On 14 December, the European Council agreed to open accession negotiations with Ukraine. Negotiators from the European Union and Ukraine will now decide what reforms must conditionally take place under the chapters of acquis before the country becomes an EU Member State. TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

policy reforms and policies that affect Ukraine’s impact on the EU budget will be fundamental to the outcome of the negotiations.

Despite recent EU enlargement ideas in Brussels, the chapters are focused on what reforms Ukraine must implement before accession, not what reforms the EU needs to implement before accepting a new Member State.

There are also many internal factors driving tax and budget policy reforms, in addition to preparing for membership, such as a history of corruption, the need for government revenue, and the promotion of innovation and investment. Ukraine must finance the ongoing war effort and needs roughly €45.8 billion per year ($50 billion) in aid to close its current budget gap. Surely, this amount will increase for reconstruction after the war, so Ukraine must take steps to create a stable, healthy economy that needs as few EU transfers as possible.

On the other side of the negotiation, the EU must decide how best to financially support Ukraine without burdening it with debt or allowing it to become a permanent drain on EU coffers. Some Member States worry about the domestic political fallout of Ukraine’s membership on their own distribution of EU funds. Ironically, other Member States might fear that Ukraine’s tax system is too competitive and could tempt companies to shift investment further east.

So, how competitive is Ukraine’s tax system relative to current EU Member States, and what tax reforms should the EU mandate to ease Member States’ fears?

Without a common understanding, Ukraine’s membership bid could face pushback across the continent.

Ukraine’s Tax Code Is Competitive, but the Tax BaseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

Is Shrinking

Aside from wartime tax policy measures, Ukraine’s current tax code is fairly conventional by EU standards and its rates are in line with other EU nations. The personal income tax rate is 18 percent, the corporate rate is 18 percent, and the value-added tax (VAT) rate is 20 percent. The social contribution rate is 22 percent with an additional 1.5 percent military surcharge.

