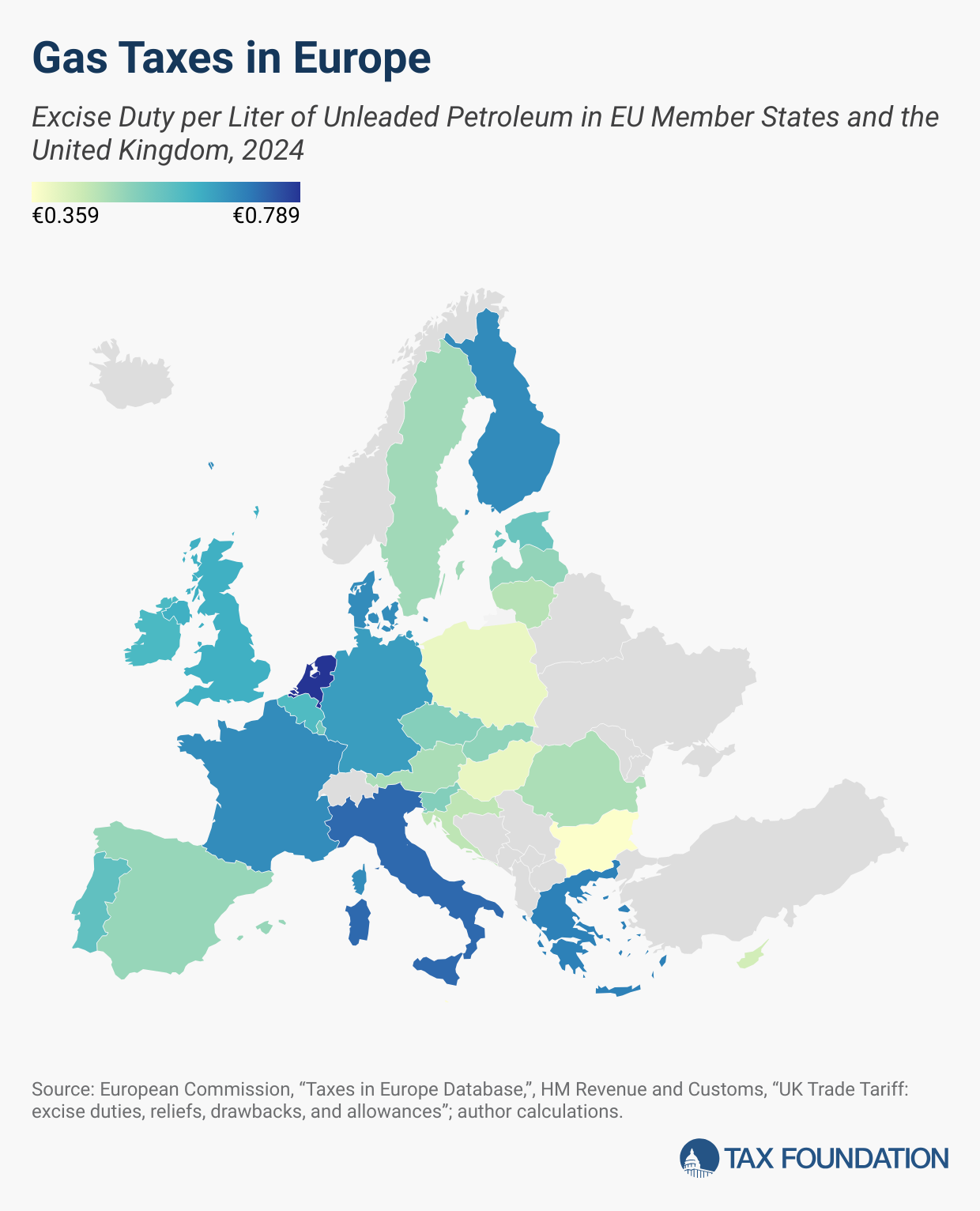

Fuel taxes continue to be a central policy consideration for European countries amid supply chain disruptions related to the Russo-Ukraine war, increased emphasis on environmental policy, and deteriorating economic conditions felt by average consumers. The European Union requires Member States to levy a minimum excise duty of €0.359 per liter ($1.47 per gallon) on petrol (gasoline).

As this map shows, only Malta sticks to the minimum rate, while all other EU countries levy higher excise duties on gasoline. Malta, at €0.359 per liter, has the lowest gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline.

, followed by Bulgaria at €0.363 per liter ($1.49 per gallon) and then Poland at €0.391 per liter ($1.60 per gallon).

The Netherlands has the highest gas taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

in the EU at €0.789 per liter ($3.23 per gallon), followed by Italy at €0.728 per liter ($2.98 per gallon) and Greece at €0.700 per liter ($2.86 per gallon).

The market for diesel vehicles in the EU has been steadily declining, but they still account for almost 15 percent of new car registrations. Some European consumers, then, face excise duties on diesel instead of gas. The minimum excise duty required by the EU is slightly less for diesel at €0.33 per liter ($1.35 per gallon).

Most EU countries levy a lower excise duty on diesel than gas. Belgium and the United Kingdom, which is no longer part of the EU, levy the same rate on the two fuels. The EU average excise duty on gasoline is €0.548 per liter ($2.24 per gallon), while the average excise duty on diesel is €0.445 per liter ($1.82 per gallon).

The United Kingdom levies the highest excise duty on diesel at €0.626 per liter ($2.56 per gallon), followed by Italy at €0.617 per liter ($2.53 per gallon) and Belgium at €0.600 per liter ($2.46 per gallon).

The lowest excise duties are levied by Bulgaria and Malta at the EU minimum of €0.330 per liter ($1.35 per gallon), then Poland at €0.360 per liter ($1.47 per gallon).

The EU minimum excise duty on gasoline ($1.47 per gallon) is greater than the highest gas tax in the US, which is approximately $1.25 per gallon in California (combining federal and state taxes).

All EU Member States also levy an additional value-added tax (VAT) on the sale of gas and diesel. The excise amounts shown on the map only reflect excise taxes and do not include the VAT.

Gas and diesel taxes continue to be prominent policy issues throughout Europe. As the EU undergoes sweeping changes for its green transition, fuel taxes are likely to be a crucial aspect of policy discussions.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share

Previous Versions

-

Diesel and Gas Taxes in Europe, 2023

5 min read

-

Gas Taxes in Europe, 2022

5 min read

-

Gas Taxes in Europe, 2021

5 min read

-

Gas Taxes in Europe, 2020

4 min read

-

Gas Taxes in Europe, 2019

4 min read