Developed countries raise taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a tax system is. For example, taxes on income can do more economic harm than taxes on consumption and property. Countries across the Organisation for Economic Co-operation and Development (OECD) differ substantially in how they raise revenue.

While tax revenue took a hit due to the pandemic, many OECD countries are beginning to bounce back. But as the recovery continues, governments should pay close attention to how they raise revenue and avoid policy changes that could stifle an economic recovery or impose a complex burden on individuals and companies.

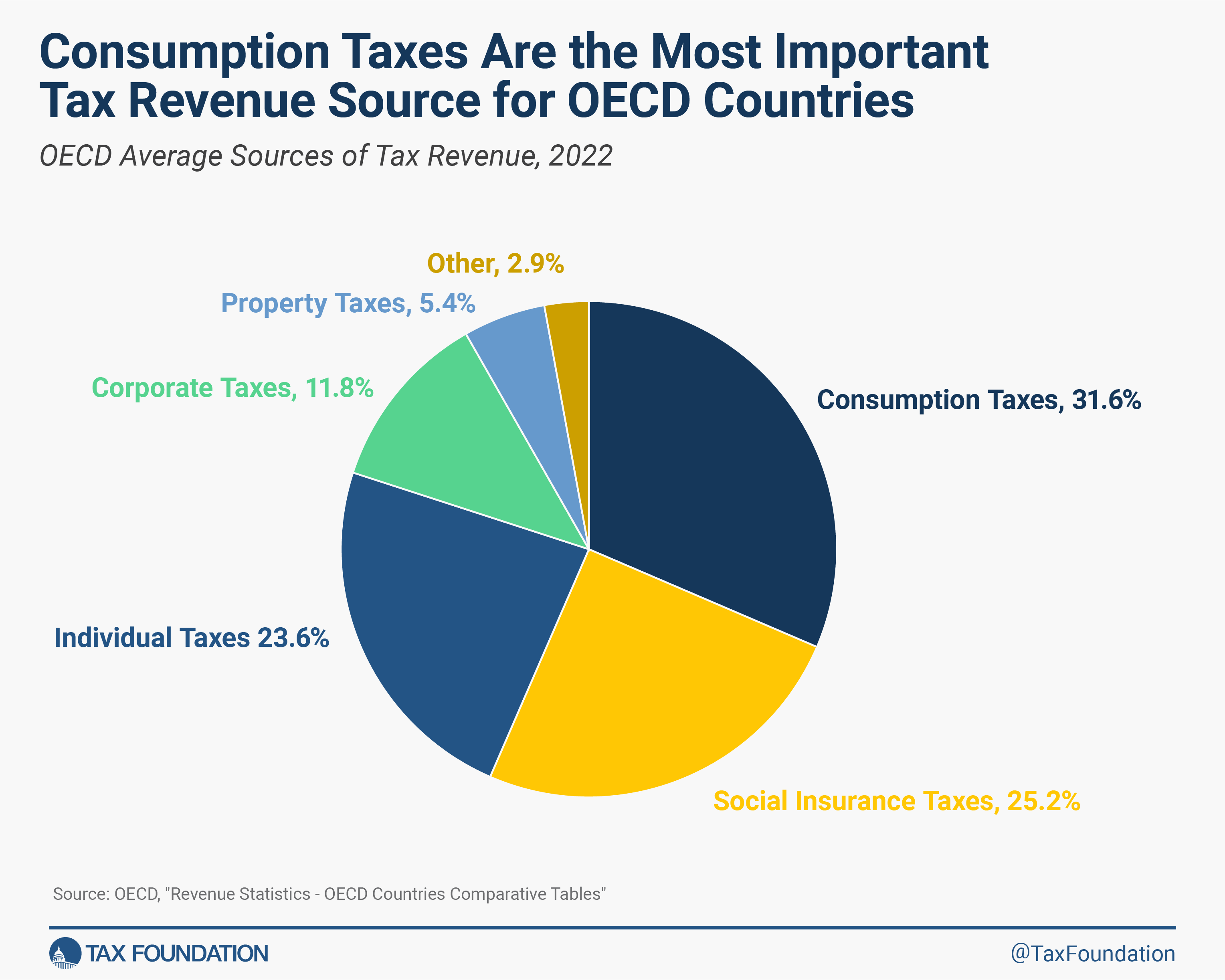

In general, OECD countries lean more on consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or an income tax where all savings is tax-deductible.

es (31.6 percent), social insurance taxes (25.2 percent), and individual income taxes (23.6 percent) than on corporate income taxes (11.8 percent) and property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services.

es (5.4 percent).