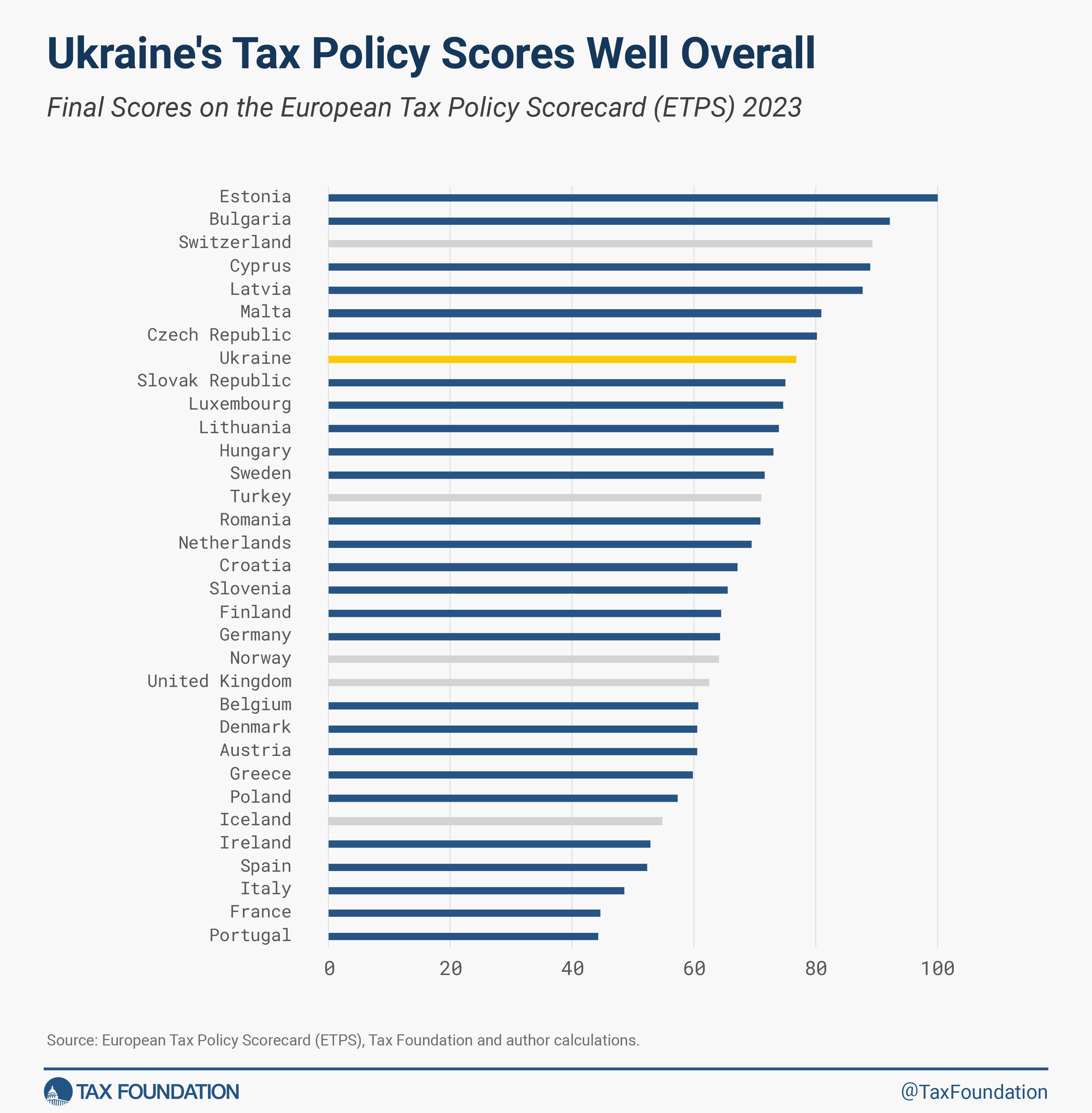

Using Tax Foundation’s European Tax Policy Scorecard, Ukraine would rank as the 7th-most competitive tax system in the EU (and the 8th among ETPS countries) if it joined today.

