 2022, https://cen.acs.org/environment/recycling/plastic-recycling-chemical-advanced-fuel-pyrolysis-state-laws/100/i17.

[20] Waste Advantage, “With Wyoming, Half the Country Open to Advanced Recycling,” Mar. 27, 2024, https://www.wasteadvantagemag.com/with-wyoming-half-the-country-open-to-advanced-recycling/.

[21] Marissa Heffernan, “Eco-modulation requirements set EPR programs apart,” Resource Recycling, Aug. 6, 2024, https://www.resource-recycling.com/recycling/2024/08/01/diverse-eco-modulation-requirements-set-epr-programs-apart/; Consumer Goods Forum, “Guiding Principles for the Ecomodulation of EPR Fees for Packaging,” February 2022, https://www.theconsumergoodsforum.com/wp-content/uploads/2023/04/EPR-Ecomodulation-2022-v2.pdf.

[22] Angela Logomasini, Interstate Waste Commerce, Competitive Enterprise Institute, https://www.cei.org/sites/default/files/Angela%20Logomasini%20-%20Interstate%20Waste%20Commerce.pdf; C & A Carbone, Inc. v. Clarkstown, 511 U.S. 383 (1994); United Haulers Assn., Inc. v. Oneida-Herkimer Solid Waste Management Authority, 550 U.S. 330 (2007); Geoffrey Segal, “Supreme Court Ruling Threatens Privatization,” Reason Foundation, Jul. 4, 2007, https://www.reason.org/commentary/supreme-court-ruling-threatens/.

[23] Evita Hegmann, “Understanding Producer Responsibility Organisation’s (PRO) role in EPR,” Zero Waste Maldives, Nov. 27, 2022, https://www.zerowastemaldives.com/producer-responsibility-organisation/.

[24] Sustainable Packaging Coalition, “Guide to EPR Proposals,” https://epr.sustainablepackaging.org/.

[25] Global Partners for Plastics Circularity, “Tracking Our Progress,” https://www.plasticscircularity.org/our-progress/.

[26] Break Free from Plastic Pollution Act of 2021, S.984 – 117th Congress (2021-2022), https://www.congress.gov/bill/117th-congress/senate-bill/984.

[27] Angela Logomasini, “The High Costs of the Break Free from Plastic Pollution Act,” Competitive Enterprise Institute, Jan. 13, 2022, https://www.cei.org/studies/the-high-costs-of-the-break-free-from-plastic-pollution-act/.

[28] Washington State Legislature, SB 5022 – 2021-22, https://app.leg.wa.gov/billsummary?BillNumber=5022&Year=2021&Initiative=false.

[29] 130th Maine Legislature, “An Act to Support and Improve Municipal Recycling Programs and Save Taxpayer Money,” https://www.mainelegislature.org/legis/bills/display_ps.asp?ld=1541&PID=1456&snum=130; Colin Staub, “Chemical recycling not ‘recycling’ in Maine,” Resource Recycling, Mar. 6, 2024, https://www.resource-recycling.com/plastics/2024/03/06/chemical-recycling-not-recycling-in-maine/.

[30] Oregon State Legislature, 2021 Regular Session, SB 582 Enrolled, https://olis.oregonlegislature.gov/liz/2021R1/Measures/Overview/SB582.

[31] Colorado General Assembly, HB22-1355, Producer Responsibility Program for Recycling, https://leg.colorado.gov/bills/hb22-1355.

[32] Sam Brasch, “Why Gov. Polis vetoed legislation to end state incentives for ‘advanced recycling,’” CPR News, May 20, 2024, https://www.cpr.org/2024/05/20/why-polis-vetoed-bill-to-end-state-incentives-for-advanced-recycling/; Tess Kazdin, “Colorado Gov. Polis vetoes bill to disincentivize advanced recycling,” Recycling Today, May 22, 2024, https://www.recyclingtoday.com/news/colorado-gov-vetoes-bill-to-disincentivize-advanced-recycling/.

[33] California State Legislature, SB-54 Solid waste: reporting, packaging, and plastic food service ware, https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=202120220SB54.

[34] CalRecycle, “Single-Use Carryout Bag Ban,” 2024, https://calrecycle.ca.gov/Plastics/CarryOutBags/; Jessica Roy, “California’s plastic bag ban is failing. Here’s why,” The Los Angeles Times, Aug. 24, 2023, https://www.latimes.com/environment/story/2023-08-24/whats-the-deal-with-single-use-plastic-bag-bans; Norbert Sparrow, “California Bans Single-use Plastic Bags. Again,” Plastics Today, Sep. 3, 2024, https://www.plasticstoday.com/legislation-regulations/california-bans-plastic-grocery-bags-again; Lynn La, “Why California legislators want to ban more plastic bags,” CalMatters, Feb. 9, 2024, https://www.calmatters.org/newsletter/plastic-bag-ban-california/.

[35] CalRecycle, “California overhauls recycling with plastic pollution and beverage container reforms,” CalRecycle, Mar. 8, 2024, https://calrecycle.ca.gov/2024/03/08/press-release-24-03/; Tim Shestek, “As recycling rate drops, California should embrace innovative recycling technologies,” CalMatters, May 21, 2020, https://www.calmatters.org/commentary/2020/05/as-recycling-rate-drop-california-should-embrace-innovative-recycling-technologies/.

[36] Minnesota Legislature, HF 3911, https://www.revisor.mn.gov/bills/bill.php?b=house&f=HF3911&ssn=0&y=2024.

[37] Sustainable Packaging Coalition, “Recent EPR Proposals,” Aug. 7, 2024, https://epr.sustainablepackaging.org/policies.

[38] Maryland General Assembly, SB0222 CH0465, Environment – Statewide Recycling Needs Assessment and Producer Responsibility for Packaging Materials, https://mgaleg.maryland.gov/mgawebsite/Legislation/Details/SB0222?ys=2023RS; Illinois General Assembly, SB1555 Enrolled, https://www.ilga.gov/legislation/publicacts/103/PDF/103-0383.pdf.

Share