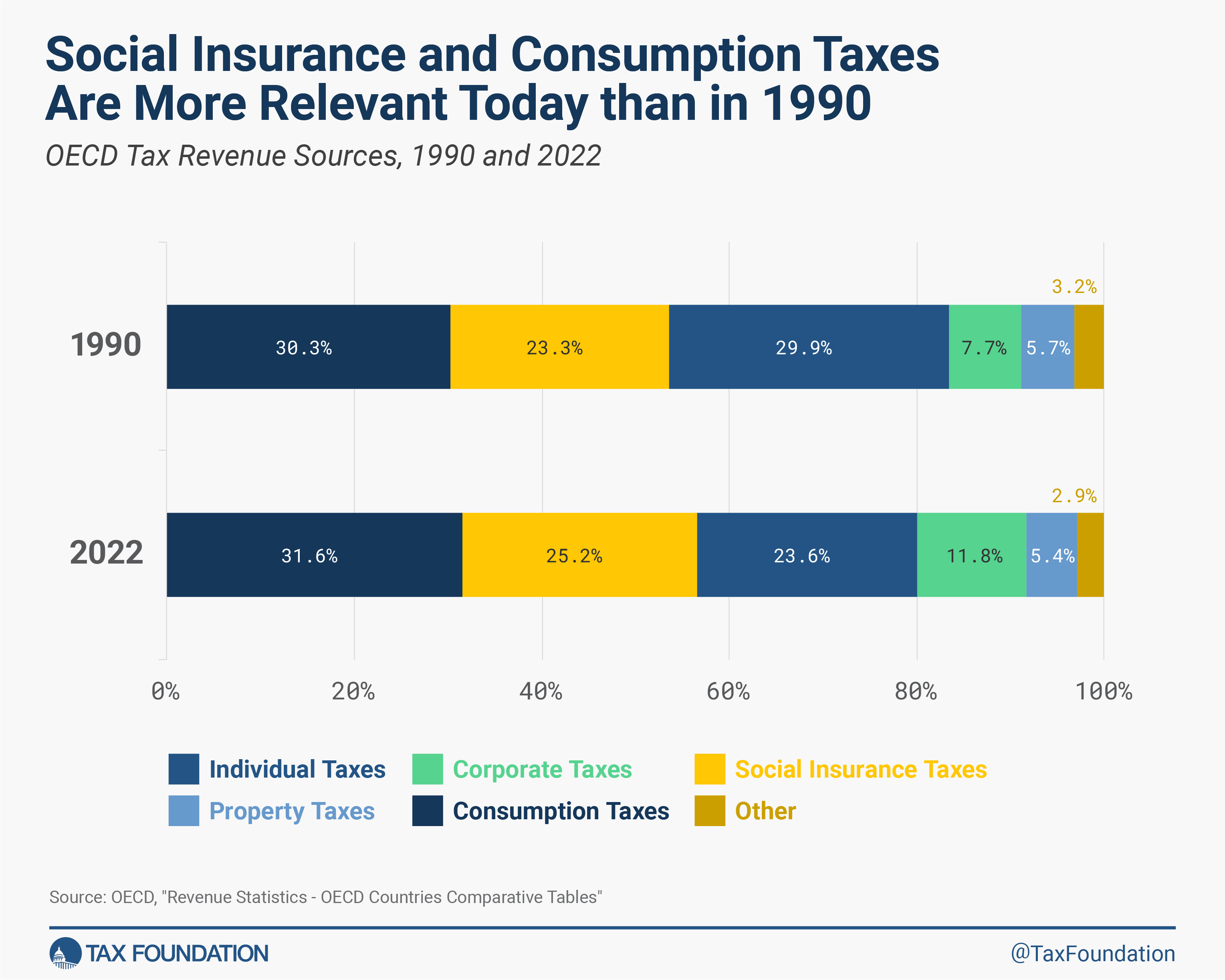

The reliance on different types of taxes has shifted over time. Compared to 1990, OECD countries have on average become more reliant on social insurance taxes (an increase of 1.9 percentage points) and less reliant on individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S.

es (a decrease of 6.3 percentage points). These policy changes matter. Social insurance taxes generally have broader bases and lower rates while taxes on personal income often have higher rates and can be more distortive to worker decisions.

OECD countries have also become more reliant on revenue from corporate income taxes. This has occurred despite a general decline in corporate tax rates around the world. One cause for this change has been a shift in the mix of OECD member countries. Since 1994, 14 countries have joined the OECD. Of this group, Colombia and Mexico raise more than 20 percent of their revenue from corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

es. The average share of corporate tax revenue among the 38 OECD countries is 11.8 percent.

