Millionaire population in the BRICS countries will see a substantial surge over the next decade contributing to the largest increase in wealth across any group of nations, according to a recent report by Henley & Partners.

Millionaire count in the BRICS countries — which together hold $45 trillion in investable wealth — is forecast to rise by 85% over the next 10 years, the investment migration consultancy noted in its report published in partnership with global intelligence firm New World Wealth.

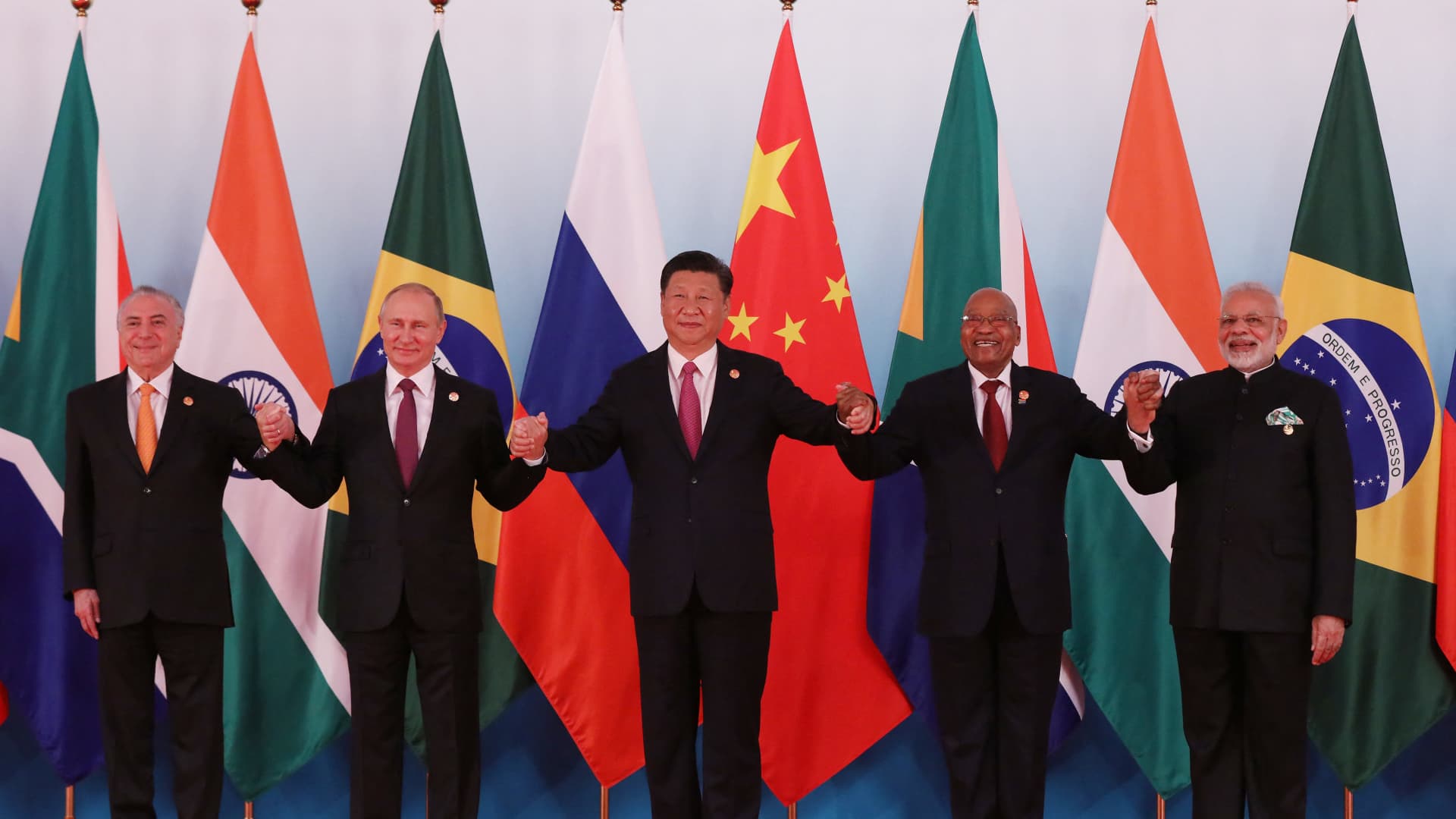

The BRICS bloc, which is composed of Brazil, Russia, India, China and South Africa, has expanded to include Egypt, Ethiopia, Iran, the United Arab Emirates this year, with Saudi Arabia also set to join the bloc.

Currently, there are 1.6 million individuals with investable assets of more than a million in the group.

The 85% forecast for BRICS will be the highest wealth growth of any bloc or region globally.Andrew AmolisWealth Analyst at New World Wealth

“The 85% forecast for BRICS will be the highest wealth growth of any bloc or region globally,” Andrew Amolis, wealth analyst at New World Wealth told CNBC.

In comparison, the Group of Seven (G7), which held $110 trillion in investable wealth as of December 2023, is expected to see the number of millionaires in the region increase by 45% over the next decade, data provided by Amolis showed.

The G7 is a coalition of the world’s advanced economies, comprising Canada, France, Japan, Italy, the U.S., United Kingdom and the European Union.

“[BRICS is] challenging the world order and establishing itself as a powerful rival to the G7 and other international institutions,” Henley & Partners’ Managing Partner and Head of Southeast Asia, Dominic Volek, said during a webcast presentation.

India is leading the charge in wealth expansion, with an estimated 110% jump in wealth per capita by 2033, followed by Saudi Arabia, where per capita wealth is forecast to expand by over 105% across the same period. UAE is poised for a 95% growth, while China and Ethiopia’s wealth is expected to grow 85% and 75%, respectively.

In the past decade, China’s private wealth expansion led the charge among the BRICS countries with a staggering 92% growth, while India came in second at 85% expansion over the same timespan. The UAE followed in third place with a 77% wealth growth.

Other members in the BRICS coalition, such as South Africa and Iran, have seen a decline in their millionaire populations since 2013.