Politicians often bemoan the trade deficit, but their disdain for this economic statistic is largely misplaced. The trade deficit reflects deeper choices about how we use our money, and reducing it may require lowering our standard of living.

What Is a Trade Deficit?

We can use our money in two ways: saving or spending.

Each year, Americans as a whole (including the government) spend more money buying goods and services than we earn selling goods and services. Altogether, the U.S. buys more things from the rest of the world (imports) than the rest of the world buys from it (exports). The result is a so-called trade deficit.

Why Does the Trade Deficit Matter?

Politicians usually refer to the trade deficit as a scorecard between nations. They claim having a trade deficit with another country means we’re losing, and that’s the end of the story.

But that story is incomplete. Understanding how saving and investment affect the trade deficit tells the rest of the story.

The flip side of spending more than we produce is that we also save less than we need to fulfill the American economy’s investment opportunities. To make up the difference and finance our borrowing and investment opportunities, foreigners lend money to the U.S. and reinvest dollars into in the U.S. economy. The result is a capital surplus.

The reason we can sustainably consume at such a high level is because the United States has remained a place that foreigners are willing to lend to. It’s also because of the unique role of the U.S. dollar. The dollar is the global reserve currency, which means it is constantly in demand and used in transactions all around the world that have nothing to do with U.S. trade. That high demand for the U.S. dollar leads to higher trade deficits than would otherwise occur, but it also comes with other major benefits for the United States as a whole.

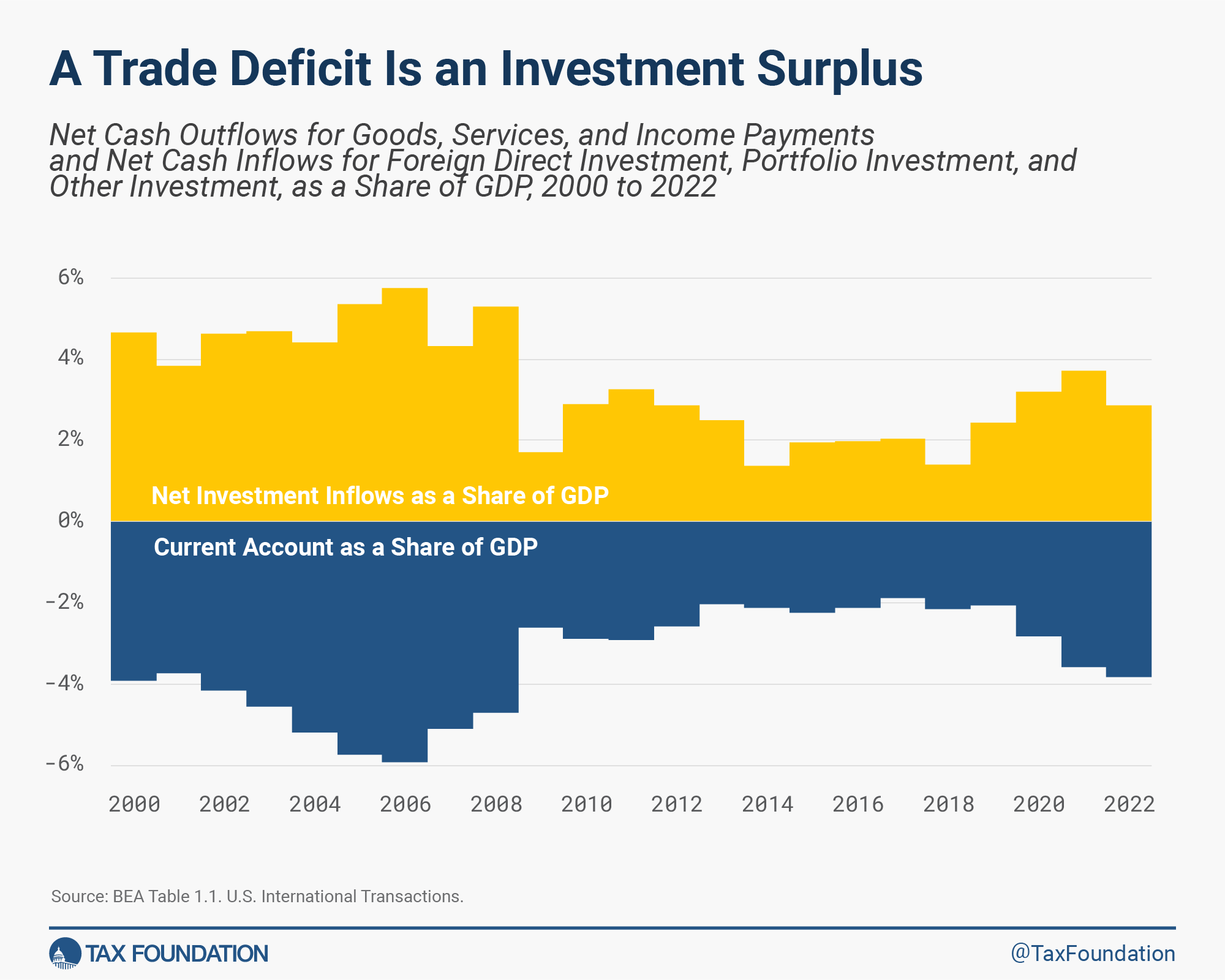

Rather than reflecting the practices of foreign nations, the trade deficit primarily represents our decisions about how much to save (or spend) versus invest. In economic terms: saving minus investment equals exports minus imports. The nearby chart illustrates the resulting mirror image. Year after year, our trade deficit is matched by a surplus, or inflow, of foreign investment.

Can (Or Should) We Tackle the Trade Deficit?

If the trade deficit is primarily the reflection of deeper choices about how we use our money, then changing it requires making different choices. To shrink it, Americans would either have to consume less and save more, or invest less. In the short term, that would mean accepting a lower standard of living because we would have fewer goods and services available.

In the longer term, whether we continue to be worse off would depend on what happens to investment. Investment today means we can produce more tomorrow. So, if we shrink the trade deficit by saving more and reducing the federal government’s budget deficit, then we can maintain investment and return to having higher incomes in the long run. But if we shrink the trade deficit by reducing investment, then our standard of living would fall further.

The next time you hear a politician complain about the trade deficit, remember that it isn’t an economic scorecard between nations. Instead, it’s the result of choices we make as a nation about saving, spending, and investing. The only way to change it is to make different choices.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share