Early property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services.

es, first implemented in feudal times, were levied primarily on land and paid mostly by farmers. In modern times, property taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

es are also levied on assets like real estate and paid on a recurrent basis by individuals or legal entities.

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on. For this reason, businesses may choose to locate away from places with high property taxes

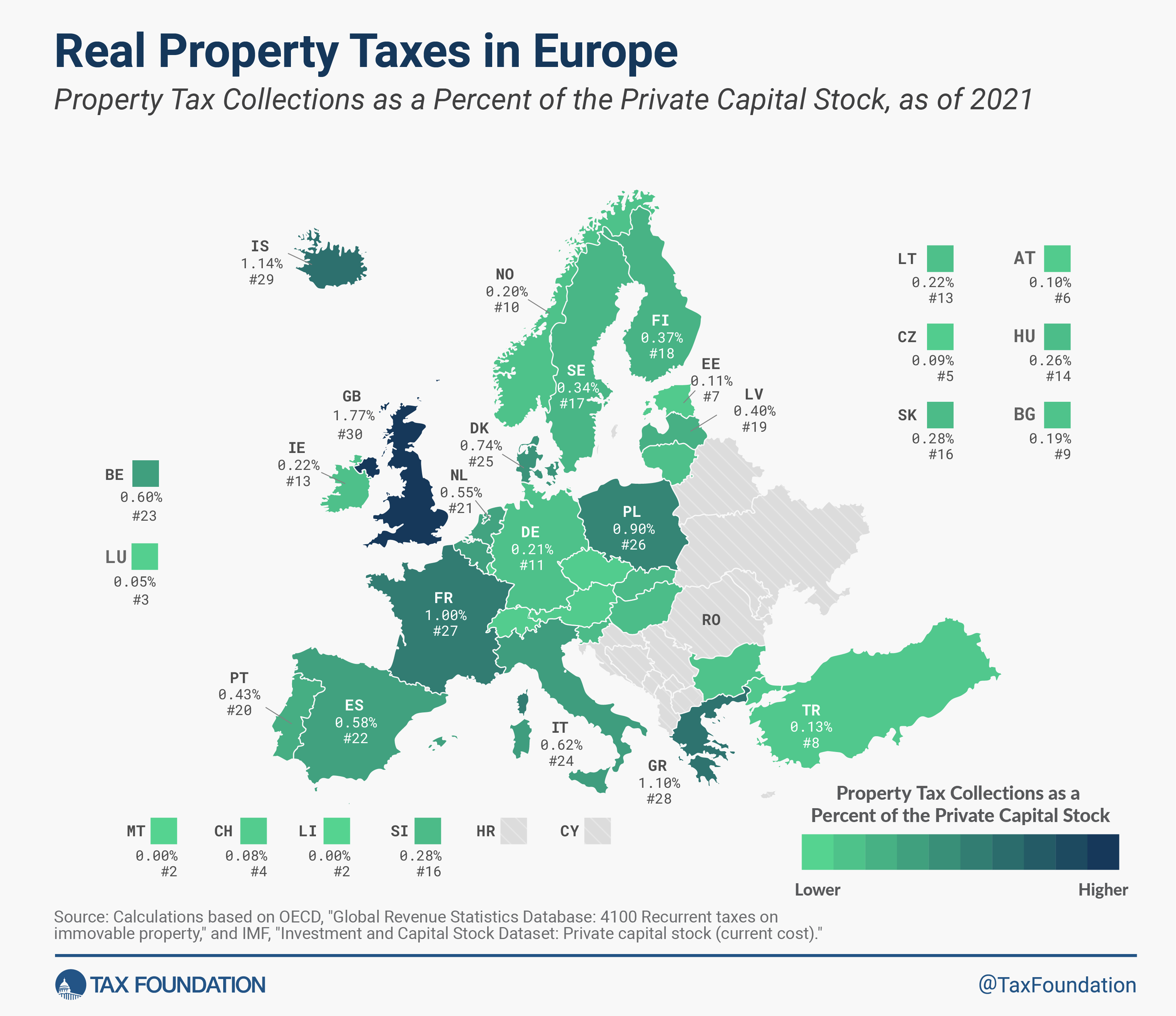

Two of the 30 European countries covered here, Liechtenstein and Malta, do not levy any recurrent taxes on property at all. Estonia is the sole country in this map to tax only land, meaning that its real property tax is the most efficient.

Of the 28 countries that levy property taxes, 23 allow businesses to deduct property or land taxes from corporate income, which mitigates the tax burden and encourages businesses to invest.

Luxembourg has the lowest property tax revenue as a share of its private capital stock, at 0.05 percent. Switzerland has the second-lowest share, at 0.08 percent, followed by the Czech Republic, at 0.09 percent. The highest property taxes as a share of the private capital stock occur in the United Kingdom (1.77 percent), Iceland (1.14 percent), and Greece (1.1 percent).

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share