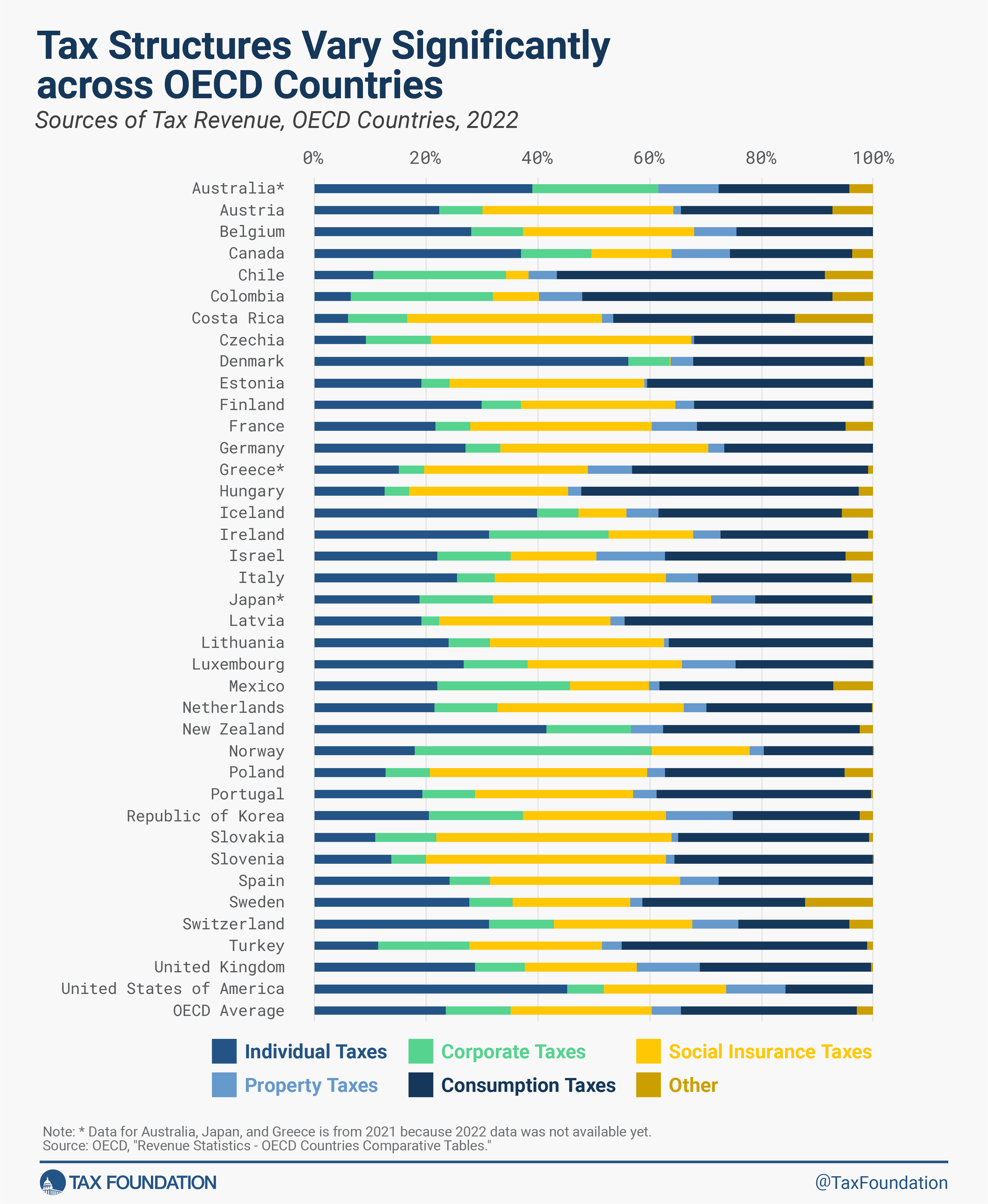

The United States is the only country in the OECD with no value-added tax (VAT). Instead, most U.S. state governments and many local governments apply a retail sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding.

on the final sale of products and excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

es on the production of goods such as cigarettes and alcohol. The lack of a VAT makes the U.S. a bit of an outlier as it raises just 15.7 percent of total government revenue from consumption taxes while the OECD average is nearly twice that amount at 31.6 percent.

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy. Policymakers should continue to explore ways to shift away from more distortive taxes like those on income toward taxes that are less likely to cause economic disruptions like consumption or property taxes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share

Previous Versions

-

-

-

Sources of Government Revenue in the OECD, 2021

16 min read

-

Sources of Government Revenue in the OECD, 2020

13 min read

-

Sources of Government Revenue in the OECD, 2019

10 min read

-

-

-

-

Sources of Government Revenue in the OECD, 2014

10 min read