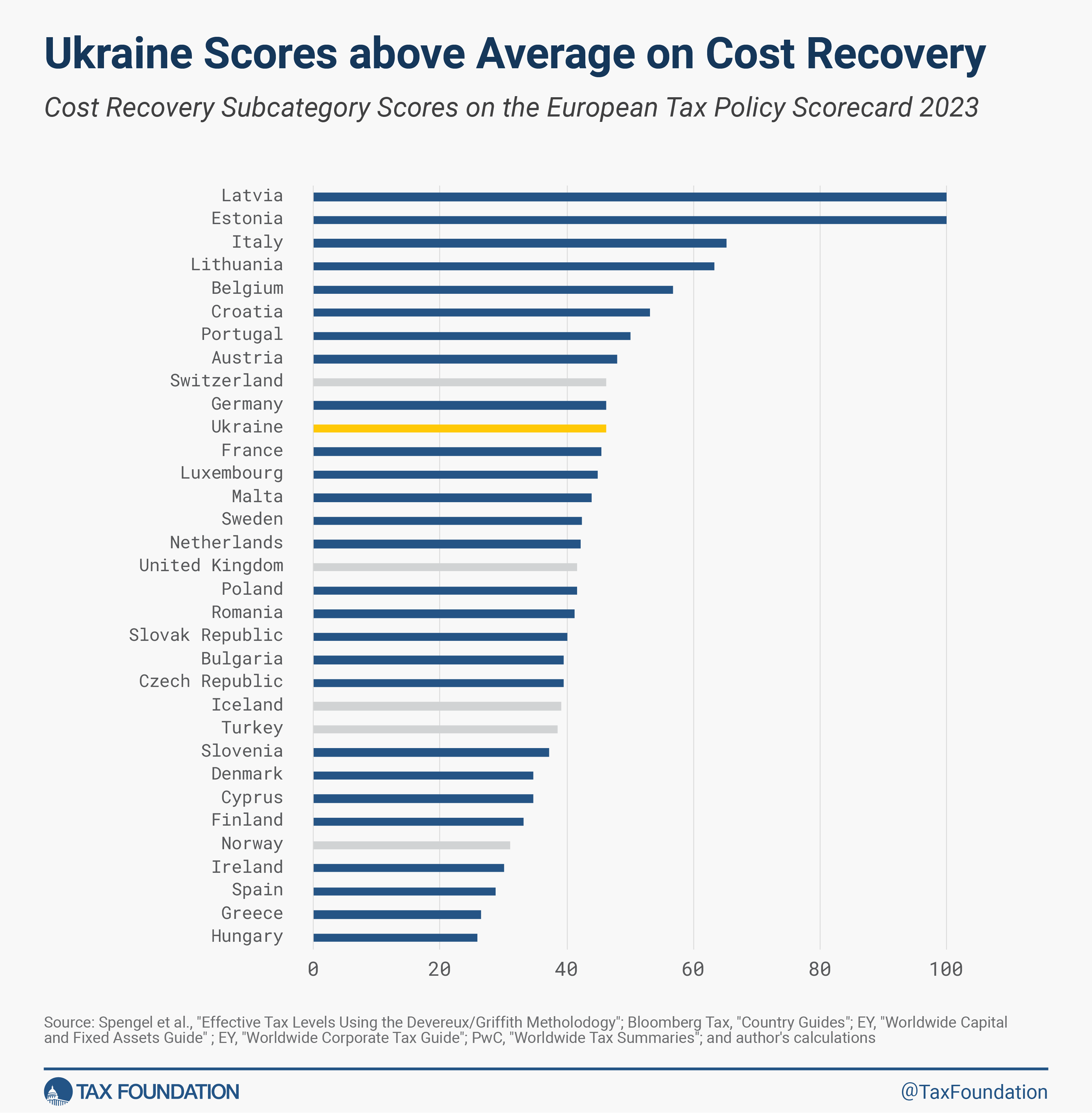

Furthermore, Ukraine would rank 10th in the EU (11th among ETPS countries) on capital cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages.

. This is particularly important for reconstruction investment and economic growth after the war.

Ukraine’s economy, however, is not conventional. In 2022, both the economy and the tax base contracted by about one-third. As many as 5 million citizens fled to other countries to escape the war, further shrinking the tax base.

The World Bank has estimated that as much as 46 percent of the Ukrainian economy is considered “informal,” which means nearly half of the economy is effectively untaxed.

Weak Enforcement and Corruption Plague Ukraine’s Tax System

The Centre for Economic Policy Research (CEPR) reports, “The government has had weak institutional capacity to enforce tax collection.” Corruption among tax collectors is a complicating factor and it is well known that better-connected firms pay less.

The complaint from small and medium-sized businesses (SMEs) is that the tax system is unpredictable, unfair, and burdensome to comply with.

The government’s effort to simplify the tax code during the war by creating a “small entrepreneurs payment” has created opportunities for evasion. Entrepreneurs and the self-employed can pay a 2 percent flat rate on turnover instead of an income tax and social contribution tax. According to CEPR, approximately 2 million workers are working as “private entrepreneurs,” which allows them to minimize their tax liability and the tax liability of their employers. A permanent turnover tax would be particularly harmful to business investment and recovery efforts if the tax is to continue after the war.

Despite Everything, the World Bank Says that Ukraine Remains Resilient

Businesses are operating below capacity but are adapting their product mix, innovating, and increasing their use of information technology. Multinational firms have not pulled back their investments and operations in Ukraine, although Ukraine has one of the lowest levels of foreign direct investment per capita of any European country.

What Should the EU Do?

EU negotiators should consider historical lessons on wartime financing (laid out in a previous blog) instructive for their mission and not force Ukraine to implement reforms that will hurt growth in the future. In particular, numerous chapters of the acquis could have significant tax policy and budget ramifications, namely Chapters 15-17 (Energy, Taxation, and Economic and Monetary Policy), Chapter 20 (Enterprise and Industrial Policy), Chapter 27 (Environment), and Chapter 33 (Financial and Budgetary Provisions).

It is economic liberalization, not burdensome regulations, or conditional loans, that will turn Ukraine into a contributing Member State in the long run. The EU should encourage Ukraine to improve upon its own version of the various flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets.

reforms championed by fellow former communist countries such as Bulgaria, Estonia, Latvia, and Slovakia. A flat tax, or cash flow tax, better suits Ukraine’s economic and governance needs than a Western-style tax system.

Some in the EU may worry that a low-rate flat tax or cash flow system could make Ukraine more competitive than many EU countries, but that should be seen as a welcome trade-off compared to years of financial support.

In the end, the best way for the EU to support Ukraine’s post-war recovery is to guarantee its tax sovereignty, not just its territorial sovereignty.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share