Beer. For many Americans, the thought of beer conjures warm memories—summer grilling, a cheers with old friends, or a cold drink at the end of a long day.

Beer taxes, however, are enough to squash those positive vibes. In the United States, taxes are the single most expensive ingredient in beer. State and local beer taxes add more to the final price of beer than the labor and raw materials combined. One report found that the different layers of taxation on production and distribution combine to make up about 40 percent of the retail price of beer. So, as you share one with your friends and family, how does your state compare?

The United States collects an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

on fermented malt beverages at the federal level (ranging from $0.11 to $0.58 per gallon based on production, location, and quantity). At the state level, all 50 states and the District of Columbia collect their own beer excise taxes, added on to any other retail sales taxes from state, and sometimes municipal, governments.

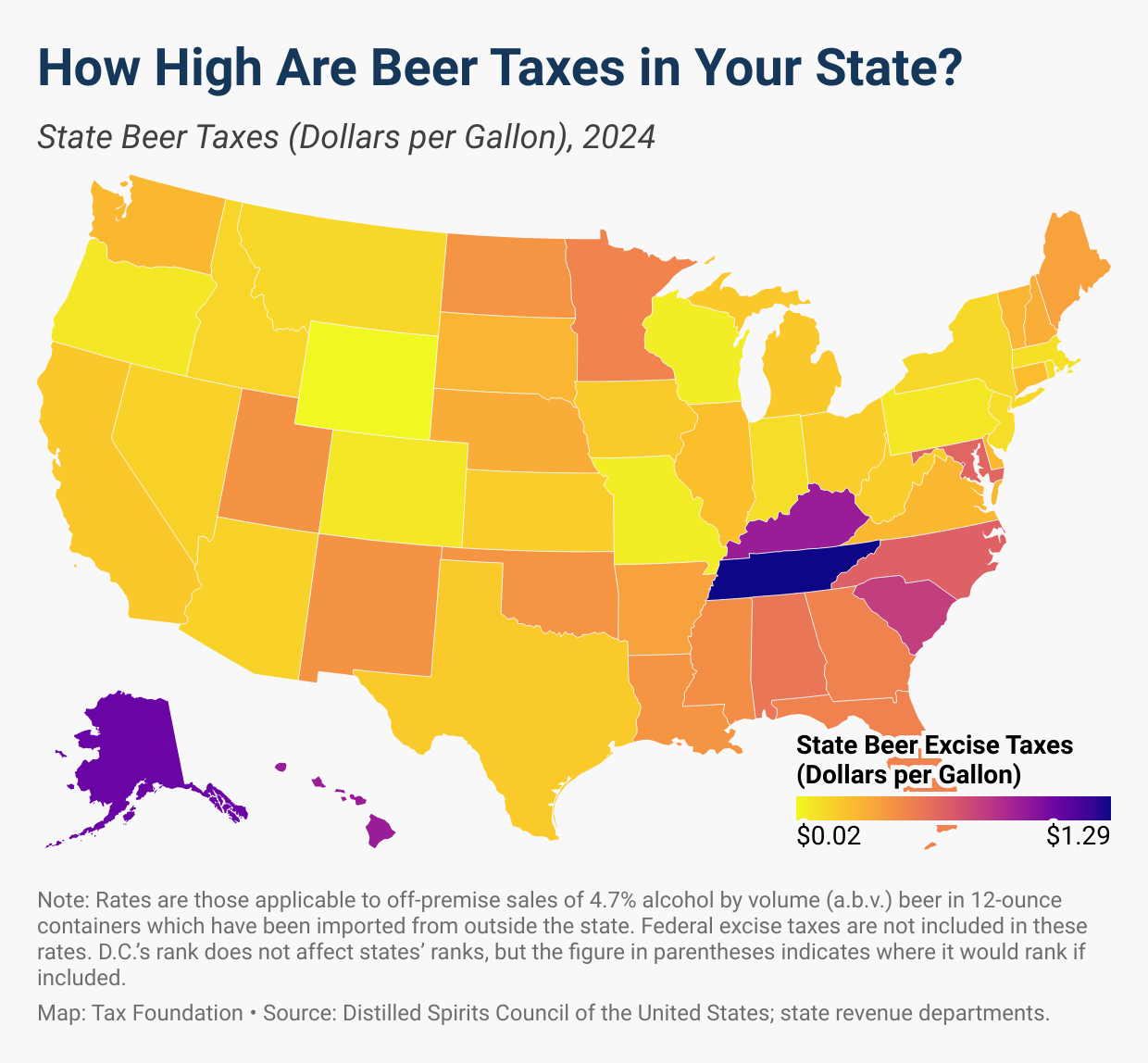

The map below shows the state beer excise taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

rates in all 50 states and the District of Columbia. Rates range from as low as $0.02 per gallon in Wyoming to as high as $1.29 per gallon in Tennessee. Missouri and Wisconsin tie for second lowest at $0.06 per gallon. Alaska charges the second-highest beer tax rate at $1.07 per gallon, followed by Kentucky and Hawaii at $0.93 per gallon. Figures on the map below are rounded to the nearest cent, but ranks reflect unrounded figures.

The per-gallon rate shown on the map reflects the excise tax for a 4.7 percent alcohol by volume (ABV) beer in a 12-ounce container. Sixteen states have beer excise tax rates that vary based on alcohol content, place of production, size of container, or place purchased. For example, in Idaho, beer containing more than 4 percent ABV is considered “strong beer” and is taxed like wine at $0.45 per gallon. In Virginia, the per-bottle rate varies for bottles that exceed 7- and 12-ounce thresholds.

State excise taxes are often levied on the manufacturer, wholesaler, or retailer of beer. The states collect these excise taxes according to the quantity of beer sold (usually expressed as a rate of dollars per gallon). In many instances, consumers won’t see the tax as an additional excise tax at checkout; the tax will already be priced into the retailer’s sales price.

Many states also generate revenue by collecting license fees from beer distributors. Others manipulate the price of beer by setting statewide minimum prices.

Beer exists in a complex tax and regulatory landscape. Understanding this taxation framework is crucial for both consumers and policymakers as public policy evolves for one of America’s most cherished beverages.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share

Previous Versions

-

Beer Taxes by State, 2023

3 min read

-

Beer Taxes by State, 2022

3 min read

-

Beer Taxes by State, 2021

3 min read

-

Beer Taxes by State, 2020

4 min read

-

Beer Taxes by State, 2019

4 min read

-

Beer Taxes by State, 2018

3 min read

-

Beer Taxes by State, 2017

3 min read

-

Beer Taxes by State, 2016

1 min read

-

Beer Taxes by State, 2015

2 min read