Note: Remarks prepared for a congressional event, “Unraveling China’s Impact: Exploring Taxation, Illicit Trade, and the Nicotine Market in the United States,” on July 25, 2023.

Taxation plays a key role in driving illicit trade. People respond to incentives, and sizable price markups for legal cigarettes create incentives for tax avoidance.

Tax avoidance can take two different forms, each with different policy implications. Customers can shop across borders to purchase cigarettes legally in lower-tax jurisdictions, or illicit actors can establish a marketplace in which cigarettes are sold with little or no tax paid whatsoever.

Cross-border shopping or tax arbitrage is mostly a zero-sum activity from a cost perspective, and smugglers may even facilitate an increase in total economic activity by decreasing the market tax burden. A smuggler who legally purchases cigarettes in a lower-tax region like Virginia and then sells the cigarettes in a high-tax area, like Washington, D.C., still pays tax and buys American products—even if the tax loss for D.C. exceeds the tax gain for Virginia, and tax-based attempts of discouraging consumption are partially thwarted.

There are real social costs associated with the tax arbitrage in legally purchased manufactured cigarettes, but those costs pale in comparison to the dangers posed by counterfeit and illicit markets.

Rather than pay market prices and some amount of tax on cigarettes, criminal organizations produce counterfeit cigarettes with the look and feel of legitimate brands and sell them with counterfeit tax stamps, paying no tax at all.

China is the counterfeit cigarette capital of the world. While the size of the Chinese counterfeit market is challenging to estimate, one report suggests production exceeds 400 billion cigarettes per year. Because of the enormous volume of product that ships into global ports from China, economic forces may make counterfeit distribution less costly to smuggle Chinese cigarettes through ports than transport product across continental territories.

“Cheap whites” or “illicit whites” are a staple of the international counterfeit market. These generic-looking white cigarettes are produced legally in low-tax jurisdictions but are often intended for smuggling. Reports indicate that the Chinese tobacco monopoly is playing a significant role in the “illicit whites” tobacco markets across North, Central, and South America.

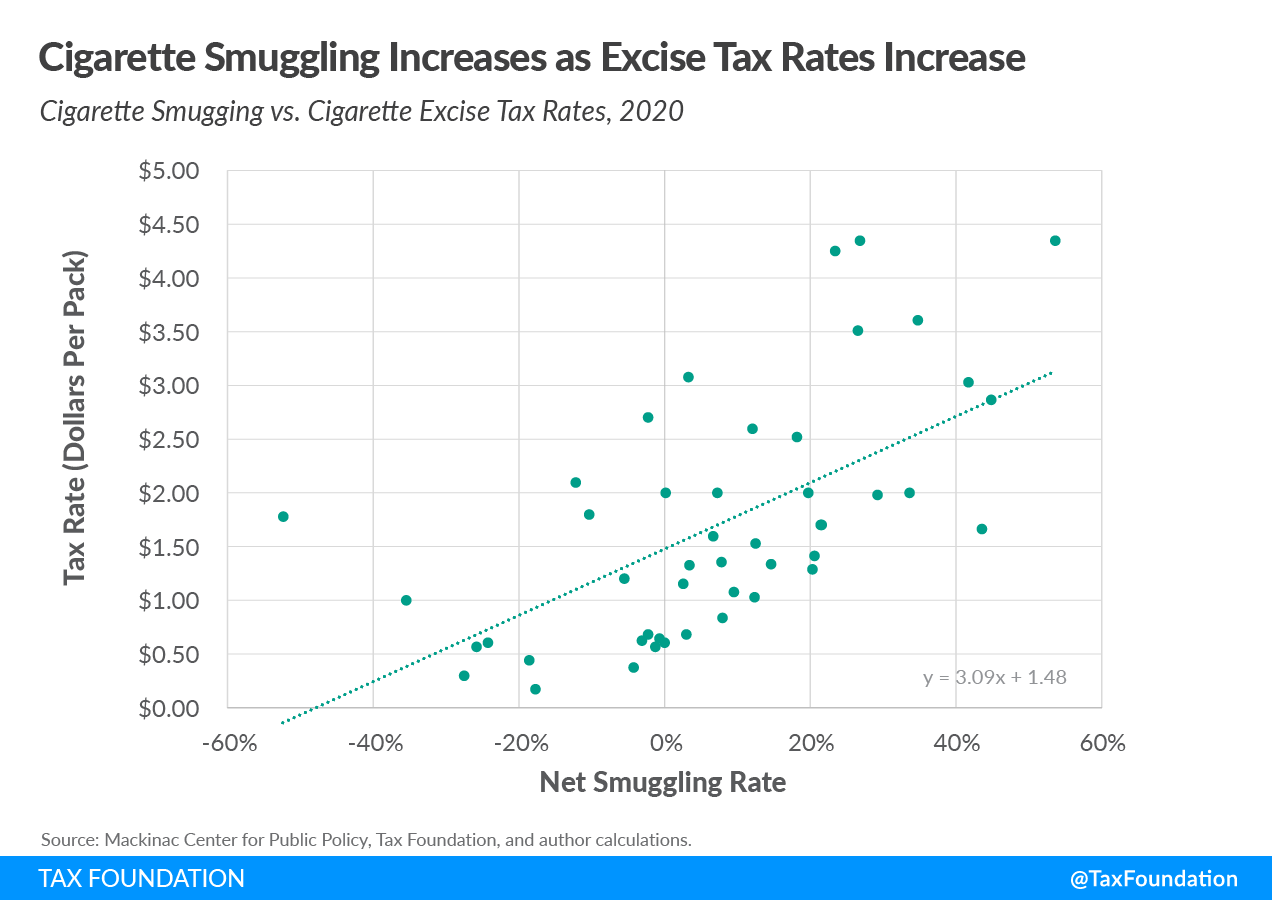

Empirical studies consistently show a positive relationship between cigarette tax rates and smuggling. Estimates suggest that a $1 increase per pack of cigarettes increases net U.S. smuggling by an average of 31 percent. Globally, a €1 increase in tax per pack of cigarettes would increase illicit market share by 5 to 12 percentage points and increase illicit cigarette sales by 29 percent to 95 percent.

Today, more than half of the cigarettes consumed in New York are not purchased in New York. The packs not taxed by New York cost the state more than a billion dollars a year in foregone revenue. And smuggling markets are likely to receive a substantial boom in demand.

When Massachusetts banned menthol-flavored cigarettes in 2020, legal sales declined. But 9 out of 10 of the packs no longer sold in Massachusetts could be tracked to new purchases in neighboring states. Prior to 2020, Massachusetts didn’t have a robust market for illicit cigarettes.

California, on the other hand, is a different story altogether. California has a large land border with Mexico and some of the largest ports in the country. Late last year, the state banned the sale of menthol cigarettes. As expected, legal sales fell. However, we haven’t noticed an uptick in sales in nearby states. We won’t have data on discarded cigarette packs or smoking rates in the state for a few years, but our expectations are that the overwhelming majority of cigarettes now consumed in California have been smuggled into the state. With the possibility of a nationwide ban on menthol flavor and a no-nicotine product content ruling by the U.S. Food and Drug Administration, U.S. policy decisions are setting the stage for illicit trade to thrive.

Clearly, global illicit trade in tobacco is a growing problem. Cigarette smuggling is low-risk and high-reward; billions of dollars are made each year through smuggling. To make matters worse, smuggling operations involve corruption, money laundering, and terrorism. These operations hurt consumers, because the products often fail to adhere to health standards; governments, because of lost revenue; legal businesses, because they cannot compete with illicit products; and bystanders, because they endure the effects of a more financially solvent black market.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.